Abstract:With so many brokers diluting the forex market, scams seem to have become the industry norms. Clients frequently report withdrawal or price manipulation issues, especially when trading with unregulated companies like Alfatrade.

AlfaTrade - Overview

AlfaTrade is unregulated forex and CFD brokerage firm located in Bulgaria. However, the company's exact location is still unknown since some online resources claim its headquarters is in St. Vincent and Grenadines, while others confirm it is a UK-based company. AlfaTrade has been operational for over a decade. The broker is not regulated anywhere in the world. Instead, it's just a clone firm that tries to disguise clients by copying the trade names of other brokers. For instance, clients might confuse AlfaTrade with Alfa Trade (UK) Ltd. Let us discuss some tactics this broker uses to defraud clients.

How does Alfatrade scam clients?

Alfatrade keeps concealing its identity owing to the increasing number of complaints against it. The company pretends as if its website is undergoing maintenance and will be back shortly while it keeps trading operations accessible through MetaTrader4.

AlfaTrade specifically targets newbies to take advantage of their limited market exposure. When clients access the broker's website, the company apologises for the inconvenience amid maintenance activity and notifies them to reach customer support via phone or email.

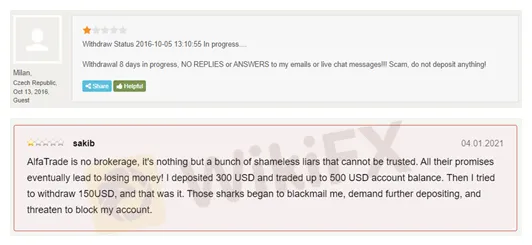

Once they have clients' contact details, they keep taking follow-ups, pushing them to make deposits. After receiving funds from clients, they usually become less concerned. Clients have also reported that the company stops attending to their phone calls or replying to their emails. The worst part is that it doesn't process withdrawal requests either.

Price manipulation is another method brokers like AlafaTrade typically use to control the prices of underlying assets. They artificially hold the prices at a high or low to trigger your stop-loss orders.

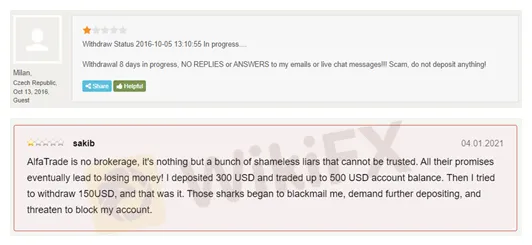

While AlfaTrade has been the subject of numerous complaints proving its shady practices, different regulators have marked it as a flagged entity reported for scamming investors worldwide.

How to confirm if a broker is regulated?

The best way is to search the company's registration number in its respective regulatory authority's database. You can also filter your search using the company name or postal code. For instance, Alftatrade was once known to have been regulated by FCA. So, here are the steps you can follow to check its regulatory status.

1) Go to https://register.fca.org.uk/.

2) Enter the company's name i-e Alfatrade.

3) Click the search button.

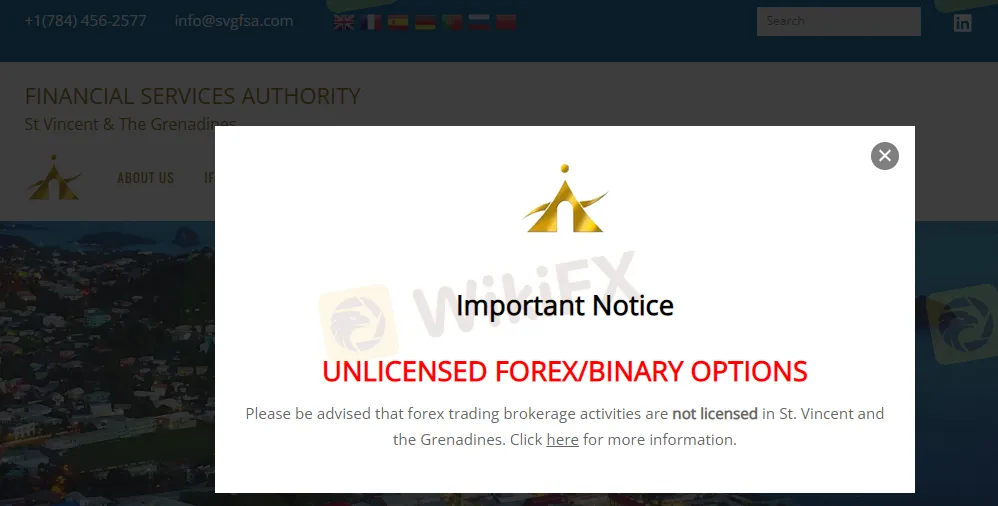

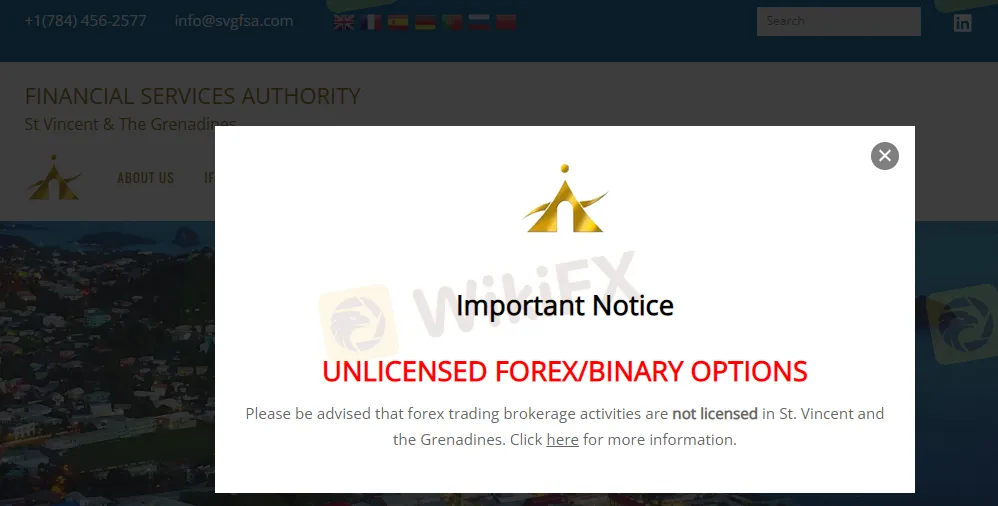

Although the broker is registered with St. Vincent and Grenadine Financial Services Authority, it doesn't mean that the broker is regulated. The SVGFSA does not provide broker licenses. It's not a controller; it merely registers limited liability companies and issues a registration certificate. The authority has mentioned on its website that if a registered company gets involved in forex trading activities, it does so without a license.

How to avoid signing up with scam brokers?

First of all, always go for a regulated entity. Regulated brokers are more secure than the non-regulated ones owing to strict regulatory bindings. Checking a broker's reputation on platforms like BrokersView, followed by diligent scrutiny of available payment methods, security measures, trading fees, and customer support, can also help you find a legitimate broker and avoid signing up with scam entities.