Abstract:Investors trading at AFX Markets have lost more than £7 million due to the bankruptcy of AFX Markets.

Vietnam

Broker Bankruptcy

1. Investors trading at AFX Markets have lost more than £7 million due to the bankruptcy of AFX Markets.

The news was recently announced by FSCS(Financial Services Compensation Scheme) that it has completed an initial assessment of the company's activities, indicating that investors may be eligible for compensation and will contact clients soon to approve complaints and services online inquiries. Therefore, AFX clients have had new hope when the British sponsorship system FSCS - the protection and compensation mechanism for Forex Trader in case of dispute or the company (Broker) goes bankrupt/financial loss is initiated.

Record-high Dividends

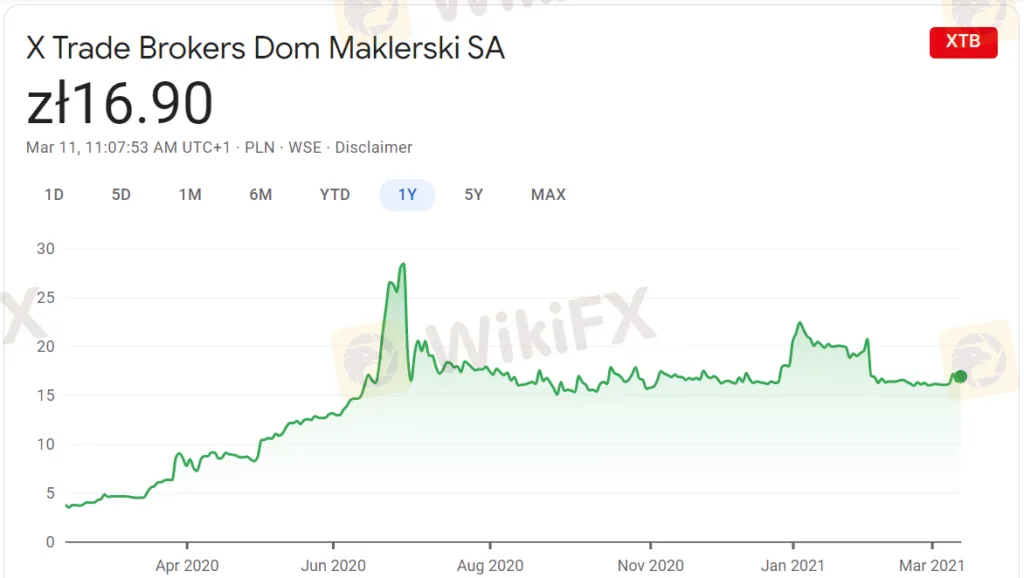

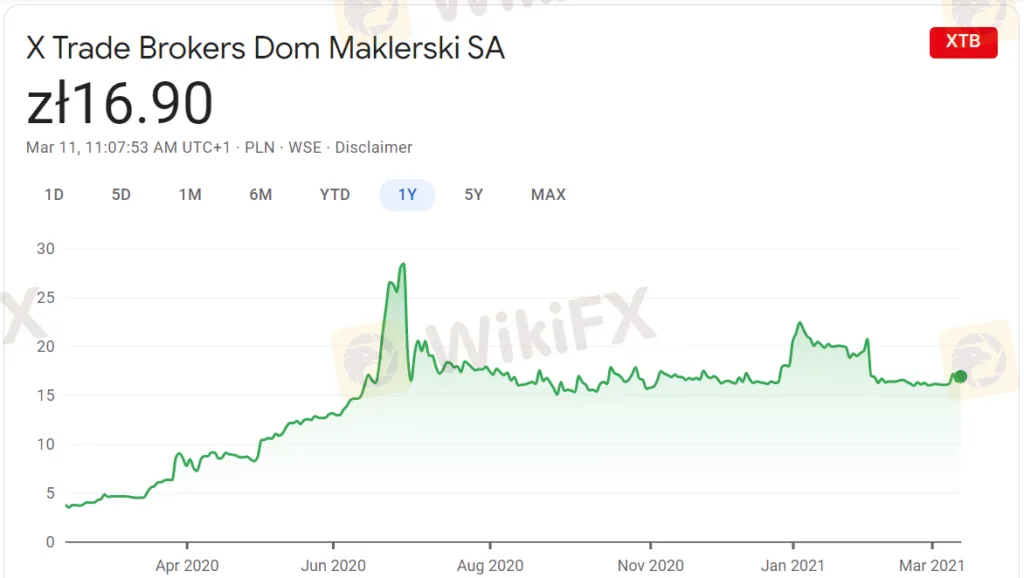

2. The Board of Directors of X-Trade Brokers approved a dividend of 1.79 PLN per share, up 750% from the previous payout. Dividends at record highs will be paid on April 30.

XTB board of directors authorized the company to pay out its 210.1 million PLN ($ 54.7 million) in 2020 net profit. Furthermore, the company decides to allocate the remainder of the company's net profit, the equivalent of PLN 208 million, into its reserve capital.

The most significant change in XTB's financial results comes from annual net profit, up to $107 million (PLN 402 million) and a 600 percent increase from net profit $14,89 million (57.7 million PLN) a year earlier.

FCA Warning

3. The UK Financial Conduct Authority (FCA) warned of a fraudulent website impersonating BNKPro, the London-based company that manages the FxPro Invest brand.

FCA said RealFXPro has tried to misappropriate FxPro Invest's name and other legal information in many fields, creating a website under the domain https://realfxpro.com/ with a similar design to the original website and bringing out that RealFXPro is actually an authorized company.

This fake website records information developed or authorized by brands that are managed to attract investors and engage in deceptive practices. Among the companies warned this month were illegal companies with intent to be affiliated with financial services group AT Global Markets (UK) Limited.

Yearly Revenue

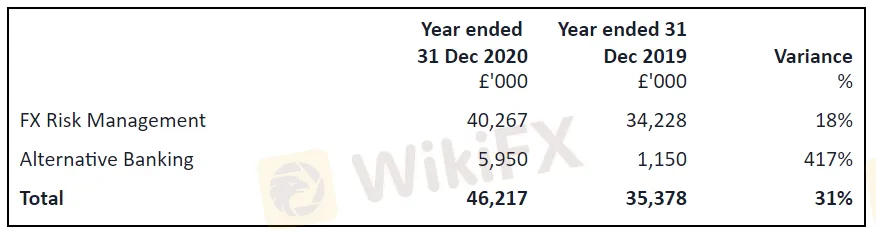

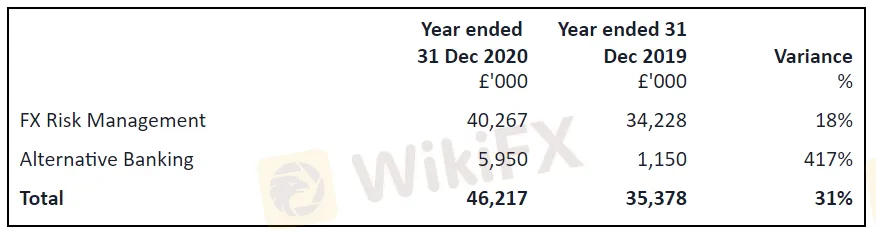

4. The London Stock Exchange (LSE) filing of Alpha FX Group (LON: AFX) reveals that the group's revenue rose 31% to £ 46.2 million, or £ 35.4 million the year before, generating more 40 million pounds in revenue from foreign exchange risk management and the balance from an alternative banking service. Profit before tax was reported to be £ 17.1 million, up 27%. The result is an increase in demand in the forex trading market, which is the main service of the group company.

Business Combination

5. eToro has confirmed to merge with FinTech Acquisition Corp to go public on the Nasdaq. The confirmation from eToro comes after many media disclosed the company's plans to list shares in the past several months.

The combined companies will operate under the name eToro Group Ltd and an estimated equity value will be around $ 10.4 billion, which is expected from previous reports. This will put eToro's corporate value at $ 9.6 billion.

Indonesia

New Business

6. PT Kliring Berjangka Indonesia ( KBI) is officially carrying out its function as a Settlement Clearing and Transaction Guarantee Institution for the Physical Tin market for domestic tin trading starting March 22, 2021 on the Jakarta Futures Exchange.This new business run by KBI is in line with KBI's role as a State-Owned Enterprise (BUMN) in an effort to encourage national economic growth.It is known that Indonesia is the largest tin producing country in the world and domestic demand is also quite large.For this reason, it is necessary to have a good trading system related to domestic tin transactions, which in turn will provide benefits to the state and society.

Thailand

Stable-coin Regulation

7. Thailand‘s central bank is moving towards bringing regulations for the so-called stable-coin as soon as this year, the Bank of Thailand’s Assistant Governor, Siritida Panomwon Na Ayudhya revealed on Friday. “The central bank is receiving opinions from market regulators and participants before announcing regulations,” she said in a press briefing.The Thai regulator first raised its concerns against stablecoins earlier this week while flagging THT, a Baht-denominated digital currency created outside the country. It highlighted that such stablecoins could ‘cause fragmentation to the Thai currency system’ and ‘replace, substitute or compete with Baht issued by the BOT’.

New Ponzi Scheme

8. Department of Special Investigation (DSI) of Thailand has announced a new type of ponzi scheme “Binary Option” claiming that the company is registered overseas. And is investing in foreign companies in Europe Which has not been approved by the government in Thailand in any way, the investors have to invest in packages ranging from 99 euros or 4,000 baht investment packages to 2,499 euros or 120,000 baht by using a binary marketing plan. Investors must recommend four people to join the investment within 14 days in order to receive the bonus and return from the company. Department of Special Investigation would like to alert the public to be careful with such forms of investment. The feasibility of the business should be studied before investing.

Japan

Transaction Data

9. Number of Over-The-Counter Retail FX Margin Trading Operaters : 51(February 28, 2021)

Number of members reported : 51

Volume : 467116.3 billion JPY

Open Positions(as of the end of the month) : 7542 billion JPY

Short : 3805.1 billion JPY

Long : 3736.9 billion JPY

Commonwealth of Independent States (CIS)

MedicineDonation

10. On February 12, 2021, XM, through the Universidad Panamericana organization, sent medicines to the 20 de Noviembre Hospital in Mexico City, the aid in the fight against Covid-19. The medical equipment included face masks, gloves and medical gowns.

Crypto Instruments

11. RoboForex decided to reduce the list of cryptocurrencies and crypto indices available for trading in MetaTrader 4, MetaTrader 5 and R Trader platforms.

On April 23, 2021, between 12:00 and 13:00 server time, all open positions for these instruments will be closed at the last market price, and pending orders will be canceled.