UbitMarkets Review 2026: No Regulation, Direct Links to UBIT Coin Scam, and Serious Platform Risks

UbitMarkets review reveals no valid license and direct links to a fraudulent project, raising serious concerns over investor fund safety.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:But bear in mind that higher leverage also creates a substantially higher risk exposure – if the market turns against you, you may lose all the money in your account in a matter of minutes.

We checked the warning list of the UK regulator FCA and found a forex broker named 4XLimited. After WikiFX's study, we believe that this broker is very risky and would like to warn investors not to trade with it!

Regulatory Inconsistencies

In fact, according to the WikiFX App rating, 4XLimited is only 1.00/10.00. Also, we can clearly see the words unregulated and unlicensed.

In the footer of the 4XLimited website, we see that the broker claims to be regulated by the BVI FSC.

It is verified that BVI FSC does not have any information about this broker. Therefore, the regulation of 4XLimited is unknown, i.e. there is a risk!

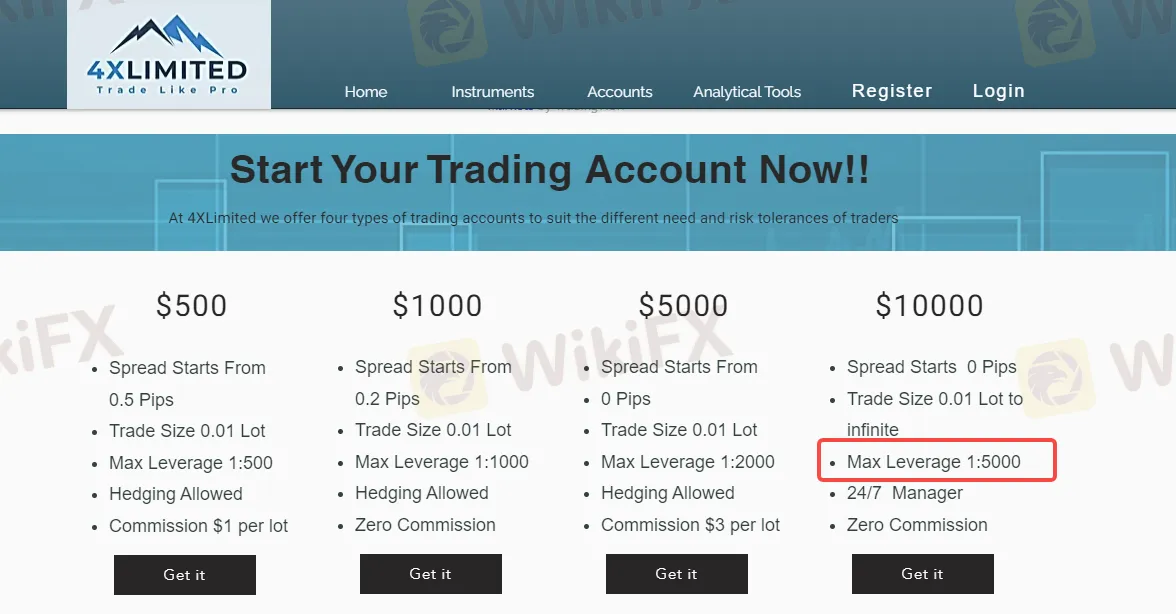

High leverage of 1:5000

According to 4XLimited's account type description, we can see the fourth category, where a deposit of 10,000 USD gives you a maximum leverage of 1:5000. This is ridiculously high!

Such leverage ratios may seem attractive because of the greater profit potential it offers. But bear in mind that higher leverage also creates a substantially higher risk exposure – if the market turns against you, you may lose all the money in your account in a matter of minutes.

That is why trading with leverage higher than 1:100 is recommended only for those who have some experience in the forex market. And these traders usually apply risk management strategies such as Stop Loss and Hedging.

Conclusion

No doubt, 4XLimited is a risky broker! If youre scammed by this broker, please keep the evidence and contact us as soon as possible. You can also log in to our official website or mobile app for self-exposure, copy this link to the browser to open it, and check how to expose the scam https://bit.ly/3dWv4N1

As we all know, Forex trading has a significant level of risk. Make certain that the broker you choose comes highly recommended and has excellent reviews on WikiFX. Conduct extensive research on a certain broker to see whether they have any complaints, particularly on the withdrawal procedure, customer support, website stability, and so on. Some of us would like to test a new broker due to their incredible offers since we don't know what's behind them. It is their marketing approach to entice individuals, but once you are caught on their web, they will gradually begin the scamming process. That is how most scammers operate. Before investing, it is preferable to choose a reputable and well-recommended forex broker.

WikiFX app is available for free download on the App Store and Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

UbitMarkets review reveals no valid license and direct links to a fraudulent project, raising serious concerns over investor fund safety.

LMAX GROUP review: FCA regulation, WikiFX score 7.51/10, trader complaints, risks, and broker comparison. Is LMAX GROUP safe for traders?

Is withdrawal issue perennial for Phyntex Markets traders like you? Does the Comoros-based forex broker give you numerous excuses to deny you withdrawals? Faced account blocks when raising Phyntex Markets withdrawal queries? Feel that the broker’s customer support service does not exist for you? Many traders have openly expressed frustration on how the broker goes about its business on review platforms. In this Phyntex Markets review article, we have shared multiple complaints against the broker. Keep reading to know the same.

Have you made multiple unsuccessful attempts to withdraw funds from your Tifia forex trading account? Registered successful trades but could not withdraw because of inadequate customer support service? Have you been facing capital losses due to severe slippage on the Tifia login? These issues have become increasingly common for traders here. Many of them have made such allegations on broker review platforms. In this Tifia review article, we have explored some scam allegations. Take a look!