Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Using Fibonacci levels, as we discussed in the last session, can be quite subjective. However, there are several things you may do to improve your chances.

Using Fibonacci levels, as we discussed in the last session, can be quite subjective. However, there are several things you may do to improve your chances.

While the Fibonacci retracement tool is incredibly helpful, it should not be applied alone.

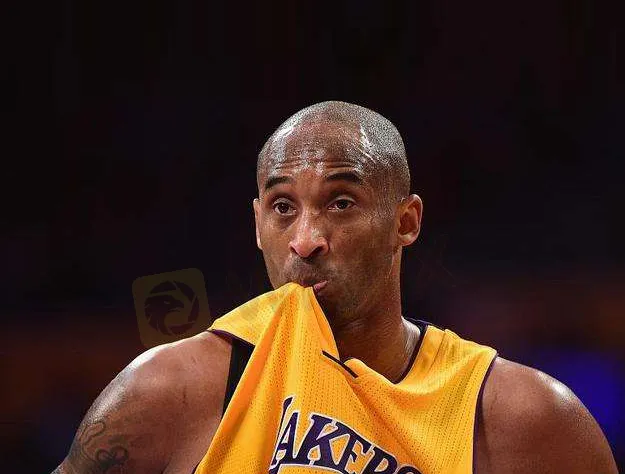

It's like putting it up against NBA superstar Kobe Bryant.

Even though Kobe was one of the best basketball players of all time, he couldn't win those championships on his own.

He required assistance.

Similarly, other tools should be used in conjunction with the Fibonacci retracement tool.

Let's take what you've learnt so far and combine it to assist us find some nice trade opportunities in this lesson.

Are you all set? Let's get this pip show rolling!

Support and Resistance + Fibonacci Retracement

Finding potential support and resistance levels and seeing if they line up with Fibonacci retracement levels is one of the greatest ways to use the Fibonacci retracement tool.

If you combine Fibonacci levels with other price places that a lot of other traders are following, the chances of price bouncing from those areas are significantly higher.

Let's look at an example of how Fibonacci levels can be combined with support and resistance levels. A daily chart of the USD/CHF is shown below.

As you can see, it's been on a recent upward trend. Look at how many green candles there are!

You make the decision to join the long USD/CHF bandwagon.

“However, when do you enter?” is the query.

You use the Fibonacci retracement tool, with the Swing Low set at 1.0132 on January 11 and the Swing High set at 1.0899 on February 19.

With all those Fibonacci retracement levels, your chart now looks very good.

We can now answer the question “Where should you enter?” because we have a framework to maximize our chances of finding a solid entry.

When you take a step back, you'll notice that the 1.0510 price was previously a good resistance level, and it just so happens to coincide with the 50.0 percent Fibonacci retracement level.

It might now be used as assistance and an excellent spot to buy now that it's broken.

You'd be a very happy camper if you placed an order around the 50.0 percent Fib level!

There would have been some uncomfortable moments, notably on April 1 when the support level was tested for the second time.

Price failed to close below the support level despite attempting to pierce through it. The pair eventually broke through the Swing High and resumed its upward momentum.

On a downtrend, you can use the same method. The idea is that you should look for pricing levels that have previously piqued your interest.

If you think about it, the price will probably jump from current levels.

First, as we discussed in Grade 1, prior support or resistance levels are usually good places to buy or sell since other traders will be watching them closely.

Second, as many traders employ the Fibonacci retracement tool, they may be trying to take advantage of these Fibonacci levels.

There's a significant likelihood that there are a lot of orders at those price levels because traders are looking at the same support and resistance levels.

While there's no guaranty that the price will rebound back from those lows, you can feel more secure in your trade. After all, there's a lot of power in numbers!

It's important to keep in mind that trading is all about probabilities.

If you stick to the higher-probability transactions, you'll have a better chance of making a profit over time.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.