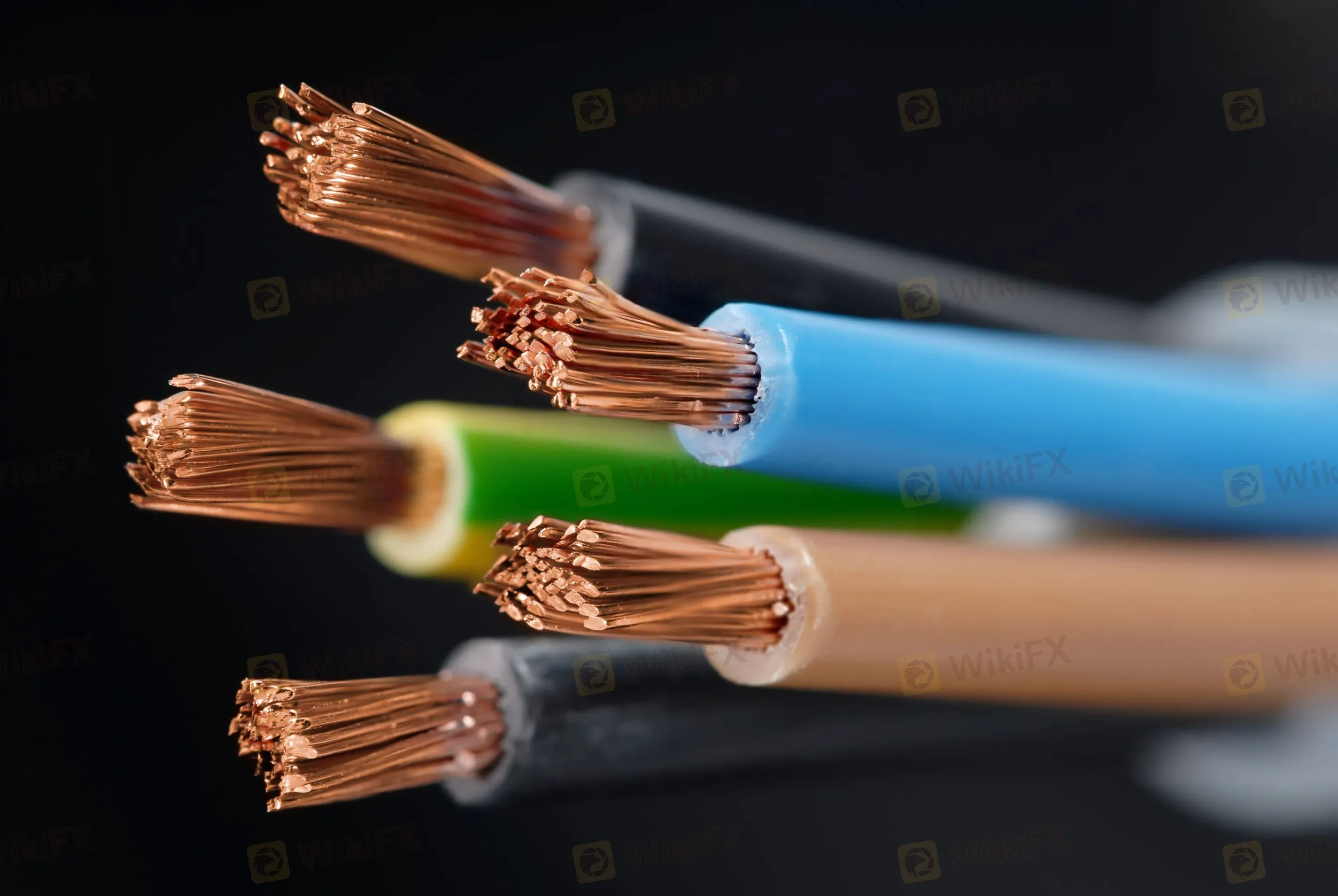

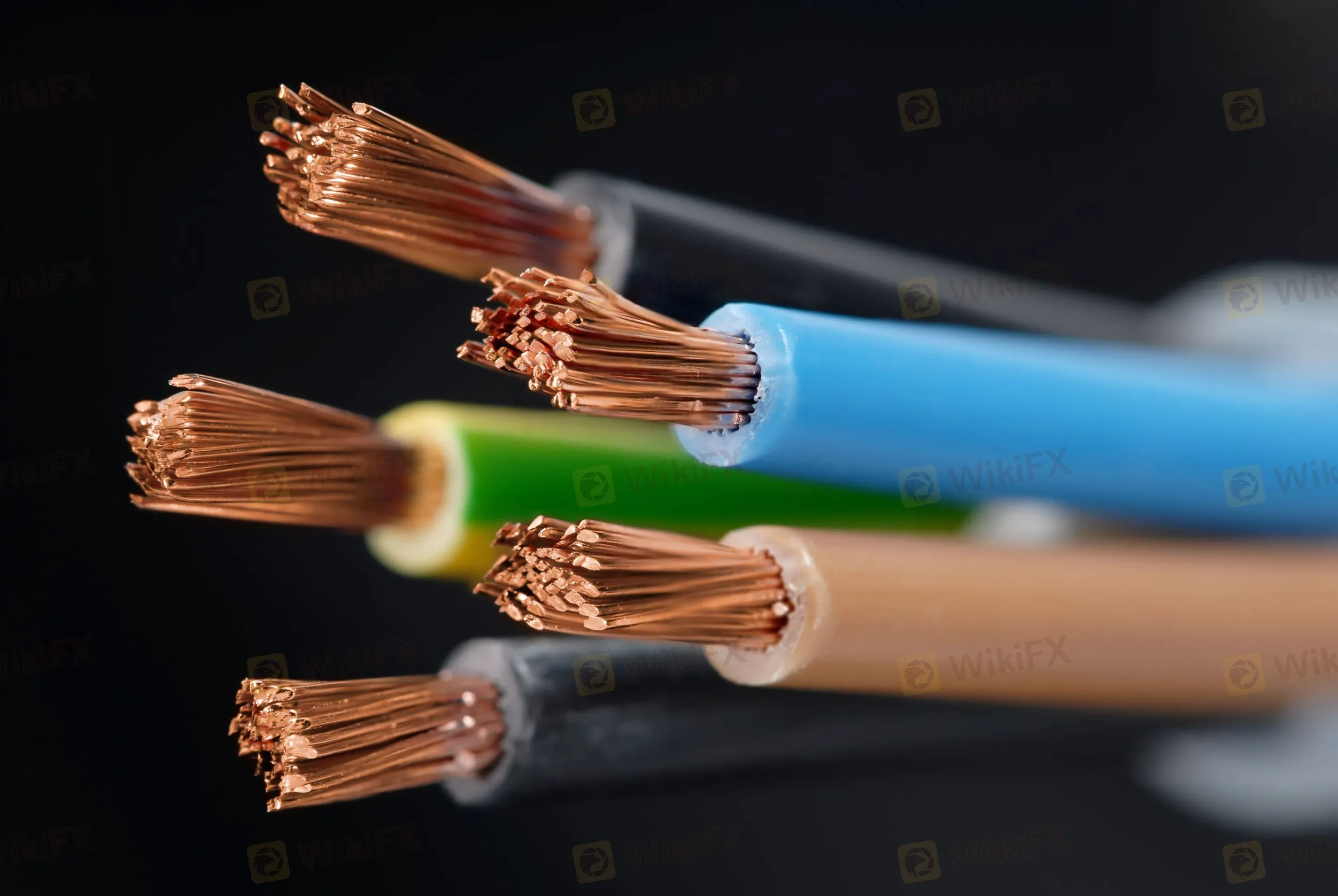

Abstract:Copper prices hold onto the bear-run as firmer US dollar and hardships for the largest customer, namely China, challenge the inventory conditions and favor sellers. The commodity prices hit the four-month low on LME earlier in the week and remain depressed afterward.

Copper remains pressured near four-month low on LME, down over 1.0% on SFE.

Inflation fears propel US dollars safe-haven demand ahead of NFP.

Chinas covid woes, tussles with the US challenge metal prices.

“Benchmark three-month copper on the London Metal Exchange (LME) was down 0.4% at $9,455.50 a tonne, as of 0156 GMT,” said Reuters. The news also mentioned that the most-active June copper contract on the Shanghai Futures Exchange fell 1.3% to 72,100 yuan ($10,783.89).

That said, the risk-aversion wave takes clues from the concerns that the higher inflation will escalate interest rate and negatively affect the global growth, which in turn dampens the red metals industrial demand.

The inflation-linked woes worsened the previous day after the Bank of England (BOE) forecasted double-digit inflation and economic recession. The same rocked the US boat due to the rising inflation fears and firmer jobs market, which the Fed seemed to have taken lightly by rejecting 75 basis points (bps) of a rate hike.

On the other hand, the US Securities and Exchange Commission (SEC) added over 80 Chinese firms to the list of companies facing probable delisting from the US exchanges, which portrayed fresh Sino-American tussles and weighed on the risk appetite as well. Further, the worsening covid conditions in China and the European Unions (EU) readiness for more sanctions on Russia add to the risk-off mood.

The downbeat Factory Orders from Germany, softer activity data from the West and Perus refrain to remove temporarily suspension of civil liberties in an area comprising a major copper mine are some additional challenges for the red metal prices.

On the positive side, depleting inventory levels and supply crunch are some motivations for the buyers to stay on the table.

That being said, the commodity prices are likely to remain depressed in the short-term considering the global woes and downbeat conditions in China. Today‘s US employment data may add to the metal’s weakness should the headline Nonfarm Payrolls (NFP) beat the expectedly easy figures with strong numbers.