Abstract:Bitcoin (BTC) is still trading 18% up on the monthly chart.

Bitcoin (BTC) and the broader crypto market have corrected 5% as investors decide to turn risk-averse preparing for the biggest Fed rate hike. Earlier today, Bitcoin fell to a low of $42,700 before recovering back marginally.

This is for the first time since March 24, 2022, that the BTC price has dropped under $43,000. In the last two days, the worlds largest crypto has corrected by more than 10%.

Altcoins have witnessed a similar drop with the top ten altcoins connecting anywhere between 4-10%. The Bloomberg report states that comes that the selling pressure in crypto comes amid a broader sell-off in equity markets. Earlier today, Japans Nikkei index was down by more than 1.5%.

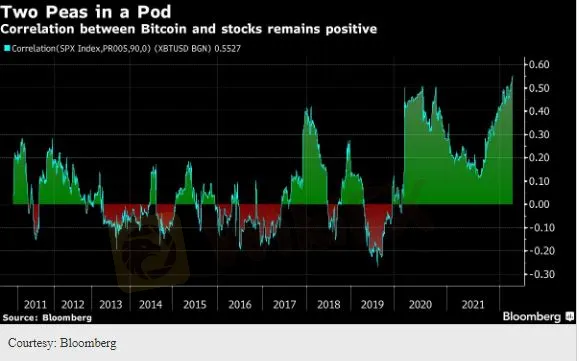

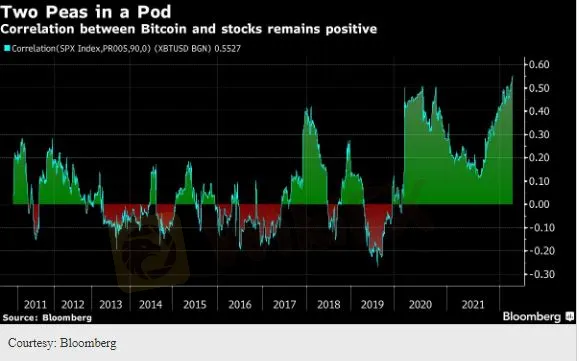

Furthermore, Bloomberg adds that the correlation between Bitcoin and the U.S. equities has climbed over the last three months.

Over the last few weeks, Bitcoin has been showing strength along with the broader crypto market. Last week, the world‘s largest crypto surged to $48,000 before reversing its trajectory. Even with today’s correction, Bitcoin (BTC) is still trading 18% up on the monthly chart.

When Will Bitcoin (BTC) Take Off Again?

For now, Bitcoin can take short-term support at $42,500 levels. Crypto billionaire Mike Novogratz believes that Bitcoin (BTC) can start taking off once again once the Fed takes a pause. Well, Fed doesnt;t seem to be stopping anytime soon as it has hinted at a minimum of 4 rate hikes.

Novogratz predicts that the Federal Reserve will remain hawkish for a while amid the surging inflation and could raise the interest rate by 50 basis points on an immediate basis. But he adds that as the Fed steps back, “Bitcoin goes to the moon”.

Novogratz‘s comments came while speaking at the ongoing “Bitcoin 2022” conference in Miami. On the other hand, Bitcoin’s on-chain metrics continue to show strength. Theres a huge surge in the number of Bitcoins moving off the exchanges.