Abstract:The fintech firm will use Stripe to support payments in the UK, Europe and several other global markets.

The companies are planning to deliver innovative payment products.

Stripe, one of the prominent financial infrastructure platforms for businesses, recently announced that Revolut has added Stripe to drive international expansion. The fintech firm is planning to leverage Stripes infrastructure to enter several new markets.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.

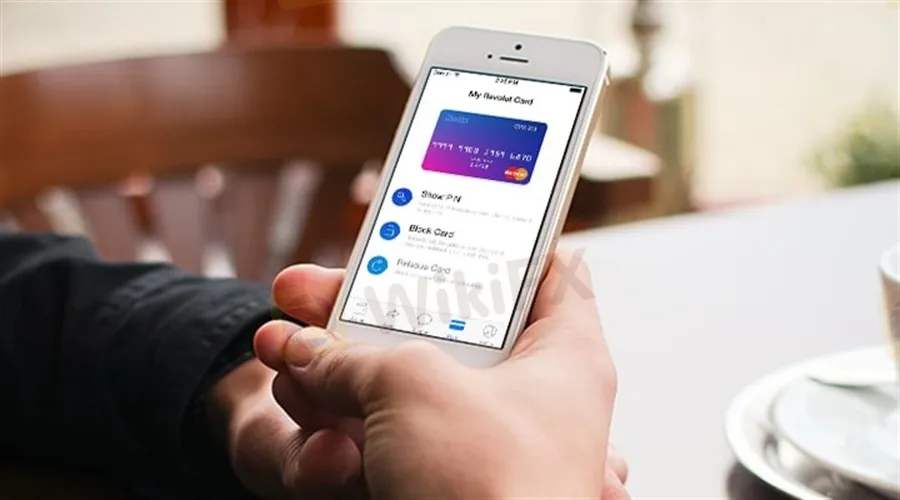

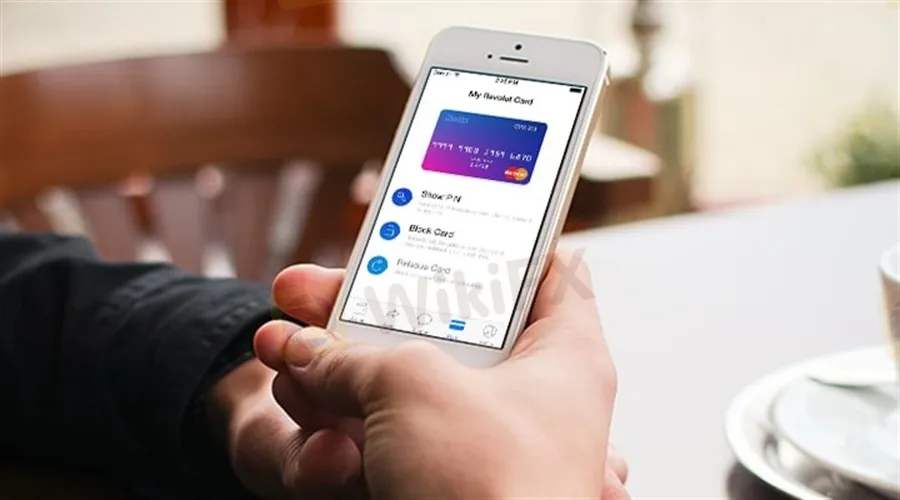

Founded in 2015, Revolut is one of the most valuable fintech startups in the world. Last year, the company raised $800 million in a funding round and reached a valuation of $33 billion. Additionally, Revolut has more than 18 million customers.

According to the details shared by Stripe, Revolut will initially use the companys platform to facilitate seamless payments across the United Kingdom and Europe.

“Revolut builds seamless solutions for its customers. That means access to quick and easy payments and our collaboration with Stripe facilitates that. We share a common vision and are excited to collaborate across multiple areas, from leveraging Stripe‘s infrastructure to accelerate our global expansion to exploring innovative new products for Revolut’s more than 18 million customers,” said David Tirado, the Vice President of Business Development at Revolut.

Expansion Plans

Among new markets, Revolut is planning to launch in Mexico and Brazil soon. In addition to the current collaboration, both companies aim to increase their partnership in the near future to deliver technology-driven payment products.

“Revolut and Stripe share an ambition to upgrade financial services globally. We‘re thrilled to be powering Revolut as it builds, scales and helps people around the world get more from their money,” said Eileen O’Mara, the EMEA Revenue and Growth Lead at Stripe.

In the past few months, Revolut has formed several partnerships with some of the leading financial companies to accelerate its international presence. Recently, the fintech company collaborated with Tink to ease money transfers across the European region. In February, the firm announced the expansion of its services in Australia through the launch of stock trading.