简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PO Trade - A Cautionary Tale of Fraud

Abstract:In the competitive world of forex trading, protecting the rights and interests of traders is paramount. Unfortunately, there are brokers who exploit traders' trust, leading to significant financial losses. One such case involves PO Trade, a forex broker that has come under scrutiny for allegedly defrauding its clients. This article highlights the experience of a victim, Abdel, who claims to have lost over $115 million in profits due to PO Trade’s unethical practices.

In the competitive world of forex trading, protecting the rights and interests of traders is paramount. Unfortunately, there are brokers who exploit traders' trust, leading to significant financial losses. One such case involves PO Trade, a forex broker that has come under scrutiny for allegedly defrauding its clients. This article highlights the experience of a victim, Abdel, who claims to have lost over $115 million in profits due to PO Trades unethical practices.

The Victim's Account

Abdel, a 23-year-old trader from Yemen, has detailed a troubling experience with PO Trade, also known as Pocket Option. According to Abdel, after successfully trading on the platform, his account was suddenly banned, and his substantial profits were confiscated. He states:

“I traded in PO TRADE LTD/POCKET OPTION correctly and officially, and I have evidence that my transactions are legitimate. My profits exceeded $115 million, but the company blocked my account and stole my earnings, claiming it was due to a technical glitch.”

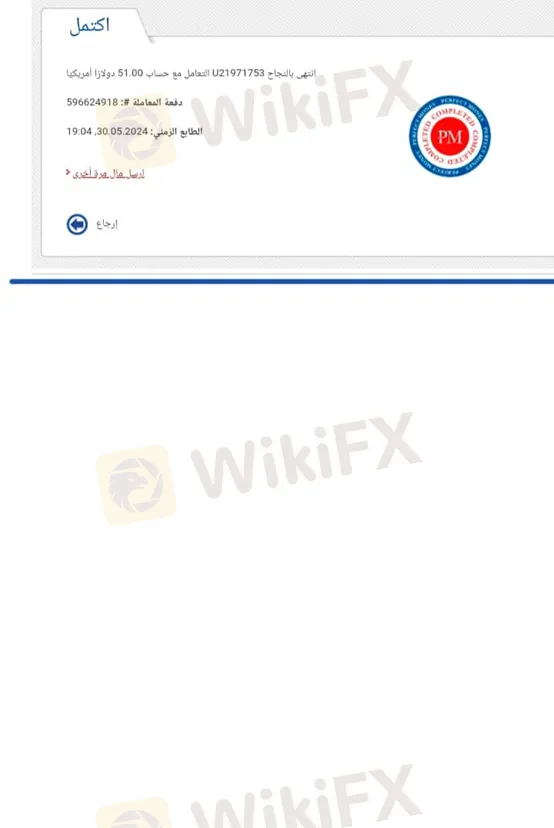

Abdel alleges that PO Trade manipulated transaction timings in his account statement to justify their actions. He points out discrepancies in the timing of one particular transaction, stating:

“The transaction No. 35272010 shows a time of 11:45:54 on 5/26/2024, but the actual time was 00:45:54 on 5/27/2024. I have documented screenshots of my transactions that prove the legitimacy of my profits.”

Evidence of Fraudulent Practices

Abdel has gathered evidence, including screenshots of his account showing the correct transaction times and amounts. He asserts that he will not rest until he recovers his funds:

“I will continue to demand my rights until I recover all my profits. I have all the documents that prove my case, and I will not give up.”

WikiFX's Role in Protecting Traders

WikiFX is dedicated to safeguarding the legitimate rights of forex traders. This case against PO Trade serves as a stark reminder of the potential risks associated with unregulated brokers. The platform's commitment to transparency and accountability in the forex industry is crucial for protecting traders from fraud.

On WikiFX, this broker has been given a low score of 2.14/10. This is a red flag.

Conclusion

The experience of Abdel with PO Trade is a cautionary tale for all forex traders. It underscores the importance of due diligence when choosing a broker and the potential consequences of trusting unregulated entities. As this case unfolds, it is vital for traders to remain vigilant and aware of their rights. WikiFX will continue to expose fraudulent practices and advocate for the rights of traders everywhere.

If you have experienced similar issues with PO Trade or any other broker, consider reaching out to WikiFX for assistance. Your voice can help bring attention to these fraudulent practices and protect fellow traders from potential scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Currency Calculator