Can You Trade Forex on Webull? Complete 2025 Guide & Alternatives

Your Direct Answer No, you cannot directly trade traditional spot forex pairs

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Implied volatilities on 1-week forex options contracts have dipped resulting from tame expectations for price action next week. Yet, currency traders could see a volatility jolt in response to upcoming event risk.

FOREX MARKET IMPLIED VOLATILITY – TALKING POINTS

外汇市场隐含的波动性 - 谈话要点

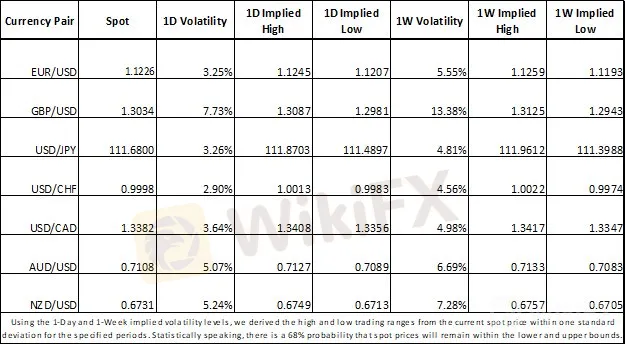

Expected market volatility measures have plunged to multi-week lows for several major currency pairs according to implied volatility on forex options contracts

预期的市场波动率指标已经下跌至多根据外汇期权合约的隐含波动率,几个主要货币对的周低点

USD, EUR and GBP face noteworthy event risk, however, which could stoke volatility and send the currencies swinging next week

美元,欧元和英镑面临值得注意的事件风险,但这可能会引发波动并发送下周摆动的货币

Implied volatilities on 1-week forex options contracts have dipped resulting from tame expectations for price action next week. Yet, currency traders could see a volatility jolt in response to upcoming event risk. The Euro, US Dollar, and British Pound may see price action pick up next week, particularly in consideration of the April ECB meeting, March FOMC minutes and latest Brexit developments posing as catalysts with potential to stir volatility.

1周外汇期权合约的隐含波动率因下周价格行动的温和预期而下跌。然而,货币交易商可能会看到波动性因未来事件风险而出现波动。欧元,美元和英镑可能会在下周出现价格走势,特别是考虑到4月欧洲央行会议,3月FOMC会议纪要以及英国脱欧最新的发展动态,这些都是可能引发波动的催化剂。

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

外汇市场隐含的波动性和交易范围

A relatively quiet week for economic events and data releases have likely contributed to the breakdown in 1-week implied volatilities. However, Wednesdays session appears chalk-full off potential risks that could spark volatility and has potential to bring about much-overdue price action.

相对平静的一周经济事件和数据发布可能有助于1周隐含波动率的细分。然而,周三的会议似乎充满了潜在的风险,可能引发波动,并有可能带来大量过期的价格行为。

The European Central Bank will likely dominate market themes for the Euro on Wednesday with the central bank providing its latest monetary policy update. Last months ECB meeting surprised market participants with its announcement to add a third round of TLTROs in addition to altering its interest rate guidance – an increasingly dovish position which sent EUR cratering. Since then, Eurozone economic data has deteriorated further as shown by the latest PMI readings and German factory orders. This could encourage ECB President Mario Draghi to further bolster market sentiment and the European economy with accommodative policy.

欧洲央行可能会主导市场主题周三欧元与央行提供最新报价货币政策更新。上个月欧洲央行会议对市场参与者表示惊讶,该公司除了改变其利率指引外,还宣布增加第三轮TLTRO--一个日益温和的立场导致欧元贬值。此后,欧元区经济数据进一步恶化,最新的PMI数据和德国工厂订单显示。这可能会鼓励欧洲央行行长马里奥·德拉吉通过宽松政策进一步加强市场情绪和欧洲经济。

Searching for more information on the European economy and political landscape? Visit this article from DailyFX analyst Dimitri Zabelin here!

寻找有关欧洲经济和政治格局的更多信息?请访问DailyFX上的这篇文章分析师Dimitri Zabelin在这里!

FOREX ECONOMIC CALENDAR – EUR, USD, GBP

外汇经济日历 - 欧元,美元,英镑

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

访问DailyFX经济日历,获取即将发布的e的完整列表影响全球市场的经济事件和数据发布。

Turning to the US Dollar, forex traders will likely parse the Fed minutes from its FOMC meeting in March with the expectation of uncovering details of the Fed‘s latest dovish position. The consumer price index will also likely be eyed for potential signs of inflation. If core PCE overshoots expectations, the prospect of a dovish Fed may be thwarted especially considering the disconnect between the Fed projecting one more rate hike this year while futures on overnight indexed swaps are pricing in a 25 basis point cut at its December 2019 meeting. University of Michigan’s sentiment reading will cap off the week for US data.

转向美元,外汇交易商可能会在3月份的联邦公开市场委员会会议上解析美联储的会议纪要,期望发现美联储的细节。美联储最近的鸽派立场。消费者价格指数也可能会被视为潜在的通胀迹象。如果核心PCE超出预期,美联储可能会受到阻碍,特别是考虑到美联储预计今年再次加息,而隔夜指数掉期的期货在2019年12月的会议上下调25个基点。密歇根大学的情绪读数将会受到限制他本周收看美国数据。

While currency markets await the slew of economic data due for release out of the UK, the latest Brexit developments will likely dictate GBP performance. The ongoing impasse in British Parliament has shown little sign of progress towards reaching a Brexit Withdrawal Agreement even as the already-extended Article 50 deadline on April 12 approaches. While MPs have passed legislation opposing a no-deal departure from the EU, they are not legally binding.

虽然货币市场在等待即将公布的英国经济数据,但最新的英国退欧发展可能会决定英镑的表现。英国议会的持续僵局几乎没有表明在达成脱欧退出协议方面取得进展,即使已经延长的第50条第4条截止日期临近。虽然国会议员已经通过立法反对与欧盟的禁止交易,但他们没有法律约束力。

Take a look at this Brexit Timeline for a chronological list of the major Brexit developments and respective impact on the British markets.

看看英国脱欧时间表,了解英国退欧的主要发展时间表对英国市场的影响各自。

As such, it remains that the legal default for Brexit is the UK to severing itself from the EU on April 12 without a Withdrawal Agreement. Bank of England Governor Mark Carney recent emphasized this as he stated how the risk of no-deal Brexit remains high and underpriced by markets. However, Theresa May just submitted a letter to the EU requesting another Article 50 extension to delay the Brexit deadline again.

因此,英国退欧的法律违约仍然是英国在4月12日没有退出协议的情况下将自己从欧盟切断。英格兰银行行长马克卡尼最近强调了这一点,因为他表示,未交易英国脱欧的风险仍然很高,市场价格低估。然而,Theresa May刚刚向欧盟提交了一封信,要求再延长50条延期英国脱欧的最后期限。

TRADING RESOURCES

交易资源

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

无论您是新手还是经验丰富的交易员,DailyFX都有多种资源可以帮助您:监控交易者情绪的指标;季度交易预测;每日举办的分析和教育网络研讨会;交易指南,以帮助您提高交易表现,甚至是那些不熟悉外汇交易的人。

{19}

- Written by Rich Dvorak, Junior Analyst for DailyFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Your Direct Answer No, you cannot directly trade traditional spot forex pairs

Many people are drawn to forex trading to gain financial freedom or learn a valu

Finding Your Edge Choosing the right forex trading platform is one of the most

Your First Step Welcome to the foreign exchange market, the largest and most l