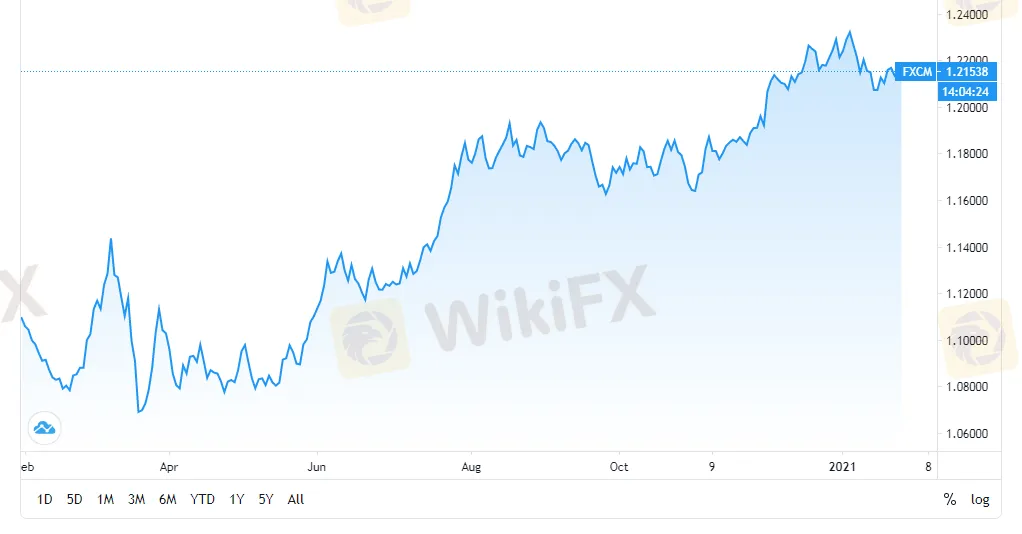

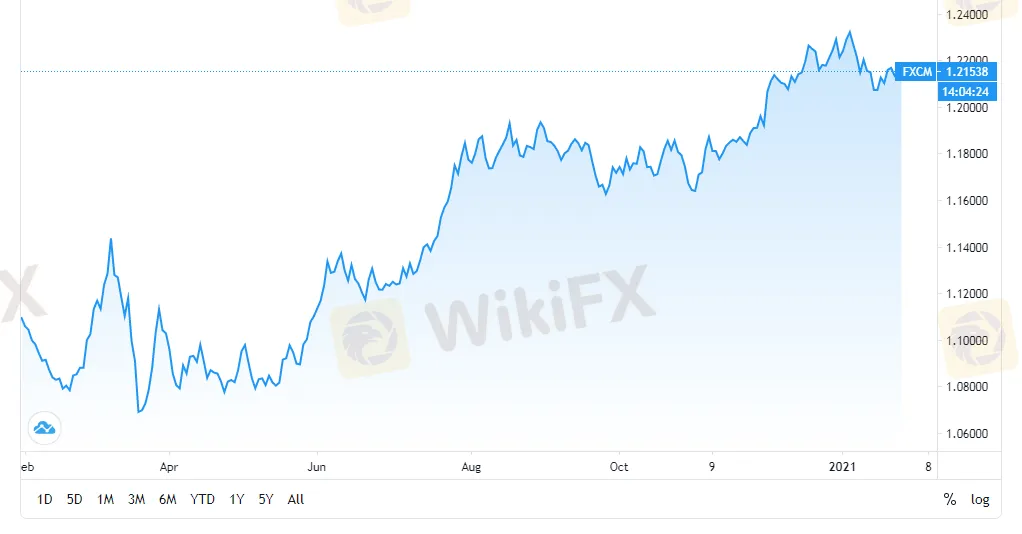

Abstract:EUR/USD may endure its gains amid upbeat expectations on the global economy.

WikiFX News (16 Feb.) - EUR/USD opened 2021 with a hit to the three-year high, after staging a powerful rally in excess of 8% in 2020. Despite the rampant pandemic, EUR/USD may endure its gains amid upbeat expectations on the global economy.

EUR/USD fell in mid-January as stringent lockdowns hit the bloc's business activities. The second Corona wave has temporarily ended the recovery of the German economy, which would stagnate in the first quarter, said Ifo-Institute President Clemens Fuest.

European Central Bank (ECB) President Christine Lagarde said that in response to the pandemic, the bank would long participate in the market and keep its vast monetary stimulus unchanged in 2021. She added that many of the uncertainties that previously clouded the outlook had now cleared, including the Brexit trade deal with the UK. The positive dynamic underpinned the euro and curbed its decline.

At the same time, Bidens bigger stimulus package would mean a further sell-off of the haven dollar, which may unleash a fresh flood of dollar liquidity. Such changes, however, will bode well for the euro, the world's second-largest reserve currency. Under this context, EUR/USD is likely to pave the way for long-term upsides.

Use WikiFX (bit.ly/wikifxIN) to discern market trends, capture trading opportunities and make more profits.

Chart: Trends of EUR/USD