简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Brexit Amendment Votes Spook GBP Traders, AUD/USD Eyes CPI Data

Abstract:The British Pound tumbled as a series of Brexit amendment votes spooked investors. AUD/USD follow-through on CPI data may have to wait until RBA. Nikkei

Asia Pacific Market Open Talking Point

British Pound tumbles as series of Brexit amendment votes spook investor

Australian Dollar follow-through on CPI report may have to wait until RBA

APAC shares may trade mixed, Nikkei 225 overshadowed by reversal patter

See our study on the history of trade wars to learn how it might influence financial markets!

The British Pound was the worst performing major on Tuesday as a series of Brexit amendment votes spooked traders. UKs Parliament voted to reject Amendment B. In short, this would have sought to delay Brexit should Prime Minister Theresa May fail to secure a deal towards the end of next month.

What did pass was Amendment N which was proposed by Graham Brady. This one seeks to replace the controversial Irish Backstop with “alternative arrangements to avoid a hard border”. However, moments after an EU spokesman said that the agreed upon Brexit deal was not open to renegotiation. Later on, this was then backed by French President Emmanuel Macron.

Given these complications, markets seemed to have interpreted it as increasing the odds of the UK exiting the European Union without a deal. Not surprisingly, the US Dollar rose with declines in Sterling but only ended the day cautiously higher. In fact, apart from the British Pound, the major currencies were rather mixed with another volatile day in stock markets.

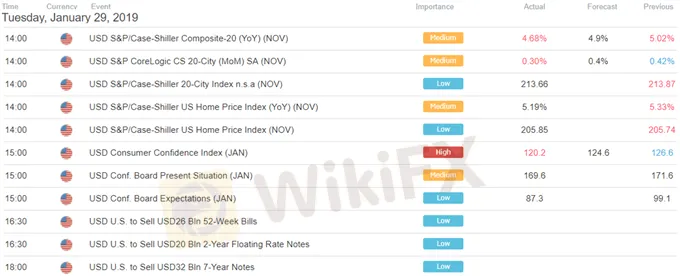

The S&P 500 closed about 0.15% lower while the Dow Jones Industrial Average ended the day roughly 0.21% higher despite bearish reversal warning signs. Markets may be struggling to choose a direction given the remaining event risk this week. This ranges from US-China trade negotiations to the Fed rate decision and prominent local economic data. Speaking of, US consumer confidence sunk to its lowest since July 2017 today.

Looking to Wednesdays Asia Pacific trading session, the Australian Dollar may look past domestic inflation data for more prominent fundamental themes this week. While it may inspire near-term volatility, lasting follow-through would probably have to wait until the RBA gives a monetary policy update next week. Meanwhile, the Nikkei 225 is also at risk to a bearish reversal pattern.

US Trading Sessio

Asia Pacific Trading Sessio

** All times listed in GMT. See the full economic calendar here

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

RM500,000 Gone: Lecturer Duped by Online Investment Scam

Fed Independence Crisis: DOJ Probe and Political Pressure Rattle Central Banks

Commodities Outlook: Geopolitics Keep Oil Volatile, Gold Reacts to Tariffs

US Dollar Falters as Tariff Blowback Crushes Consumer Sentiment

Commodities Super-Cycle: Gold Eyes $5,000 as Copper Squeezes on Supply Crunch

War Premium Evaporates: Silver Crashes 7% as Trump Signals "Wait and See" on Iran

US Imposes 25% Tariff on AI Chips, Elevating Tech Trade Tensions

Inside the Elite Committee: Talk with LadyChiun

Are You Trading Against the Central Banks? Know Your Competition

Currency Calculator