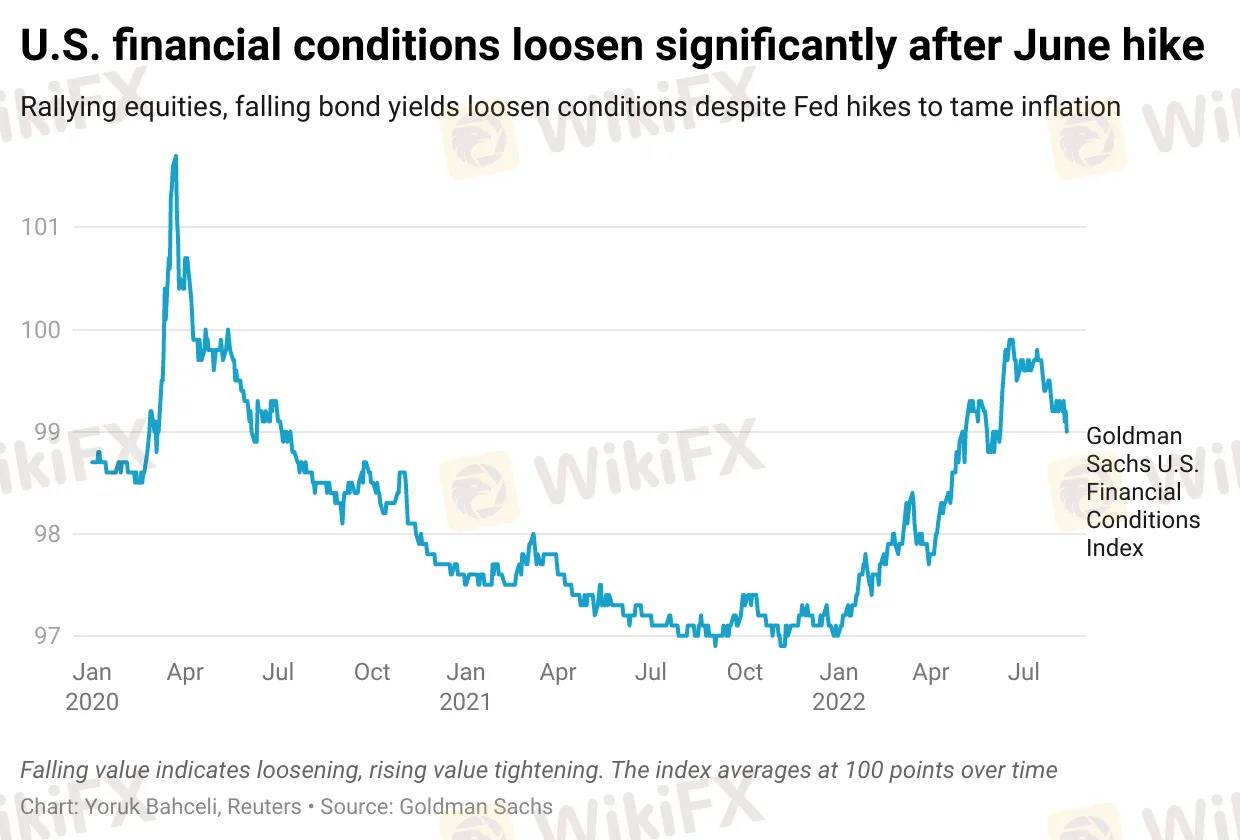

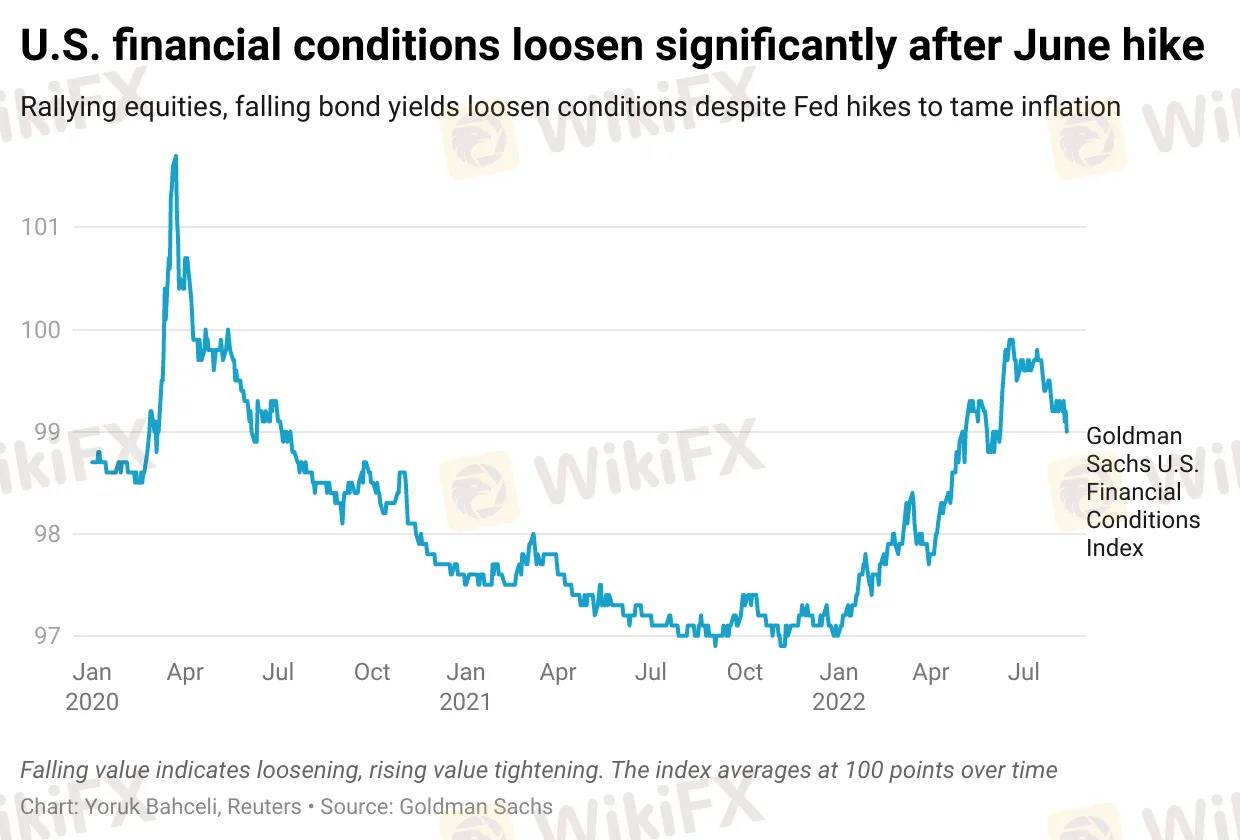

Abstract: The U.S. Federal Reserve is hiking interest rates at the most aggressive pace in a generation, but the financial conditions it needs to tighten to tame soaring inflation are heading in the wrong direction.

A rally in equities and falling government bond yields since the Feds June hike means financial conditions are actually loosening, despite the U.S. economy having been hit with a combined 150 basis points of rate hikes at that meeting and the next one.

Financial conditions reflect the availability of funding in an economy. They dictate spending, saving and investment plans of businesses and households, so central banks want them to tighten to help control inflation, which is now running far above their target levels.

A widely followed U.S. financial conditions index (FCI) compiled by Goldman Sachs, which factors in borrowing costs, equity levels and exchange rates, has loosened some 80 basis points (bps) since the Feds June meeting.

A similar index from the Chicago Federal Reserve, which tracks financial conditions independent of prevailing economic conditions, has turned negative, implying conditions are loose relative to what the current economic picture would usually suggest.

In the euro zone, conditions have also loosened by about 40 basis points, according to Goldman Sachs, and money markets have priced out most of the 2023 rate hikes they had previously expected.

“Back in June we thought that (U.S.) financial conditions were broadly where they should be to engineer the slowdown that you need to bring activity, wage growth and price inflation back to target,” said Daan Struyven, senior global economist at Goldman Sachs.

“Our best guess is that theyve eased a little too much.”

The change in conditions has been driven by recession fears, which have prompted markets to not only reduce how far they expect the Fed to hike, but also to price in rate cuts next year. This suggests investors think the Fed will be more concerned by a slowing economy rather than inflation next year.

Fed Chairman Jerome Powell‘s comments following the bank’s July rate hike were also interpreted by some investors as implying a “dovish pivot”.

Money markets now expect Fed hikes to stop at around 3.6% next March, compared with the 4%-plus expected before the June hike, followed by some 50 bps of cuts by the end of 2023.

Since the June hike, the S&P 500 has gained 13%, oil prices are down 22% and 10-year U.S. Treasury yields have fallen 70 bps. Credit markets have also rallied.

To be sure, financial conditions are still some 200 bps tighter than late 2021s record low, and stocks remain 10% down for 2022.

Goldman estimates a 100 bps tightening in its FCI will crimp economic growth by one percentage point in the coming year.

But the recent loosening is approaching what the bank terms an “FCI loop”, Struyven said.

“If you see very significant additional financial conditions easing that would probably not be sustainable because the outlook for activity, wage growth and inflation would look too hot.”

Unfinished job

That risk is already reflected in market gauges of long-term inflation expectations.

The 10-year U.S. breakeven rate has risen some 15 bps to 2.44% since early July. Euro zone expectations have risen too.

“That dovish interpretation was the reason why inflation expectations were driven up again. This just goes to show that the Fed still has an unfinished job ahead of itself,” said Patrick Saner, head of macro strategy at Swiss Re.

Data last week showing U.S. inflation unchanged in July instead of rising fuelled a further loosening in financial conditions.

But recent U.S. jobs and wage growth data point to increasingly tight labour markets.

Economists note the U.S. unemployment rate, at 3.5%, is far lower than the lowest level — 4.4% according to the Congressional Budget Office — it can reach without boosting inflation.