Allied Top Review: Scam or Legit Broker?

Allied Top review: Covering regulation, trading platforms, leverage, spreads, deposits, and real trader feedback for informed decisions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Established in 2012, BluFX is a forex brokerage owned by a company called Blueprint Capital Ltd. Blueprint Capital Ltd is based in the United Kingdom. On its website, BluFX claimed that it have funded over 20,000 traders worldwide. To fully understand this broker, WikiFX made a comprehension review. We will analyze the reliability of this broker from specific information, regulation, exposure, etc. Let’s get into it.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 34,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

About BluFX

Established in 2012, BluFX is a forex brokerage owned by a company called Blueprint Capital Ltd. Blueprint Capital Ltd is based in the United Kingdom. On its website, BluFX claimed that it has funded over 20,000 traders worldwide.

Markets Instruments

There are only 28 currency pairs as well as Gold available.

Minimum Deposit

BluFX offers a $25k live Account with a fee of 99€ monthly, and the Profit target is 5% which is 1250$. In the 25k Trading plan, they won't allow you to hold the trading position over the night. BluFX allows you only to trade from 6 AM to 9 PM UK time. So if you take any trade, you have to close it before 9 PM daily. Here comes the scam scheme. If you are an experienced trader, you know that in the forex market, we have to hold some trades over the night or a few days to be in profit because of the volatility. At this moment, limiting your limit, they are trapping you in a big dark hole.

Leverage

The leverage ratio provided by BluFX is 1:3, while traditional forex brokers offer at least 1:100 or 1:200. such low leverage is hard to attract traders attention.

Trading Size

BluFX is giving examples of the $25,000 account and the $50,000 account. The maximum trade size on a $25,000 account is 1 lot, while on the $50,000 account it is 2 lots. Each currency pair has its maximum trade size based on the margin required when trading it.

Spreads & Commissions

The costs of trading with the BluFX platform are not disclosed by the company. Given the fact they only facilitate day trading, a slightly higher spread can greatly impact the bottom line of any trader. Usually, forex brokers offer spreads within the range of 1.0 – 1.5 pips for the EUR/USD pair.

Monthly Fees

To get access to the companys capital, one must pay monthly fees specified at the beginning of this review, ranging from £99 to £249, according to the account type.

Trading Platform

This broker offers its proprietary web-based platform that has most of the functionalities the MT4 offers. There are no demo versions available.

Deposit& Withdrawal

BluFX accepts Credit/Debit cards, PayPal, USDT, Flutterwave, WebMoney, and PerfectMoney for their payments. You can withdraw your funds from your trading account after you have earned a 10% profit.

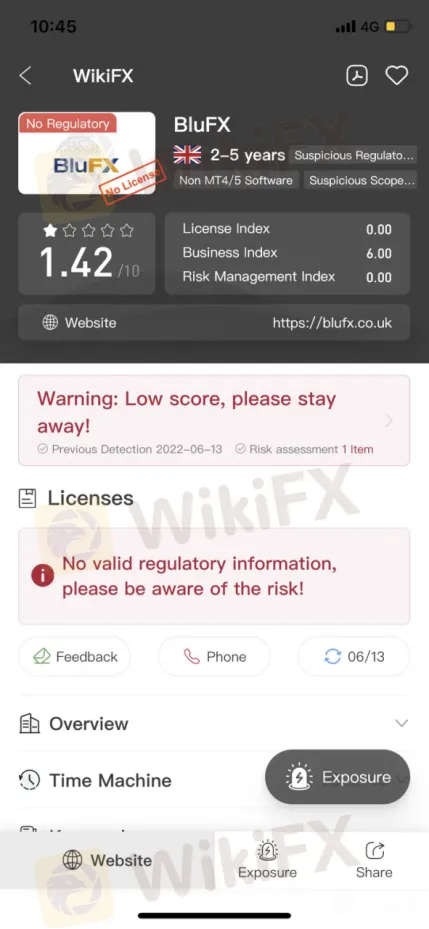

Regulation: Is BluFX legit?

BluFX is not a regulated broker. It does not hold a legitimate license. And no regulatory authorities can hold it accountable if BluFX takes your money away fraudulently. Thus, WikiFX has given this broker a pretty low rating of 1.42/10.

(Note: Because different regions or countries have different levels of regulatory strictness, the score of the same broker might be slightly varied in other regions or countries. For details, please consult WikiFX customer service.)

(source: WikiFX)

Exposure on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

As of June 13, 2022, WikiFX did not receive complaints related to this broker from traders.

Feedback on Twitter

BluFX does have an official Twitter account. As of June 13, 2022, it has only 146 followers.

Thanks to the low leverage, some traders are not interested in investing in this broker.

Some traders on Twitter complained that they got scammed by BluFX.

Conclusion:

According to WikiFX, BluFX is an offshore broker. They do not claim affiliation with the Financial Conduct Authority (FCA). Investing in an unregulated broker is more likely to get scammed. We advise investors to find a better alternative. After all, there are a lot of options to select in the forex markets. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link(https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Click on BluFX's WikiFX page for details

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Allied Top review: Covering regulation, trading platforms, leverage, spreads, deposits, and real trader feedback for informed decisions.

Global broker STARTRADER refreshes its brand identity, reinforcing trust, growth, and client focus through a modernized visual and strategic repositioning.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.