Abstract:“How can I know if my Forex broker is legitimate?”

“Who can I turn to if I got treated unfairly by my FX broker?”

“I’m a beginner, how do I choose among so many brokers out there?”

WikiFX is the only app/platform that you will ever need when it comes to broker-related concerns.

WikiFX is a reliable and transparent global forex broker regulatory query platform that stores information of over 35, 000 forex brokers worldwide. WikiFX also works collaboratively with 30 national regulators, namely the UK‘s FCA, the US’ NFA, and Australias ASIC, etc.

WikiFX publishes content that is impartial, objective, and factual for the sole purpose of exposing unreliable brokers and recommending reputable brokers to its users. In order to achieve this mission efficiently, WikiFX covers all important aspects related to a forex broker, such as registration information, licenses, regulatory status, trading instruments, and platforms offered, credit evaluation, industry reputation, users complaints, slippage, transaction speed and more.

WikiFX offers transparent and verified information about brokers.

With all the gathered information, WikiFX, analyses, assesses, rates, and ranks these forex brokers against one another. This is specially designed for the convenience of overwhelmed traders who do not have time to do lengthy research as well as for beginners who do not have prior knowledge or experience to know where to start.

If you belong to either of these categories, do not worry. All you need is to log on to www.wikifx.com or download the free WikiFX mobile application from Google Play/App Store on your device.

WikiFX ranks forex brokers.

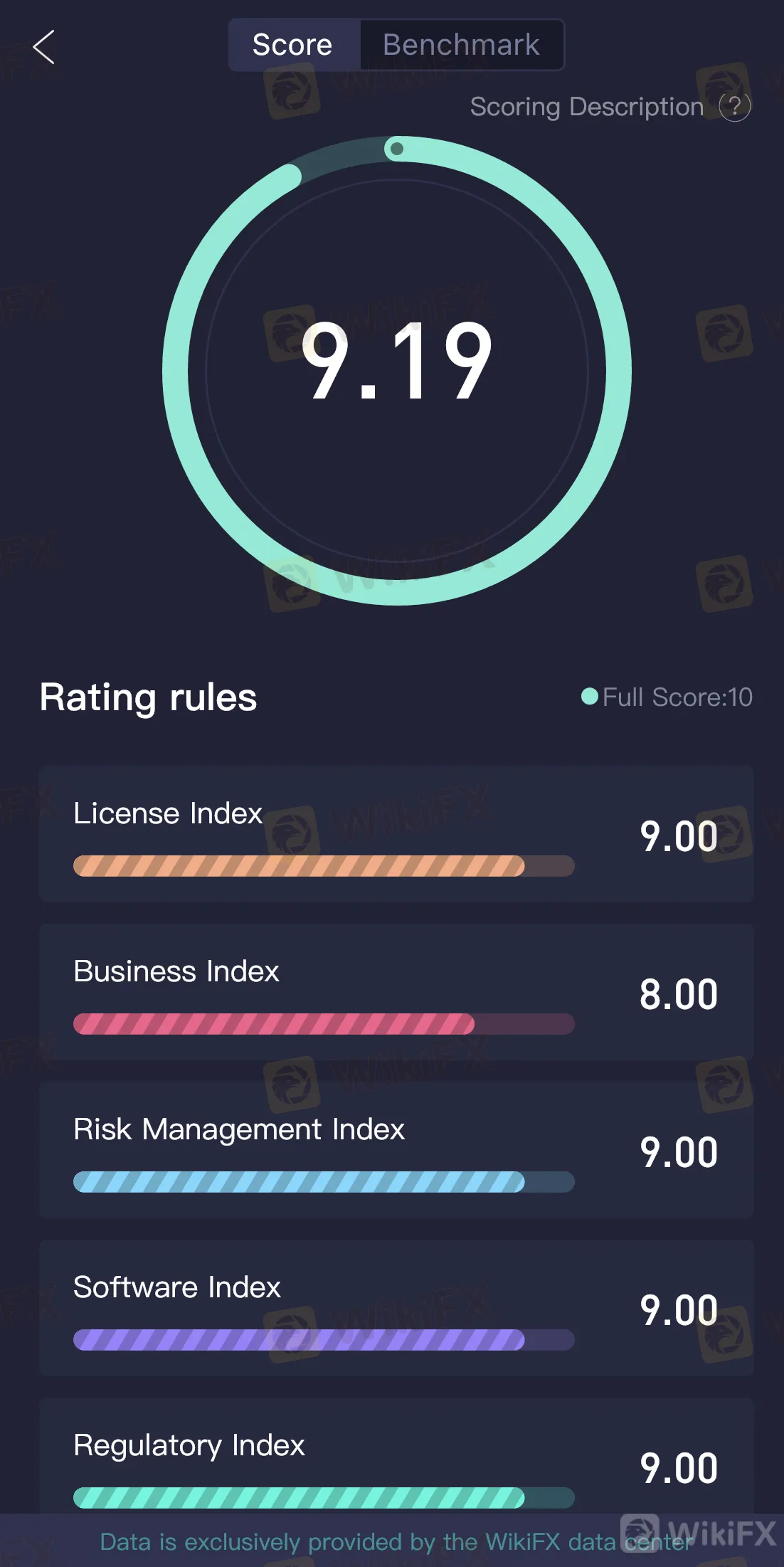

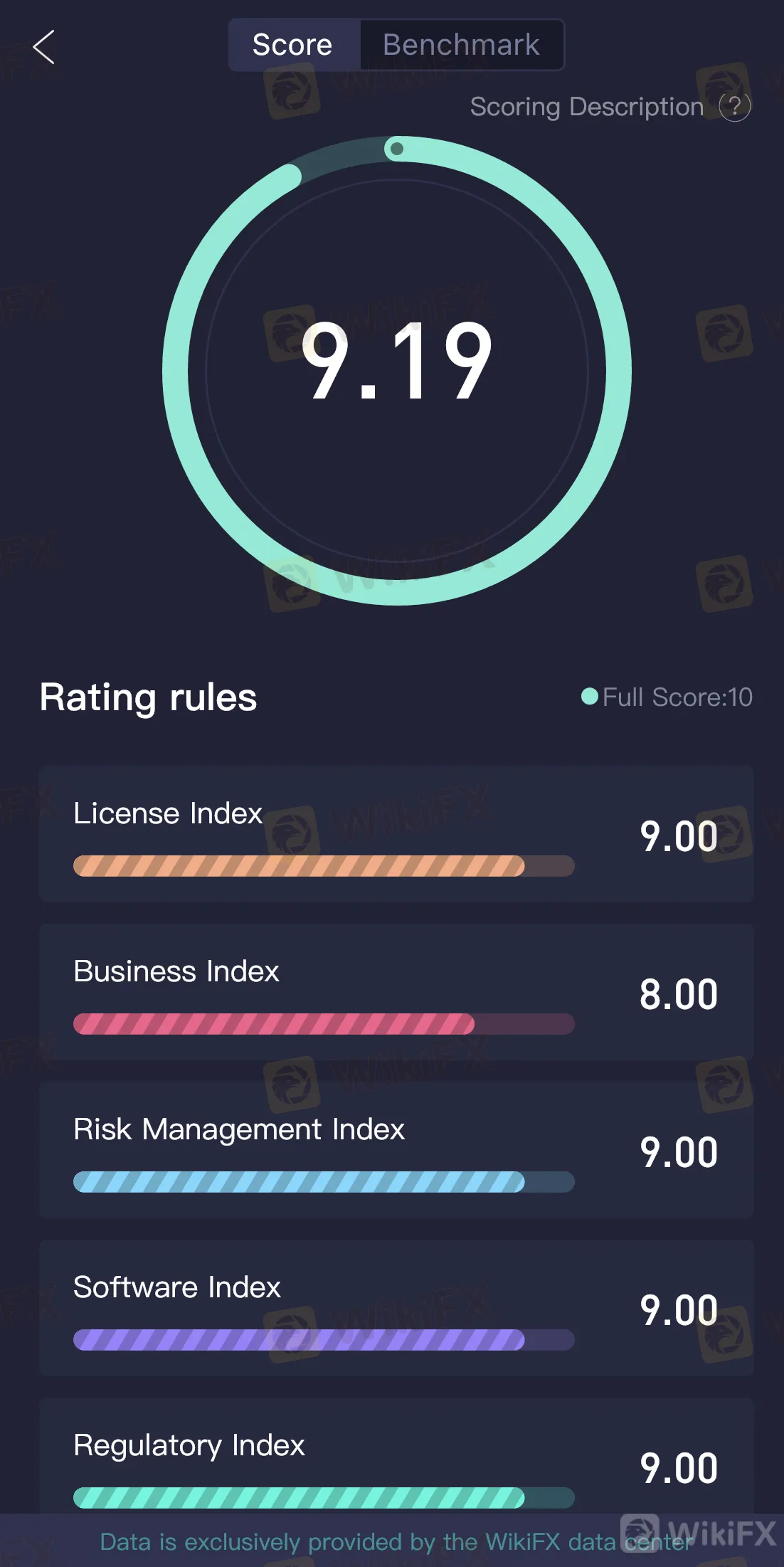

An example of the scoring and benchmarking system used by WikiFX to rank brokers taking into various aspects.

WikiFX ranks/exposes fraudulent brokers keeping users away from their schemes.

WikiFX also ranks brokers based on spread sizes of the main currency pair (EUR/USD in this instance) and commodities (typically gold and oil).

The WikiFX ‘Exposure’ page is where users can find honest comments and reviews posted by other brokers regarding their respective forex brokers. WikIFX also acts as an intermediary to resolve disputes between users and brokers.

It is highly positive that you put in a lot of time and effort in researching for the next technology device that you would like to purchase, or even a good place for dinner – so, if you are not investing even half of that diligence in reviewing and surveying for a good forex broker, you might have to rethink if that is a wise move.

Not just that, WikiFX also carries built-in features to take care of your trading in a practical manner. Click “All” for more.

WikiFX‘s ’News Express removes the need for users to read elaborated financial news by reporting the main market update in a single sentence.

WikiFX‘s ’News Express removes the need for users to read elaborated financial news by reporting the main market update in a single sentence.

WikiFX‘s ’Calendar function shows the upcoming economic events with their previous value, expected value, and announced value so traders and investors can brace themselves for any form of market volatility that could hit them unknowingly.

If you have made it till this far in the article, be sure that you have the free WikiFXs application downloaded on your phone so everything you need to know about forex trading is always accessible at the tip of your fingers.