Abstract:On July 1, Veracity Markets posted on its Facebook and Instagram pages that it had been notified by the FSCA on June 28 and was actively cooperating with the regulator's investigation.

In the past week, Veracity Markets, a South African Forex broker, exposed itself to be in deep crisis of FSCA investigation. Let's take a look at the latest developments in this matter.

Founded in 2020, Veracity Markets has grown from a relatively unknown company to a major player in the African forex trading industry in just two years. The FSCA is a regulatory body set up by the South African government to ensure that financial institutions and financial service providers adhere to strict rules of conduct.

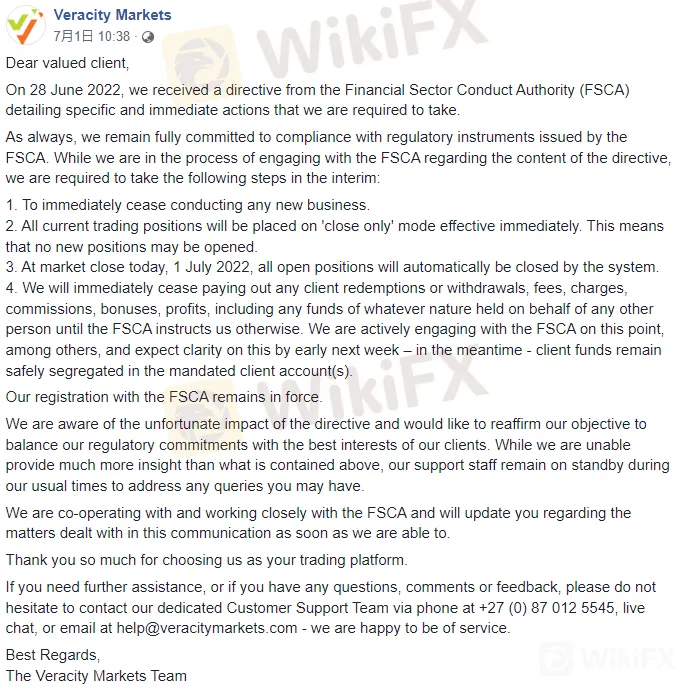

On July 1, Veracity Markets posted on its Facebook and Instagram pages that it had been notified by the FSCA on June 28 and was actively cooperating with the regulator's investigation. With immediate effect, it will suspend all operations, including the closure of the withdrawal freeze. The announcement reads as follows:

Key Points

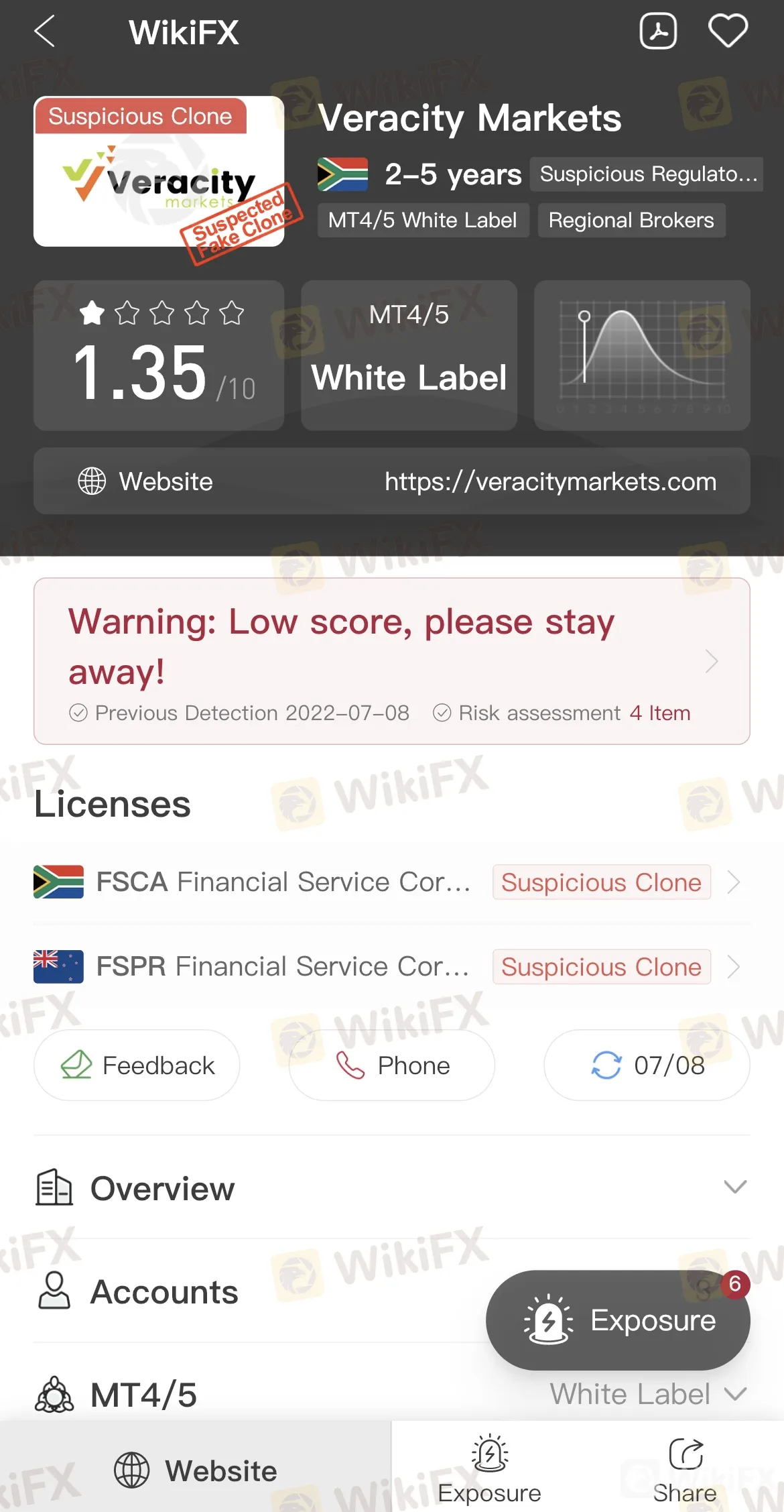

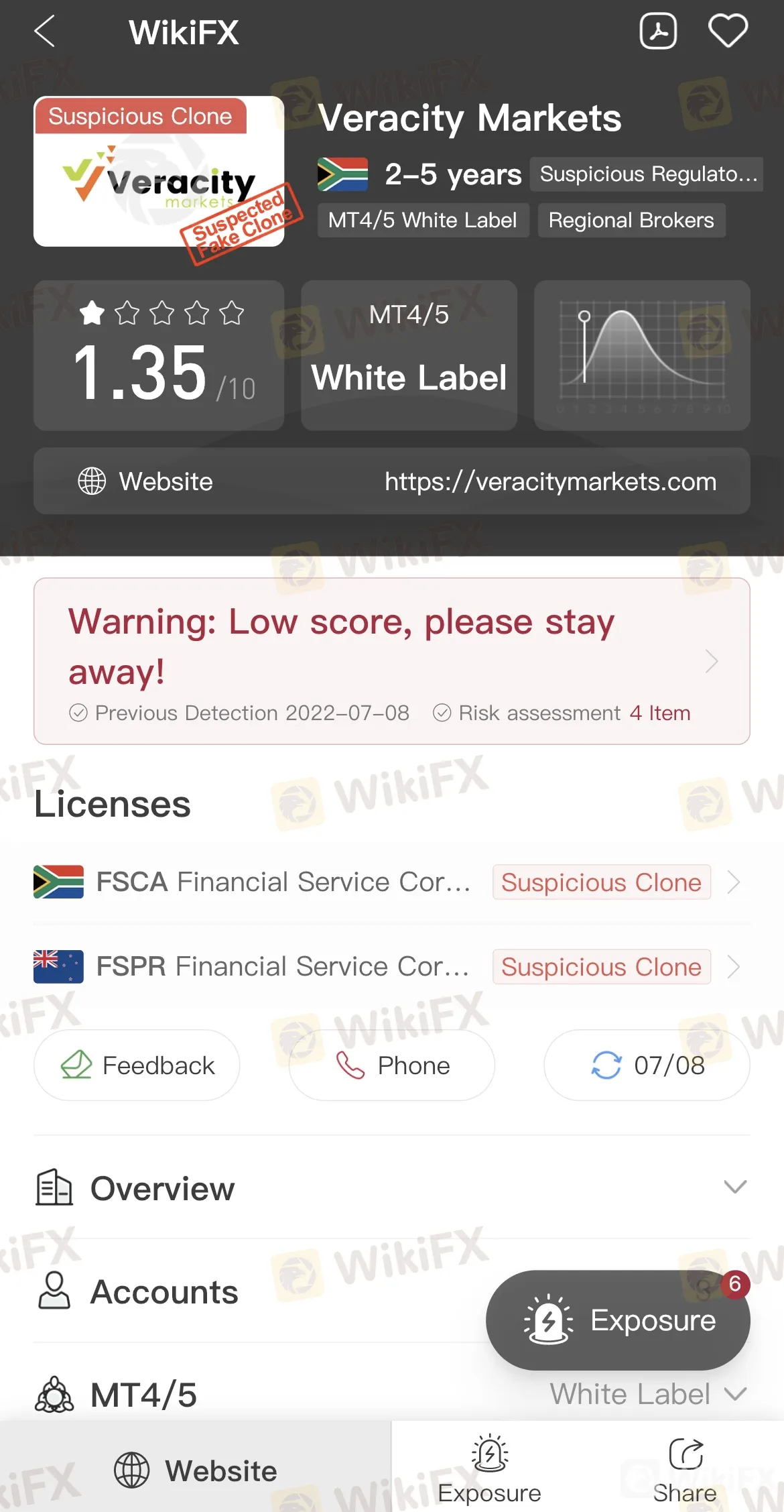

It is worth noting that Veracity Markets has emphatically mentioned in its announcement that its registration with the FSCA remains in force. In fact, WikiFX had already reported that Veracity Markets was a Suspicious Clone.

It was verified that the FSPR License No. 40983 and the FSCA License No. 4701 claimed by the broker were both suspicious clones.

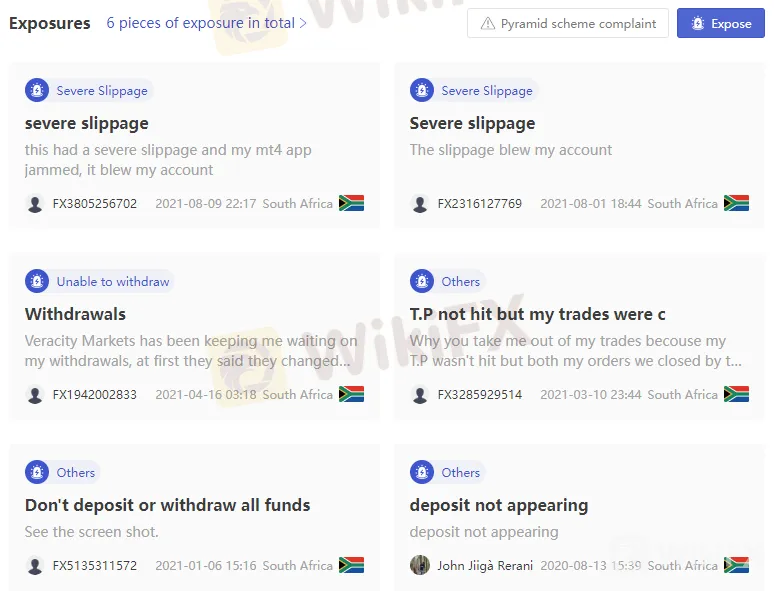

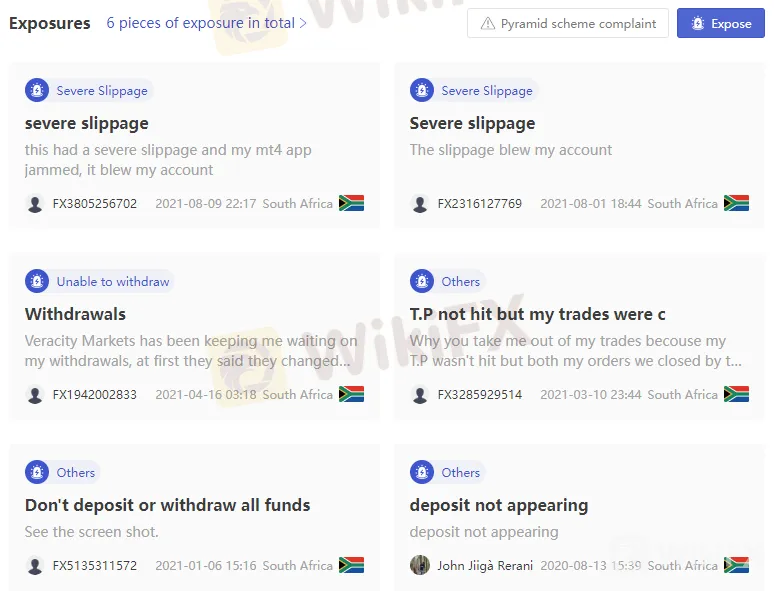

Earlier, some investors from South Africa had reported to WikiFX that they were experiencing serious slippage problems when trading with Veracity Markets. In addition, the broker also delayed their withdrawal requests citing technical problems.

FSCA's position

Although the FSCA has not issued any official press release to date explaining the whole story, it is clear that Veracity Markets is risky enough to attract the attention of local financial regulators.

In addition, there are rumors that Veracity Markets is considering filing for bankruptcy liquidation.

Today, Veracity Markets has stopped paying customers withdrawals or redemptions, fees, charges, commissions, bonuses and profits, including any funds held on behalf of any other person, while the FSCA has not yet decided to close its platform. We have reason to suspect that Veracity Markets may take advantage of this opportunity to run away early! Investors are also advised to be aware of the risks!

WikiFX will keep an eye on

As of now, it's unclear whether the FSCA will actually shut down Veracity Markets, but the broker's shutdown is enough to cause concern among investors.

Our recommendation is not to trade with this risky broker. You should immediately stop depositing funds with Veracity Markets if you are already trading with them, particularly if they ask for a withdrawal fee.

Finally, WikiFX will keep track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website or download the WikiFX APP to evaluate the safety and reliability of this broker!