Abstract:Last night at UTC +8 8.30 pm, the U.S. Department of Labour released its Consumer Price Index (CPI) data report. The CPI report for March reported a 1.2% increase after a 0.8% rise in the previous month. This figure lived up to the forecasted rate.

<WikiFX Malaysia Original: Editor - Fion>

Last night at UTC +8 8.30 pm, the U.S. Department of Labour released its Consumer Price Index (CPI) data report. The CPI report for March reported a 1.2% increase after a 0.8% rise in the previous month. This figure lived up to the forecasted rate.

However, the Core CPI m/m which was originally expected to remain at 0.5% (as highlighted in our Mondays article https://www.wikifx.com/en/newsdetail/202204116994539231.html), dropped to 0.3% instead. From a YoY standpoint, the total increment of the CPI data report in March is 8.5%, making it the fastest 12-month inflation pace since December 1981.

This new CPI report highlights the increasingly severe inflationary situation in the U.S. Energy prices, housing costs, and food prices had climbed significantly due to the Russian-Ukraine conflict as well as the supply chain disruptions with China combating a new wave of Coronavirus.

This CPI report also shows that, excluding the more volatile food and energy prices, core CPI rose 0.3%, which is equivalent to a 0.2 basis points rise in comparison to Februarys report. The YoY increase with this exclusion is 6.5%, making it the highest value since August 1982. This puts additional weight on American households, typically the low-income groups, now have to carve out more budget for their daily expenditures.

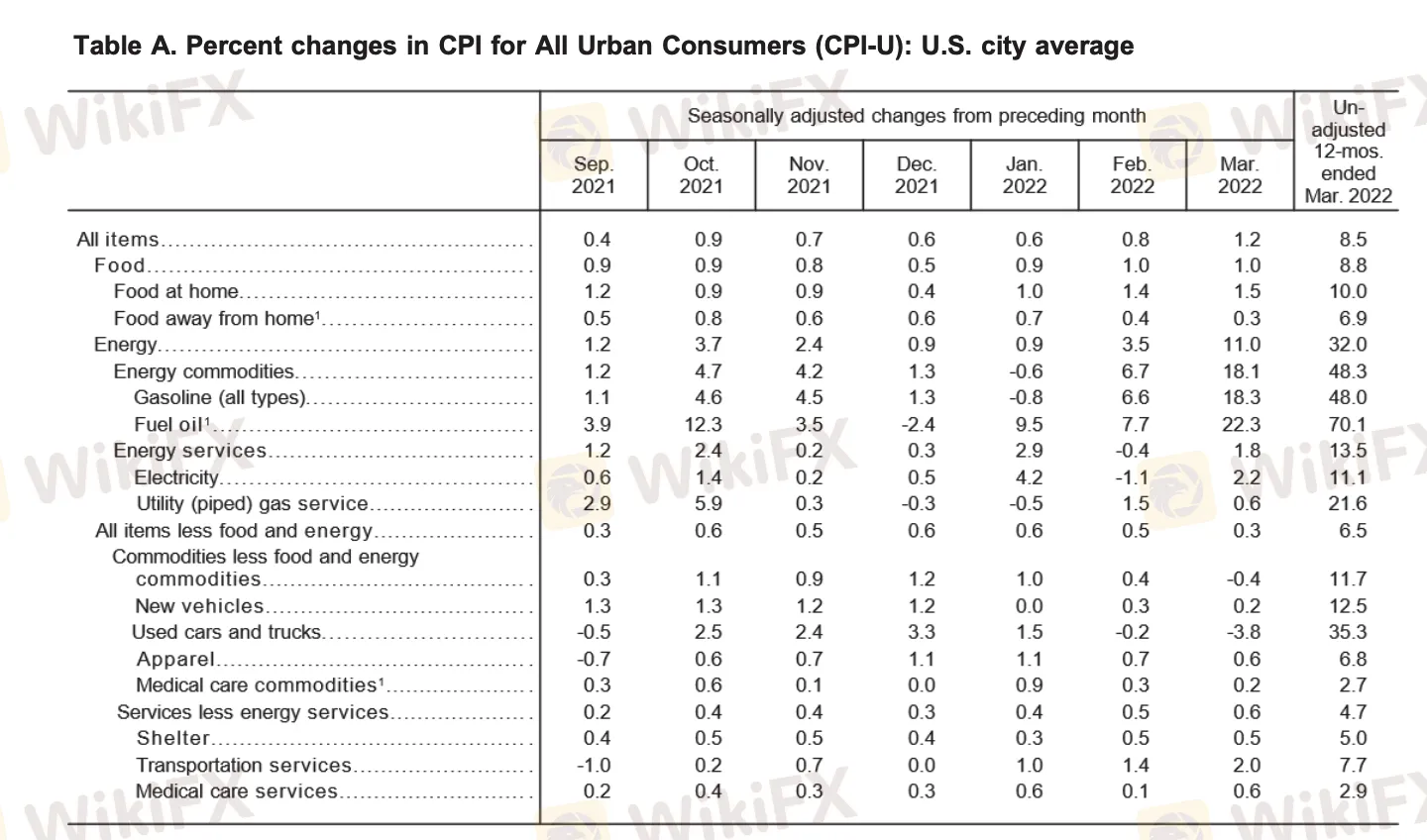

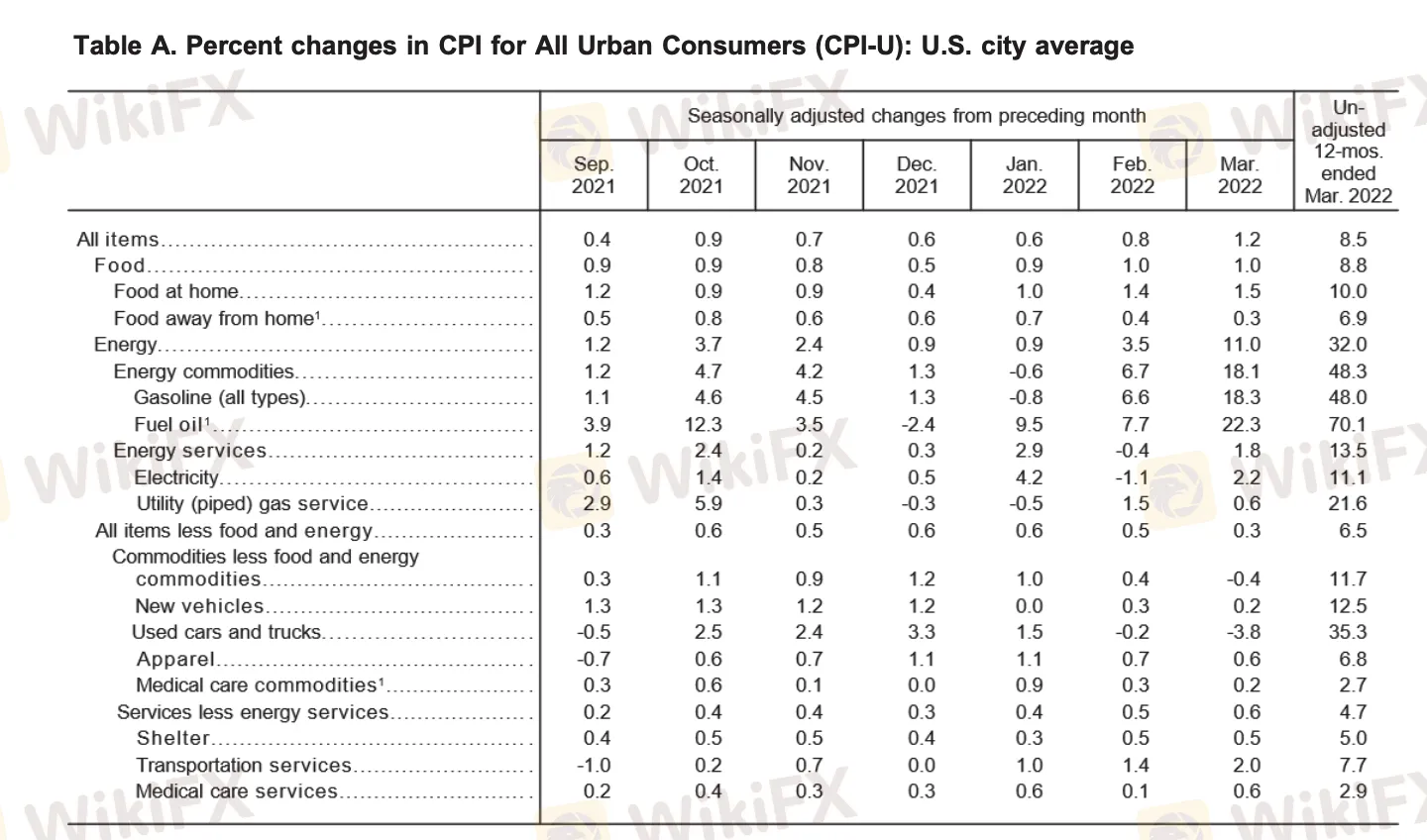

Extracted from the CPI March 2022 Data Report

As we break the components down of Americas CPI, we could see that energy prices jumped 11% with gasoline up by 18.1% and fuel oil up by 18.3%, which was a whopping 70.1% in terms of YoY.

According to the chief economist from Grant Thornton, one of the biggest accounting organizations in the world and America, oil price could be reaching its peak and it is time to divert our attention to another sector. A bigger problem lies within the rising prices of consumer goods and services. The increase in vehicle prices, typically the used cars and trucks that recorded a YoY increment of 35.3% could pose another issue for Americans too. If the supply chain issues persist, all these problems could become more severe.

Considering that the supply chain disruptions caused by the pandemic have not yet improved and the increase in U.S. consumer demand for services such as travel, the inflation rate is unlikely to fall back to the 2% inflation target set by the Federal Reserve in the near future.

At the same time, the risk of inflation dragging the U.S. economy into recession is building up. Economists predict that Americas economic activity may shrink as consumers gradually cut back on spending due to rising prices.

The market is now widely expecting a 50 basis points interest rate hike during the May FOMC meeting.

<WikiFX Malaysia Original: Editor - Fion>