Abstract:Expert Advisors (EA) trading is an automated system that utilizes computer programming to help traders in achieving systematic profits and growth. In today’s article, we are introducing WikiFX’s EA that could help elevate your trading performance without you lifting a finger.

EA is the abbreviation of Expert Advisors, also known as Automated Trading System (ATS) software, which is a computer simulation based on the actual operation of the order submitted by the trader to carry out the entire process of automated trading. It is a software that is specially designed to automate quantitative trading strategies after their main logical parameters have been calculated into a computer system.

Here are some advantages of automated technical trading:

1. Specialization in buying and selling methods

The computer automatically implements the order submission process when it detects the programmed buying and selling concepts as well as trading signals that are transmitted through computers.

2. Eliminates psychological problems of human nature

The hardest thing about trading is mastering ones emotions and psychological aspects, typically fear, greed, hesitation, and ego when buying and selling in the financial markets.

3. Calculated trading system

As computer software operates based on programming, it executes strictly with calculated profitability, risk control standards, and procedural processes.

4. Saves time and effort

Trading is a skill that takes a lot of effort and time to master but not everyone has the time to study the currency markets, and go through the ups and downs of the trading journey which could take years. Thus, this is where technology such as EA trading comes in handy.

WikiFX VPS‘s Expert Advisors that you could simply download into your broker’s MT4 trading platform and they execute trades automatically without any manual intervention for 24 hours, 7 days a week.

There are many EAs in the forex industry and some are sold with really high price tags. At WikiFX, all of our EAs cost as low as a cup of coffee, and they have all been through extensive backtesting to prove their ability to withstand different market conditions.

For more information, log on to the WikiFX EA Shop here: https://cloud.wikifx.com/en/eashop.html.

Alternatively, on the WikiFX mobile app, click on “EA”.

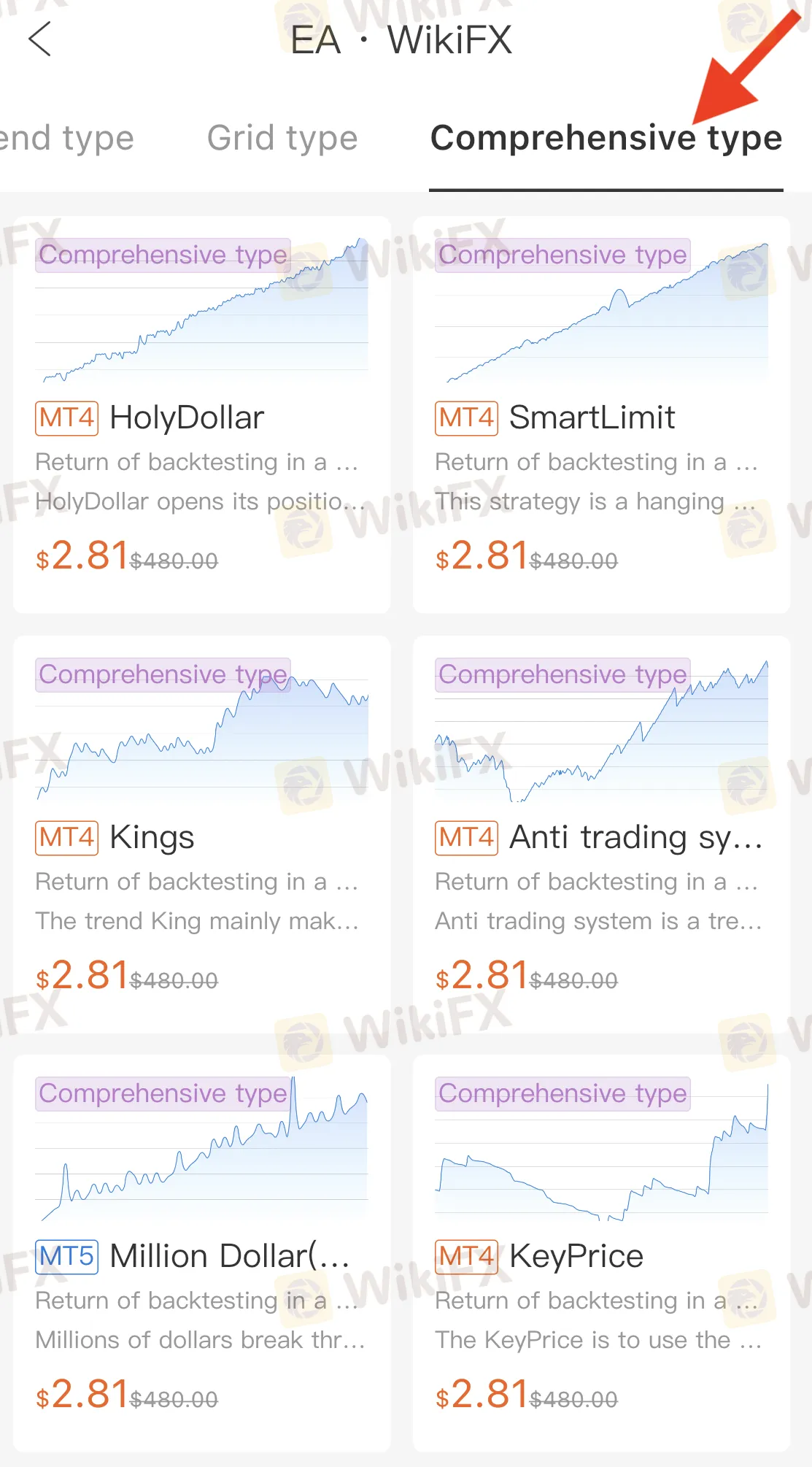

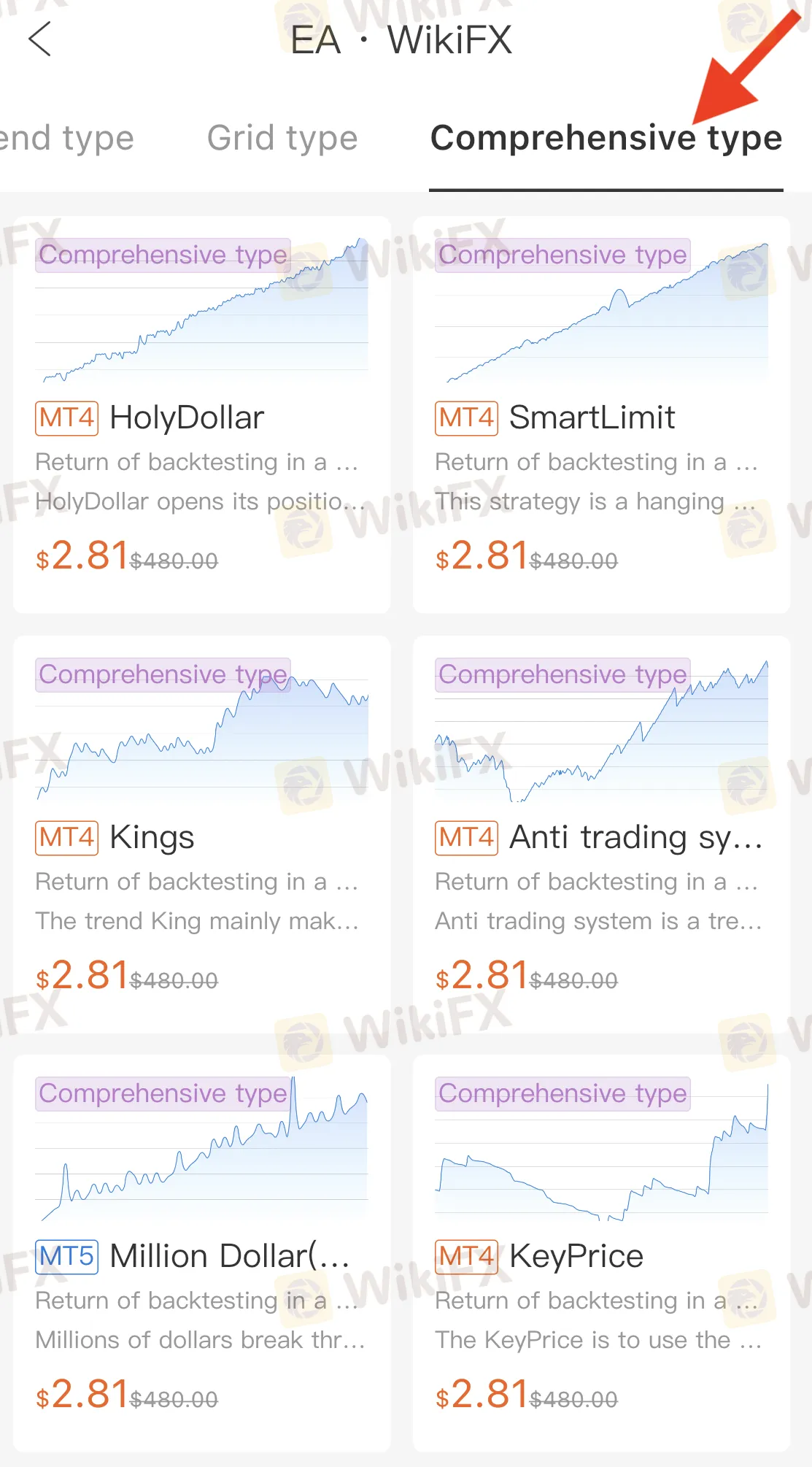

WikiFXs EA shop offers different categories of EA, namely Tools, Martin, Shock, Trend type, Grid type, and Comprehensive type.

Let us select one EA randomly as an example.

The EA we are using as an example is named Metaverse. From here you could see a detailed introduction about this particular EA including the rate of return during the backtesting period, how long it was being backtested before its official launch, how much profit/loss it had generated, etc.

From this screenshot above, you could see that this Metaverse EA has brought upon a net profit of $19.8K on a starting capital of $10K when used on trading gold.

Complete information of this EA is also available on the page for a deeper insight.

You could also download the test report to see a detailed breakdown of all the trading transactions that were carried out with this EA.

Using EA is an excellent and efficient way to trade but it is important to find an EA that works in line with your trading strategy and risk appetite. With a myriad of EA being offered on WikiFX VPSs EA page, we are certain that you could find a suitable one after doing your due diligence.

Whether you are trading with an EA or trading manually on your own, it is always wise to invest time and effort into conducting research and carrying out backtests with a demo account before trading your hard-earned money. That is also why WikiFXs EA is offered at such reasonable pricing so everyone could work towards a solid automated forex trading system at ease.