Abstract:In the event that the markets required any further justification to fear, today is Friday the 13th.

Click Here: After you read it, Daily Routine with WikiFx

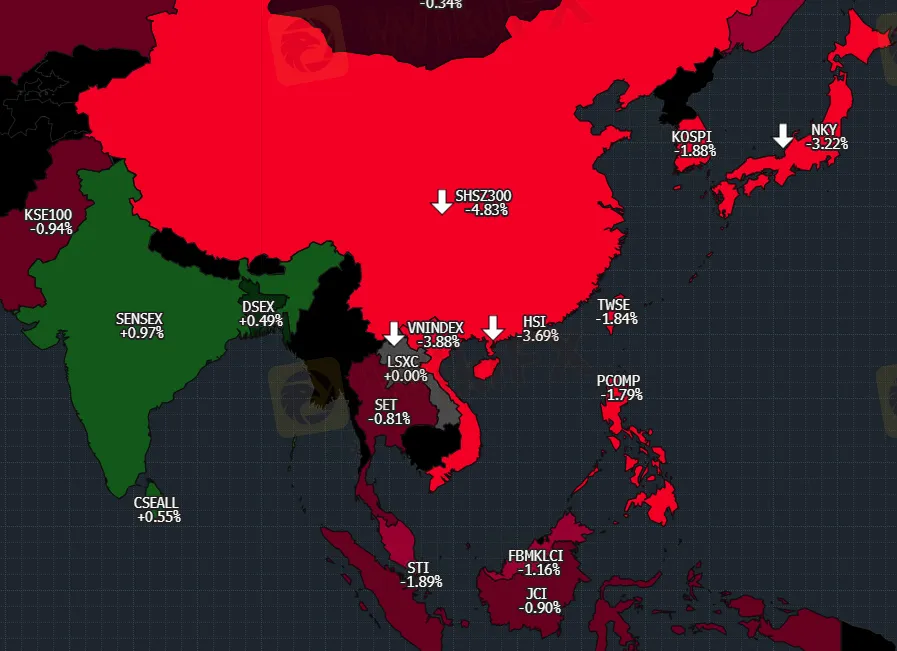

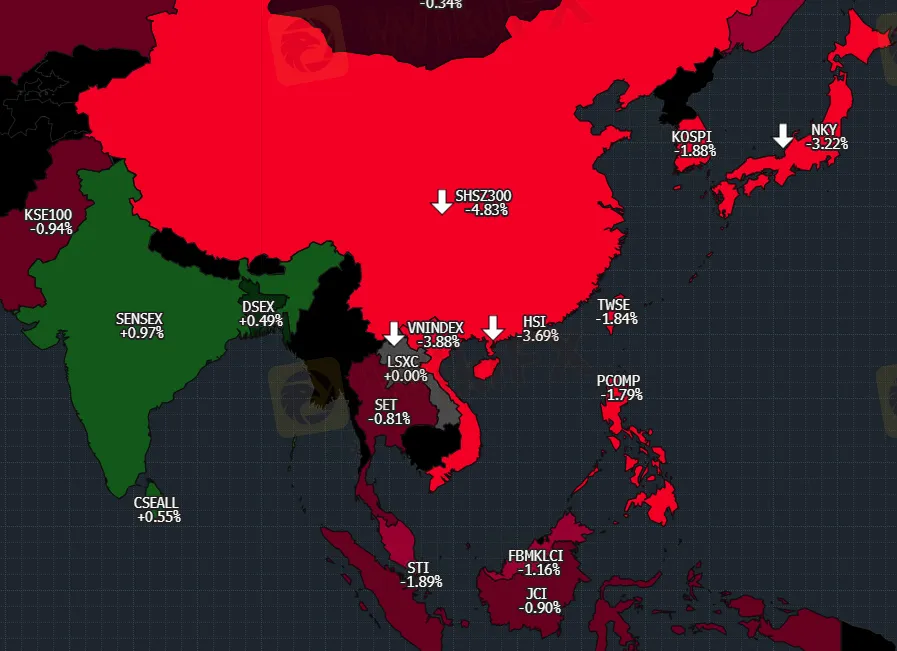

The S&P500 and the NASDAQ both finished flat yesterday, after a bumpy session with large swings in both directions. The benchmark FX index, EURUSD, fell to fresh lows of 1.0380 from 1.05s yesterday. The AUD fell to 0.685, while the JPY retreated to 128.50. Except for the JPY, Asian FX fell against the USD yesterday, with the CNY continuing its current drop. Treasury yields fell again, 2s over 10s. In May, 10Y US Treasury yields peaked at 2.86 percent, down 36bps. Have US treasury yields peaked for this cycle? Discuss… I'm curious about your ideas... I'm not sure, but it's worth thinking...

The US University of Michigan consumer confidence index and associated inflation expectations gauges are calm today. Powell and Daly have reiterated that the next FOMC meetings will provide 50bp raises, not 75bp, but this does not seem to be enough to calm the markets. We'll watch how Kashkari does today on oil and inflation.

India's April CPI came in at 7.8% YoY, above the average projection of 7.4%. The upside surprise was mainly due to food, but also to fuel and light, transportation (all reflecting higher energy prices), and apparel. Given the RBI's recent 40bp boost, it's worth pondering if the next move should be 50bp.

Today is also India's trade data. With local economic strength and higher-cost imported commodities, the market consensus is for the deficit to widen to -$20bn.

Beijing residents will be home for three days for Covid testing. Although not a “lockdown,” the economic repercussions will be similar. The zero-Covid policy holds true. A lockdown's economic impact is difficult to assess due to time and duration uncertainties Heavy rains have flooded Guangdong province. This may also impact factory operations, further hindering manufacturing and exports.

This budget includes 36.4 trillion won for the central government and 70% for small business owners. Each cash transfer is 6-10 million won (USD450-800). The remaining 23 trillion won will go to local governments. No bonds are needed because the budget is financed by 53 trillion won in extra tax income and spending restructured. Better supply conditions are expected to help the bond market. However, higher-than-expected government spending could push the CPI prediction for 2022 up to 4.6%, triggering more aggressive monetary tightening. For now, we expect the Bank of Korea to keep interest rates at 2.25 percent.

Click Here: After you read it, Daily Routine with WikiFx