AfterPrime Regulation: Is It Legit or Suspicious?

AfterPrime Regulation: CySEC regulation adds credibility, but ASIC clone and offshore risks make traders cautious.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Gold Price Forecast: XAU/USD eyes a dip to near $1,900, hawkish Fed officials sour market mood

Fed rhetoric is boosting the US dollar and weighing on gold.

XAU/USD to remain bearish amid rising US yields.

Update:

Gold (XAU/USD) is performing lackluster in the Asian session after a sheer sell-off on Tuesday. The precious metal is oscillating in a range of $1,916.70-1,924.98 and is likely to skid to near the psychological support of $1,900.00, considering the bearish price action and hawkish stance adopted the Federal Reserve (Fed) policymakers. Fed Governor Lael Brainard cleared in her speech on Tuesday that the Fed is prepared to be aggressive if the indicators of inflation and its expectations heighten the likes of such action. While Fed President Mary Daly has emphasized more on balance sheet reduction by the Fed soon. Also, the US economy is not going to witness a big slowdown due to rising oil prices.

Meanwhile, the US dollar index (DXY) has climbed to near 99.60 on negative market sentiment. Hawkish stances from the Fed officials are indicating a restriction of liquidity infusion in the world due to higher interest rates going forward. This has activated the risk-off impulse and eventually the greenback is scaling higher. Apart from the DXY, US Treasury yields are injected with steroids on rising odds of a 50 basis point (bps) interest rate hike. The 10-year US Treasury yields has overstepped 2.6% and is eyeing to register a fresh three-year high.

End of Update

The gold price was a touch lower as the US dollar weighed. The greenback hit its highest level in nearly two years as measured by the DXY index vs. a basket of other currencies. A more hawkish Fed also saw the benchmark 10-year Treasury yield run to 2.55% while the two-years hit 2.56% for the first time since March 2019.

Spot gold was down 0.3% at $1,916 per ounce, but trading in a narrow range while US gold futures eased 0.1% to $1,931.20. At the time of writing, XAU/USD is down 0.2% at $1,921 and weighed in Asia following comments from Federal Reserve Governor Lael Brainard.

The Fed member spoke of potential aggressive action from the Fed in anticipation of hawkish minutes tomorrow. Brainard said the central bank could start reducing its balance sheet as soon as May and would be doing so at “a rapid pace.” Brainard added that interest rate hikes could come at a more aggressive pace than the typical increments of 0.25 percentage points.

Eyes on the Fed

Meanwhile, the Fed officials began the process of policy normalization by lifting rates 25bp to 0.25%-0.50% at the March meeting and on Wednesday the minutes of that meeting will be released.

''The FOMC pull no hawkish punches in its policy guidance, with Chair Powell also hinting further information about QT plans will be provided in the minutes (possibly including caps details). We continue to expect an official QT announcement at the May FOMC meeting,'' analysts at TD Securities said.

''Gold prices have remained incredibly resilient, reflecting that strong ETF and comex inflows into gold are trumping outflows associated with a hawkish Fed, which is in turn creating a divergence between gold and rates markets,'' analysts at TD Securities said.

''Considering that real rates could be less useful as a barometer for measuring gold's relative price, we turn our attention to gold flows to gauge the sustainability of interest in the yellow metal. Our analysis highlighted ETF flows have tended to be more highly correlated to changes in market expectations for Fed hiking, than to real rates, the yield curve or even price momentum.

This still suggests that the strong ETF inflows have rather been associated with safe-haven appetite, which could still lead to downside risks as the negotiators continue to work towards a ceasefire and as the fear trade subsidies.''

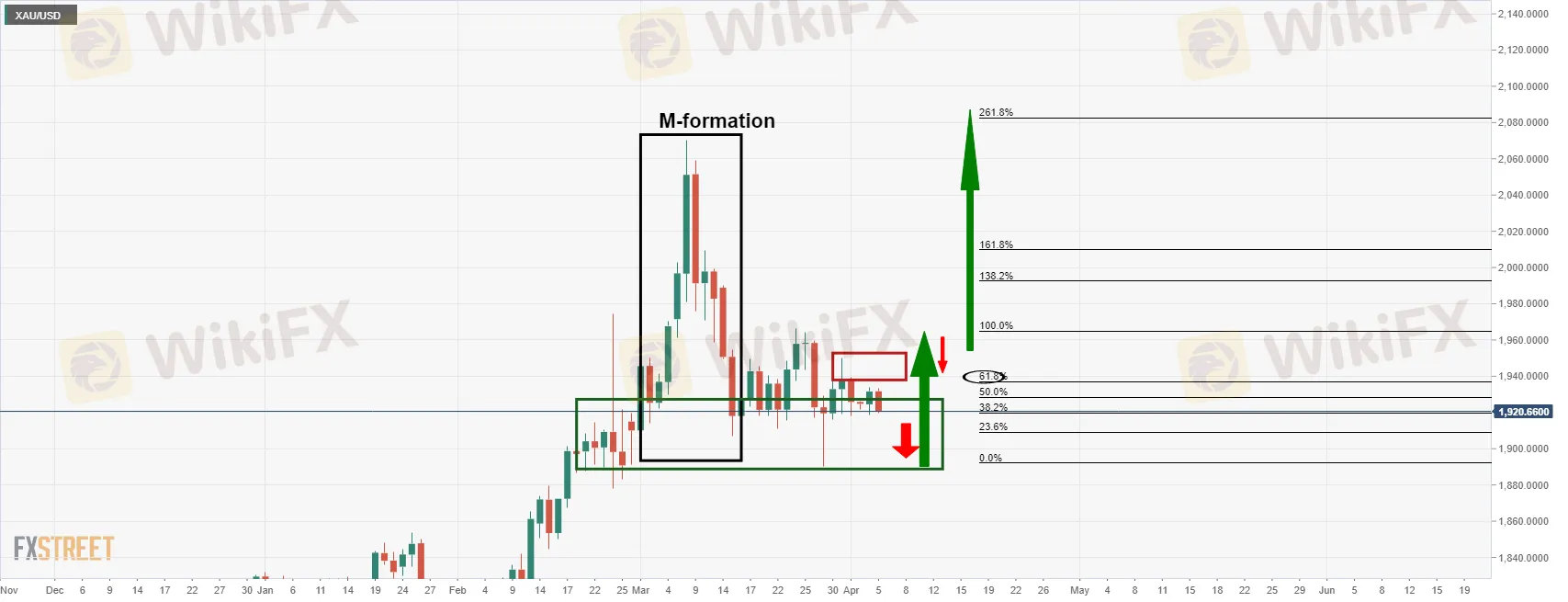

Gold, technical analysis

As per the pre-open analysis, Chart of the Week, Gold: XAU/USD is pressured for the open ...

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

AfterPrime Regulation: CySEC regulation adds credibility, but ASIC clone and offshore risks make traders cautious.

UbitMarkets review reveals no valid license and direct links to a fraudulent project, raising serious concerns over investor fund safety.

LMAX GROUP review: FCA regulation, WikiFX score 7.51/10, trader complaints, risks, and broker comparison. Is LMAX GROUP safe for traders?

Is withdrawal issue perennial for Phyntex Markets traders like you? Does the Comoros-based forex broker give you numerous excuses to deny you withdrawals? Faced account blocks when raising Phyntex Markets withdrawal queries? Feel that the broker’s customer support service does not exist for you? Many traders have openly expressed frustration on how the broker goes about its business on review platforms. In this Phyntex Markets review article, we have shared multiple complaints against the broker. Keep reading to know the same.