Abstract:DXY prints mild gains, up for the fifth day to poke April’s high.

US Treasury yields wobble around weekly bottom following mixed data, hawkish Fedspeak, IMF comments.

NFP expected to keep rate hike jitters on the table, likely offering further strength to greenback.

US dollar index (DXY) remains on the front foot around 92.58 during the early Friday. The greenback gauge versus the six major currencies refreshed multi-day high the previous day amid increasing chatters over Feds action and mostly positive US data.

US ISM Manufacturing PMI came in a touch softer than 61.00 expected and 61.2 previous readouts to 60.6 in June. This also joins the details relating to the employment component that dropped to 49.9 but the prices-paid sub-component jumped to the highest since 1979. On the contrary, Initial claims for last week fell to 364K, dragging down the four-week average to 392.75K, which in turn backs a strong NFP print that is expected to rise from 559K to 690K in June.

Following that data, Philadelphia Federal Reserve Bank President Patrick Harker told the Wall Street Journal that he supports the start of bond-buying pullback later this year. His hawkish statements precede the International Monetary Funds (IMF) comments suggesting an upward revision to 2021 GDP and rate hike calls during the second half of 2022, not to forget the start of tapering in early 2022.

It should, however, be noted that the market‘s doubts over the global economic recovery due to the latest Delta covid variant outbreak seem to probe the DXY bulls of late. Additionally, fears that the key US jobs number, the NFP, will disappoint the markets and back the need for easy money add to the USD bulls’ worries.

It‘s worth noting that the market’s indecision, as portrayed by the US Treasury yields and stock futures, also challenge the key US dollar index.

Moving on, DXY bulls will keep their eyes on the covid updates for the intermediate move but nothing will be more important than the NFP readouts, expected 690K versus 559K prior. Should the jobs report keep portraying strong recovery in the US labor conditions, the push for Feds monetary policy adjustments will be stronger and favor the USD buyers.

Read: NFP Preview: Four reasons why June's jobs report could be a dollar downer

Technical analysis

Although an ascending trend line from May tests DXY bulls around 92.70, bears are less likely to get convinced until the quote stays above the 200-DMA level of 91.43.

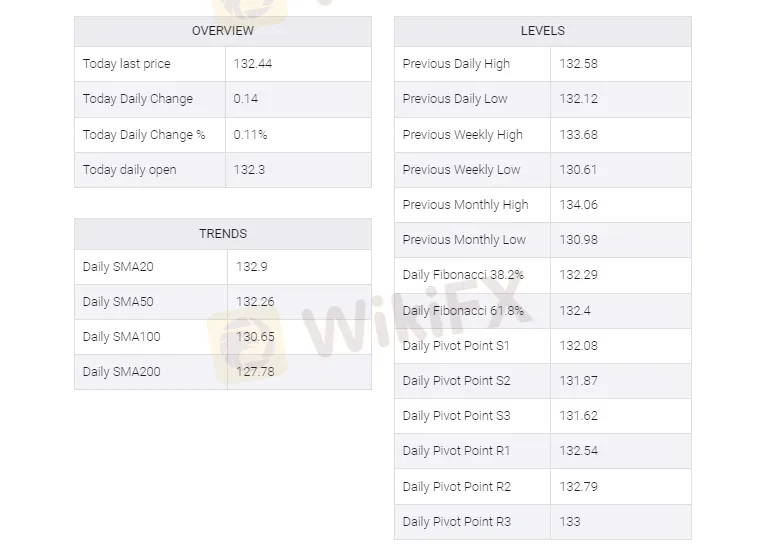

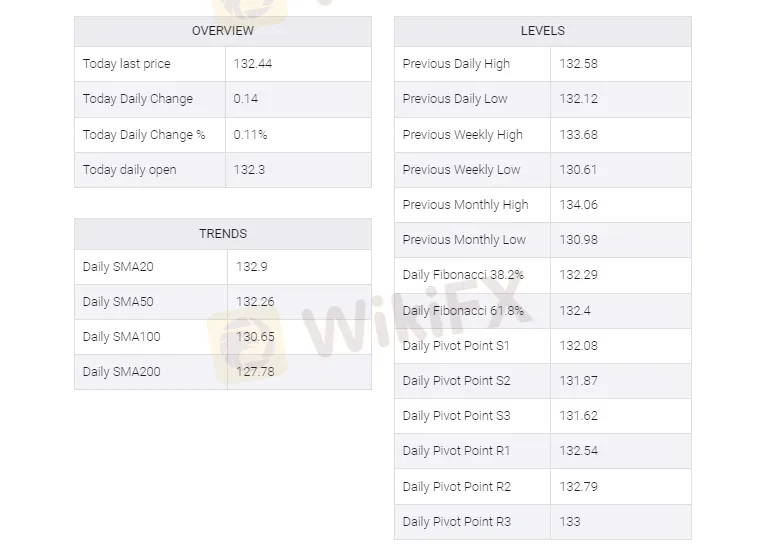

ADDITIONAL IMPORTANT LEVELS