Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:We spoke about how to scale OUT of a trade in the last lesson. Now we'll demonstrate how to scale WITHIN a trade. When your trade is going against you, the first scenario we'll go over is adding to your positions.

We spoke about how to scale OUT of a trade in the last lesson. Now we'll demonstrate how to scale WITHIN a trade.

When your trade is going against you, the first scenario we'll go over is adding to your positions.

Adding more units to a “losing” position is a delicate affair, and in our opinion, a beginning trader should never, ever do it.

Why add more and lose more if your deal is clearly a loser? Doesn't make sense, does it?

Now we say “pretty much” because it is acceptable to add to a losing position if the risk of your old position and the risk of your new position are both within your risk comfort level.

To make this happen, a set of rules must be followed in order for the trade adjustment to be safe. The following are the rules:

A stop loss is wanted and must strictly be obeyed.

Position entry levels must be pre-planned before the trade is executed.

Position sizes must be calculated ahead of time to ensure that the total risk of the combined holdings is within your risk tolerance.

Example of a Trade

Let's look at a simple trade example to see how it's done.

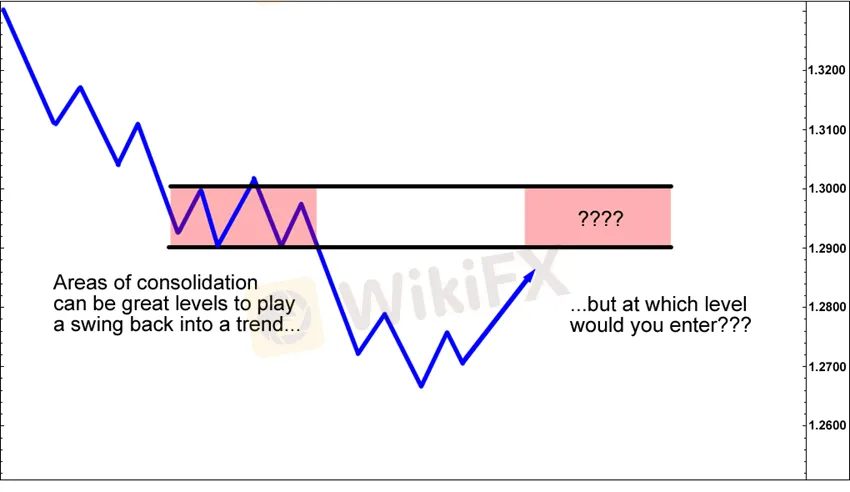

The pair dropped lower from 1.3200 on the chart above, and then the market witnessed some consolidation between 1.2900 and 1.3000 before breaching lower.

The pair retraced to the area of recent stabilization after bottoming out around 1.2700 to 1.2800.

Let's say you believe the pair will revert to the downside, but you're not sure in your ability to predict the exact turning point.

There are a few ways you could get into the business:

Option 1 of the entry process:

Short at 1.2900, the bottom of the consolidation level, which is a broken support-turned-resistance level.

The demerit of entering at 1.2900 is that the pair could rise in value, and you could have gotten in at a lower price.

Option #2 for entry:

Wait until the pair reaches the top of the consolidation region, 1.3000, which is also a psychologically significant level — and possibly a strong resistance level.

However, if you wait to see if the market hits 1.3000, you risk missing the return to the downtrend if the market does not make it all the way up there.

Option #3 for entry:

Before entering, wait for the pair to test the potential resistance area and then go back below 1.2900 into the decline.

This is the most conservative strategy because you get confirmation that the sellers have regained control, but you also miss out on getting into the downturn at a lower price.

Option #4 for entry:

What should I do? Why not try your luck at 1.2900 and 1.3000? Isn't that doable? Yes, it is! Just make sure you write everything down before the transaction and stick to the plan!

Determine the point at which a trade is invalidated (Stop Loss)

Let's find out where we want to stop. Let's say you choose 1.3100 as the threshold that indicates you were mistaken and that the market will continue to rise.

This is the point at which you close your trade.

Determine your starting point (s)

Second, let's find out what our entrance levels will be. Both 1.2900 and 1.3000 have support/resistance, thus you'll put locations there.

Both 1.2900 and 1.3000 have support/resistance, thus you'll put locations there.

Determine the Size of the Position (s)

Third, we'll figure out the proper position sizes to stay within a safe risk range.

Let's imagine you have $5,000 in your account and only want to risk 2% of it. That suggests you're willing to take a $100 risk on this deal ($5,000 account balance x 0.02 risk).

Setup a Trade

Here's an example of how to set up this trade:

Short 2,500 EUR/USD units at 1.2900.

2,500 units of EUR/USD equals $0.25 per pip fluctuation, according to our pip value calculator.

You have a 200 pip stop on this position with your stop at 1.3100, and if it hits your stop, you will lose $50 (value per pip movement ($0.25) x stop loss (200 pips).

Short 5,000 EUR/USD units at 1.3000.

Again, 5,000 EUR/USD units equals your worth per pip movement, according to our pip value calculator.

You have a 100 pip stop on this position with your stop at 1.3100, and if it hits your stop, you will lose $50 (value per pip movement ($0.50) x stop loss (200 pips).

If you're stopped out, this adds up to a $100 loss.

Isn't it simple?

We've set up a trade where we can enter at 1.2900 and exit at 1.2900, so even if the market rises and we lose a position, we can just enter another trade and stay within typical risk constraints.

In case you were wondering, the two trades combine to form a short position of 7,500 EUR/USD units, with an average price of 1.2966 and a stop loss spread of 134 pips.

If the market fell after both positions were triggered, a 1:1 reward-to-risk profit ($100) would be made if the market fell to 1.2832 (1.2966 (average entry level) – 134 pips (your stop).

Because you entered the majority of your trade at the “better” price of 1.3000, EUR/USD doesn't have to fall far from the resistance area to make a significant profit.

Exceptional!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.