Abstract:Bexchange, also called Bexchange Solution Limited, was established in 2020. As per the website, the company is located in London, UK. However, it seems that the reality is a little bit different.

What Bexchange is

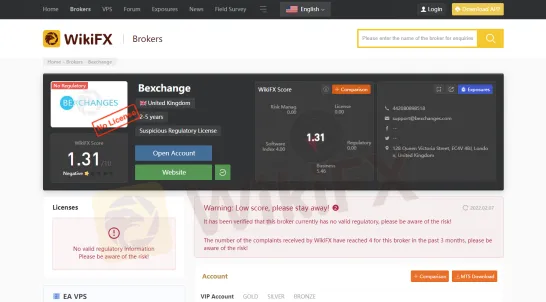

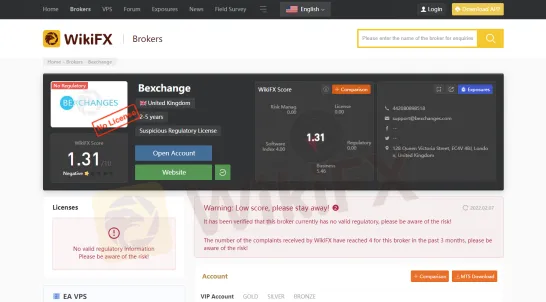

Bexchange, also called Bexchange Solution Limited, was established in 2020. As per the website, the company is located in London, UK. However, it seems that the reality is a little bit different. As a UK-based company, Bexchange should have FCA approval for providing financial services. However, what we did find is a company with the same name registered in Belize, we can not identify the actual headquarter of Bexchange. Besides, this broker currently doesnt have a legitimate license. And it has been given by WikiFX a very low rating of 1.31/10. Therefore, please note the reliability of Bexchange before you make a right decision.

Market Instruments

Bexchange offers trading on the Forex market, with commodities, equities, indices, and futures.

Minimum Deposit

In terms of deposit, Bexchange requires a minimum deposit of $1,000. An unregulated, most likely offshore broker is asking you to deposit such a high amount. Generally, most legit brokers only requires account opening amount of $100 or even less.

Leverage

Bexchange offers a whopping leverage up to 1:500. Since leverage can amplify gains as well as losses. Please note that trading with a broker with such a high leverage is relatively risky.

Spreads & Commissions

Bexchange offers the spread on the EUR/USD pair around 2 pips, which is slightly higher than the industry standard (usually between 1 to 1.5 pips).

No Demo Account

There is no demo account available for beginners to test trading conditions and practice trading strategies.

Deposit & Withdrawal

In terms of payment methods available, Bexchange does not make this part clear. Most brokers would support traders to fund their accounts through Credit/ Debit Card, Wire Transfer, as well as some online processor like Skrill and Neteller.

Complaints

WikiFX has received a bunch of complaints from traders about the problems that Bexchange has. For example, one trader who comes from Vietnam reported that a severe slippage occurred and his/her account was blown. Another trader who also comes from Vietnam claimed that the customer service was bad. She/He had waited the whole afternoon for the withdrawal.

Conclusion

Since Bexchange is not regulated by FSCA, we don't advise African traders to invest in this broker. For your money safe, we recommend you to choose the brokers that have legitimate licenses. WikiFX contains details of more than 31,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.