Bitcoin (BTC) is currently moving in the $43k-$45 range after plummeting from the $48k level within a week. On-chain data indicates a bullish divergence and a rise in whale activity at current levels. Thus, the Bitcoin (BTC) price could see a strong upward movement from here. At the time of writing, the Bitcoin (BTC) price is trading at $43,615, rebounding nearly 2% in the last 24 hours.

Bitcoin (BTC) Price Builds Bullish Momentum

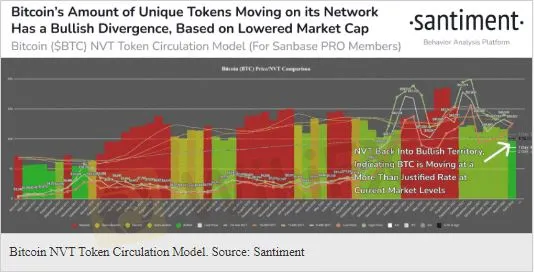

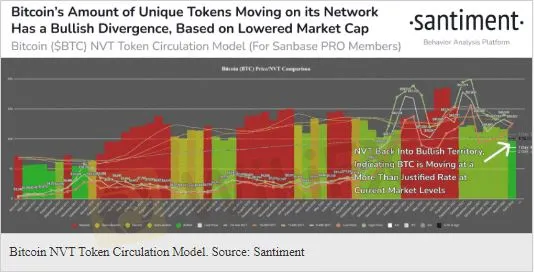

On-chain analytics platform Santiment announced in a tweet on April 8 about the Bitcoin (BTC) price indicating bullish divergence as the number of unique tokens on the network moves into bullish territory. The Bitcoin (BTC) NVT token circulation model data points to an upcoming rally in Bitcoin price at the current market levels.

Bitcoin dropped to below $43.1k, and has recovered mildly since. Through the first week of April, our model indicates a bullish divergence between the amount of unique $BTC moving on its network vs. current market cap levels.

Moreover, Bitcoin (BTC) Whale Transactions above $100k indicate that the largest spikes in whale transactions in the last 24 hours. Whales moved more than 1000 BTC worth more than $100,000. Moreover, amid the Bitcoin redistribution, whales have continued to move Bitcoin out of exchanges. Thus, the Bitcoin (BTC) price is moving higher since bottoming out near the $43k level. Also, the on-chain data points to strong bullish momentum in the Bitcoin price.

Bitcoin (BTC) Upcoming Price Trend

The Bitcoin price is currently trading sideways at the moment. With the mid-having event scheduled on April 11, the price should break higher above the $45,500 level to confirm a bullish rally. However, if the Bitcoin (BTC) price fails to build momentum and breaks the 43,000 level, we could see more downside in price.

As per CoinMarketCap, the Bitcoin price is down nearly 3% in the last week.