Abstract:The global economy will expand more slowly than predicted three months ago, according to Reuters polls of over 500 economists, who said higher commodity prices and an escalation in the Russia-Ukraine war could prompt another downgrade.

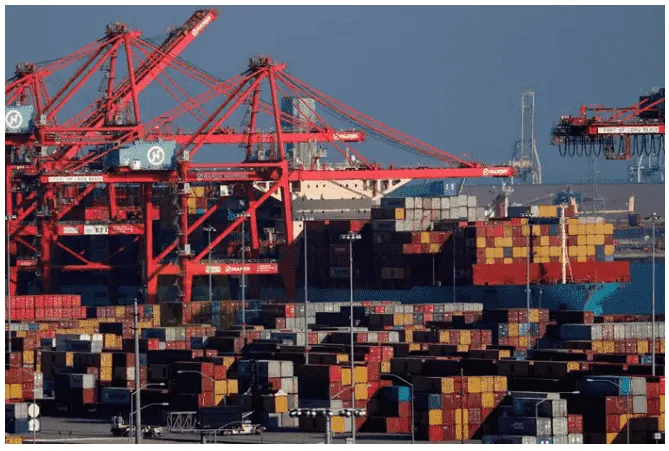

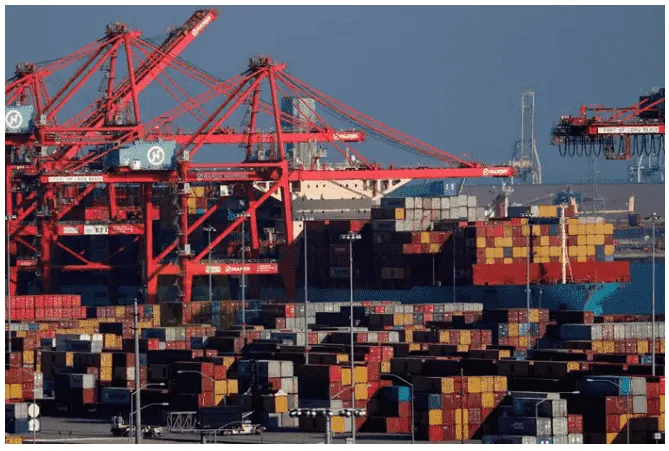

Already under pressure from monetary tightening as central banks try to stem rising inflation, world economic output was dealt a body blow when Russia invaded Ukraine on Feb. 24, sending commodity prices through the roof and triggering waves of economic sanctions.

When asked to name the biggest two downside risks to the global economy this year, the top picks of roughly 200 respondents were persistently higher commodity prices and a further escalation in the Russia-Ukraine war.

They were closely followed by supply chain disruptions – exacerbated by the Russian invasion – followed by second-round inflation effects and over-eager central bankers.

“MASSIVE SUPPLY SHOCK”

Even without those future risks, median forecasts for global growth collected in this months Reuters polls on over 45 economies were chopped to 3.5% this year and 3.4% for 2023 from 4.3% and 3.6% in a January poll.

That compares to an International Monetary Fund prediction of 3.6% growth in both years.

“Even before the Russia-Ukraine confrontation escalated, central banks were fighting a severe upsurge in inflation that reflected the imprint of the pandemic, stressed global supply chains, and tightening labor markets,” said Nathan Sheets, global chief economist at Citi.

“But now, in addition, spillovers from Ukraine have brought a massive supply shock, which has prompted us to further raise our projections for inflation and mark down our outlook for global growth.”

The experts upgraded their inflation forecasts for nearly all the economies in question, underscoring a view that inflation will remain high and above most central banks targets for longer than previously thought.

With soaring inflation gripping much of the world, only 13 of the 25 top central banks polled on were expected to get inflation down to target by end-2023, a drop from 18 in the January poll.

Most were expected to go ahead with plans to tighten policy to counter inflation despite the risk of curbing growth or even, according to indicators in some markets, triggering recessions.

“Just wrestling the inflation dragon to the ground looks to be a difficult task. Doing it while dodging recession risks will require adroit policymaking and, likely, some good luck as well,” Citis Sheets added.

GRAPHIC: Reuters poll – 2022 Global GDP growth revisions https://fingfx.thomsonreuters.com/gfx/polling/xmvjoybodpr/Reuters%20Poll-%202022%20Global%20GDP%20growth%20revisions.png

RISING RATES

In the U.S., the worlds largest economy, the Federal Reserve was expected to raise interest rates by at least another 150 basis points before year-end, with growth expected to slow to 3.3% this year and 2.2% next, down from the 3.6% and 2.4% predicted last month. [ECILT/US]

Economists gave a 25% probability of a U.S. recession in the next 12 months and 40% within two years.

Economic growth in the euro zone was expected to be 2.9% this year and 2.3% in 2023, down from 3.8% and 2.5% predicted a month ago. Poll medians also showed the European Central Bank raising its deposit rate this year, with a 30% probability of a recession within 12 months. [ECILT/EU]

“The more important point is that, with or without a recession, the performance of the worlds major economies is likely to be weaker than most currently anticipate,” said Neil Shearing, group chief economist at Capital Economics.

“Developments in the first quarter have only reinforced our belief that 2022 will be a year in which most economies struggle.”

In Britain, the cost-of-living crisis is likely to have a severe impact on economic growth this year but the Bank of England is forecast to press ahead with raising borrowing costs all the same. [ECILT/GB]

As an outlier, the Bank of Japan, which has not managed to get inflation up anywhere near its target for decades, was not expected to tighten policy anytime soon, despite the rising tide of global prices. [ECILT/JP]

That interest rate scenario has had a dramatic effect on the yen which sank to a 20-year low against the dollar last week.

Growth estimates were downgraded for most Asian economies polled as Chinas economic setbacks have darkened the outlook for countries in its orbit, from South Korea to Thailand.

That was likely to have an economic impact not just for the region but also for the world at large.