Abstract:The latest Tweet by Bloomberg states, 'A rebound in emerging-market currencies is set to falter, if technical indicators and economic forecasts are any guide ...

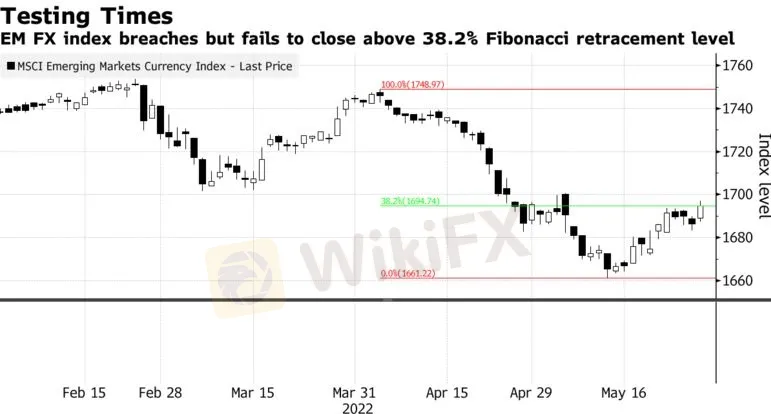

This month‘s rebound in emerging-market currencies is set to falter, if technical indicators and economic forecasts are any guide.A rally of about 2% in the MSCI Emerging Markets Currency Index has pushed the gauge to overbought territory on key momentum measures, just weeks after it climbed off an 18-month low. The basket of currencies is also yet to close above key resistance on closely watched Fibonacci charts. The deteriorating outlook for world growth adds to the headwinds, with the danger that China’s slowdown, the war in Ukraine and aggressive interest rate hikes combine to trigger recession across the globe. Its a scenario the World Bank has warned of, and one that would see money flow into dollar-denominated haven assets at the expense of developing economies.“There are plenty of risks to global growth that could support the dollar and undermine EM currencies into the medium-term,” said Jane Foley, head of FX strategy at Rabobank in London, who is cautious about emerging-market assets.

“I see recent moves as more of a short-term risk rally,” said Galvin Chia, EM FX strategist at Natwest Markets in Singapore. For the dollar to turn weaker in a more sustained way than seen recently, economic growth in the rest of the world would need to outperform, and this looks unlikely for now, said Chia.

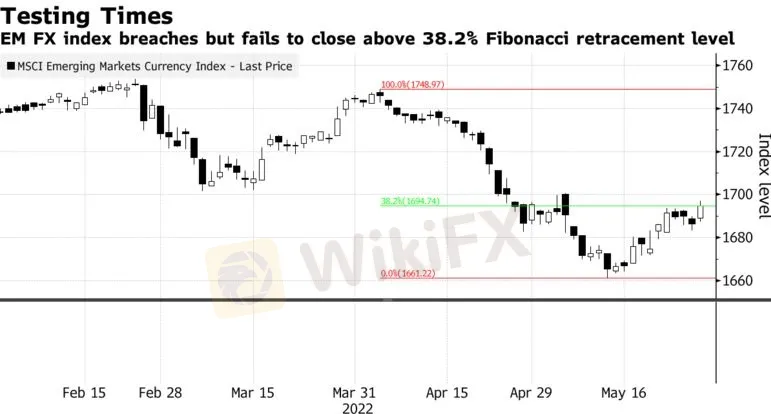

Currency speculators remain long the dollar and have increased their bets for gains in the greenback this month, though they are far less bullish than at the start of the year, data from the Commodity Futures Trading Commission show. The Bloomberg Dollar Spot Index has dropped about 3% from its May 12 high, after rallying nearly 9% to that point from a low in mid January.To be sure, not all emerging market currencies look set to stall, and some of those from Asia have the best chances of continuing to rise, according to strategists in the region.“The fundamental support for Asia is stronger relative to the other regions,” said Eddie Cheung, a Hong-Kong based EM currency strategist at Credit Agricole CIB. He sees appreciation by year-end for Asia EM currencies if Chinas economy and the yuan can show signs of stabilization.

Standing Out

Asia expected to grow faster in second quarter than other regions

Currencies of commodity importers like India should benefit if raw material prices weaken in a mild global slowdown, said Clement Niel, an emerging market debt portfolio manager at BNP Paribas Asset Management. The Thai baht “offers good value” and will benefit from a rebound in tourism, he added. A slew of indicators are due that will provide investors with cues for emerging-market currencies, including Indian gross domestic product, purchasing managers indexes for China and South Korean inflation.

Here are the key Asian economic data due this week:

· Monday, May 30: Japan machine tool orders

· Tuesday, May 31: India GDP, China PMI; Japan retail sales and industrial production; South Korea industrial production; Thailand BoP current account balance; New Zealand business confidence

· Wednesday, June 1: Australia GDP; South Korea trade; China Caixin manufacturing PMI; Manufacturing PMIs for Taiwan and India

· Thursday, June 2: Indonesia CPI and manufacturing PMI; Thailand foreign reserves; Singapore PMI; Australia trade balance

· Friday, June 3: South Korea CPI; India composite and services PMIs; Singapore April retail sales

Source:https:.bloomberg.com