Abstract:Forex trading is considered one of the most profitable financial businesses. There are various types of brokers allowed us to choose from. In today’s article, we will explain the difference between the Straight Through Processing (STP) forex broker and Electronic Communications Network (ECN) forex broker. By comparing the difference, we expect the traders can have a better understanding of different types of brokers and which types of brokers they should choose from.

What STP Forex Broker is

The acronym STP stands for Straight Through Processing. Through Straight Through Processing technology, STP brokers route trades directly to the market. The business model is a No-Dealing Desk (NDD). The accuracy of the quote and the speed of trade processing make STP brokers a preferred choice for traders.

What ECN Forex Broker is

Electronic Communications Network (ECN) forex brokers only offer routing services for investors‘ trading. The forex broker can route the orders through to the central interbank market without dealer intervention. The bank that fills the order does not know the investors’ identities and where the stop order is placed.

STP VS ECN

Both STP and ECN brokers offer direct market access through no-dealing-desk models. Both of them send your trades directly to the market. In contrast, ECN brokers act as liquidity centers, bringing together banks and financial institutions to compete for your trade. Having an ECN account means faster execution speeds and lower spreads

ECN brokers, however, route transactions to a pool of liquidity providers that they work with. Additionally, they usually have a smaller minimum lot size (0.1, or 10,000 units of the base currency).

Example of STP forex broker

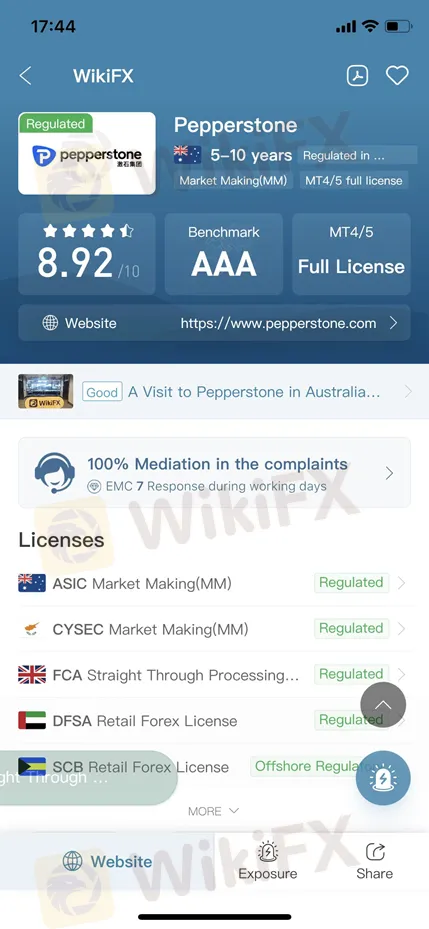

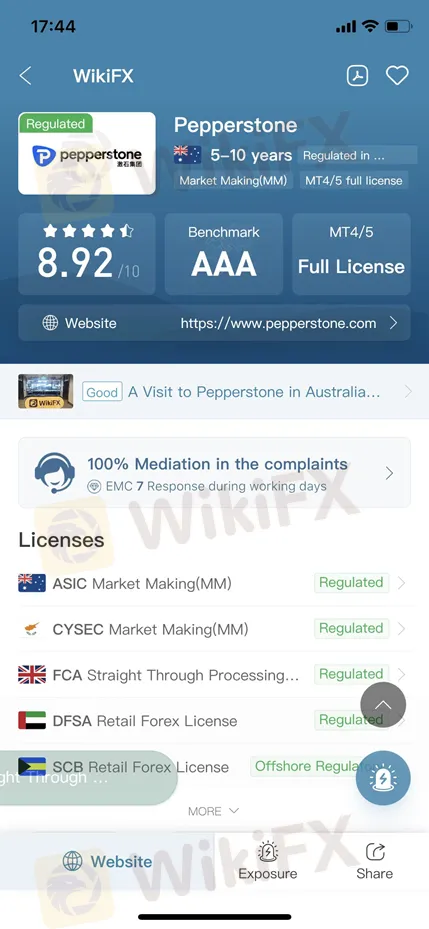

Pepperstone

Pepperstone is a broker providing Forex and CFD trading services, founded in 2010 by a management team with extensive experience in the Forex and IT industries. Pepperstone offers the Standard STP account for investors. The main spreads for standard STP accounts are 1.2-1.6 for USD/EUR and 1.2-2.2 for GBP/USD, with no commission required. According to some reports, Pepperstone has been rewarded as “ The best STP broker for the beginners 2022”.

Example of ECN forex broker

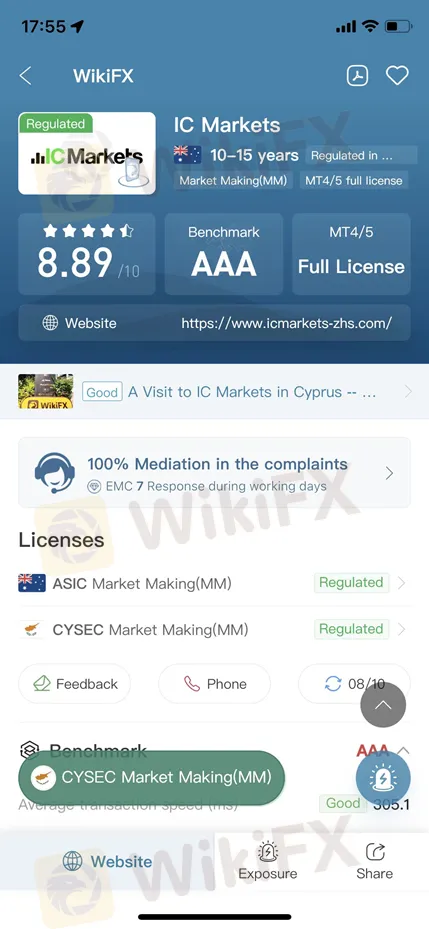

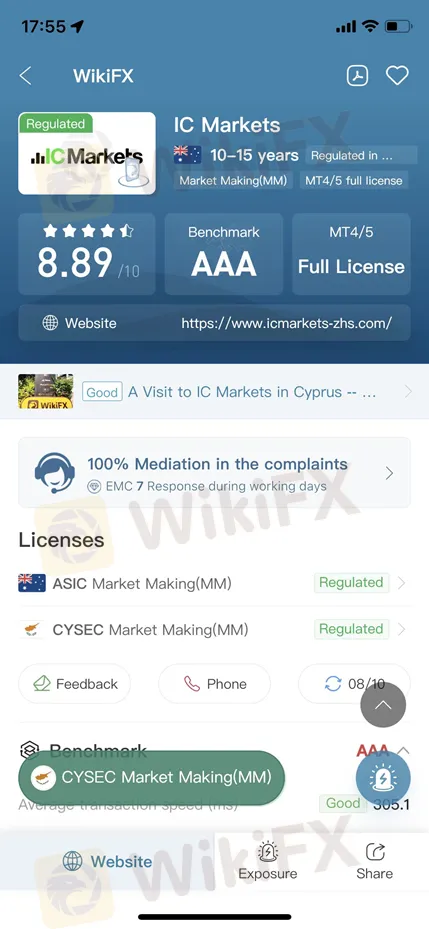

IC Markets

IC Markets is a leading forex broker around the globe, offering various solutions for active traders, day traders, scalpers, and more. IC Markets offers three different types of accounts, which are Raw Spread Accounts (cTrader), Raw Spread Accounts, and Standard Accounts. The minimum deposit for the three types of accounts is €200,