Score

Juno Markets

Vanuatu|5-10 years| Benchmark B|

Vanuatu|5-10 years| Benchmark B|http://www.junomarkets.com/en/

Website

Rating Index

Benchmark

Benchmark

B

Average transaction speed (ms)

MT4/5

Full License

JunoMarkets-Demo

United Kingdom

United KingdomInfluence

C

Influence index NO.1

United States 2.76

United States 2.76Benchmark

Speed:B

Slippage:A

Cost:C

Disconnected:A

Rollover:B

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

C

Influence index NO.1

United States 2.76

United States 2.76Surpassed 49.80% brokers

Contact

Licenses

Single Core

1G

40G

Disclosure

Danger

Contact number

+678 5553134

Other ways of contact

Broker Information

More

Juno Markets Limited

Juno Markets

Vanuatu

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by Australia ASIC(license number: 540205)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

- The Vanuatu VFSC regulation with license number: 40099 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | B |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $500 |

| Minimum Spread | From 0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

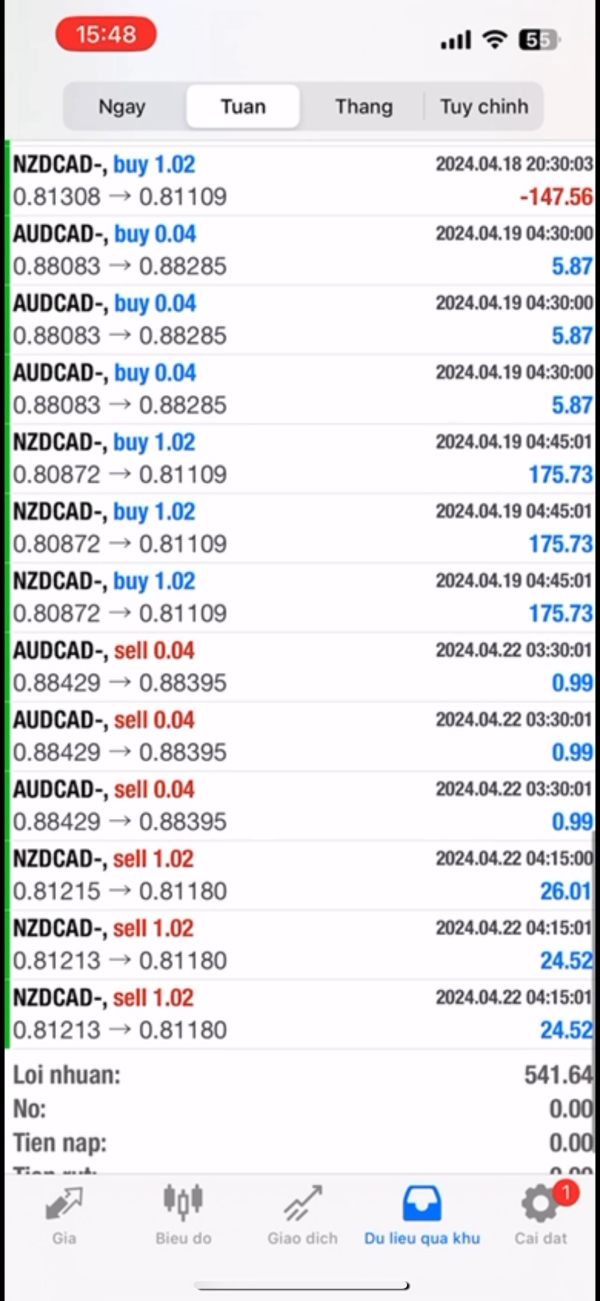

| Depositing Method | (7+) Neteller Bank transfer Skrill |

| Withdrawal Method | (7+) Bank transfer Skrill Neteller |

| Commission | $3.5 per side per lot |

| Benchmark | B |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $25 |

| Minimum Spread | from 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (7+) Bank transfer Skrill Neteller |

| Withdrawal Method | (7+) Neteller Bank transfer Skrill |

| Commission | None |

| Benchmark | B |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | $25,000 |

| Minimum Spread | From 0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (7+) Neteller Bank transfer Skrill |

| Withdrawal Method | (7+) Skrill Neteller Bank transfer |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Juno Markets also viewed..

XM

MiTRADE

GO MARKETS

AUS GLOBAL

Sources

Language

Mkt. Analysis

Creatives

Juno Markets · Company Summary

| Juno Markets | Basic Information |

| Registered Country/Region | Vanuatu |

| Founded in | N/A |

| Regulation | VFSC |

| Trading Instruments | Forex, Metals, Energy, Indices |

| Account Types | STP, ECN, Institutional |

| Demo Account | Offered |

| Swap-free options | Available |

| Leverage | Up to 1:500 |

| Minimum Deposit | $25 (STP Account) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Leverage | Up to 1:500 |

| Spreads | Variable |

| Commission | Varies based on account type |

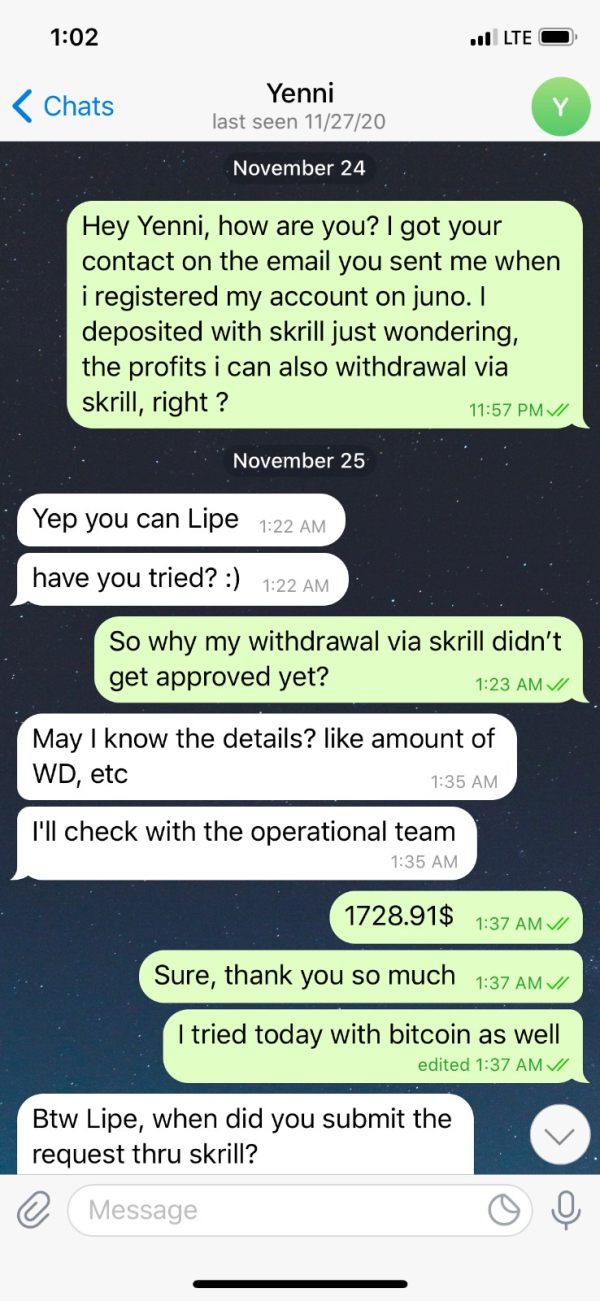

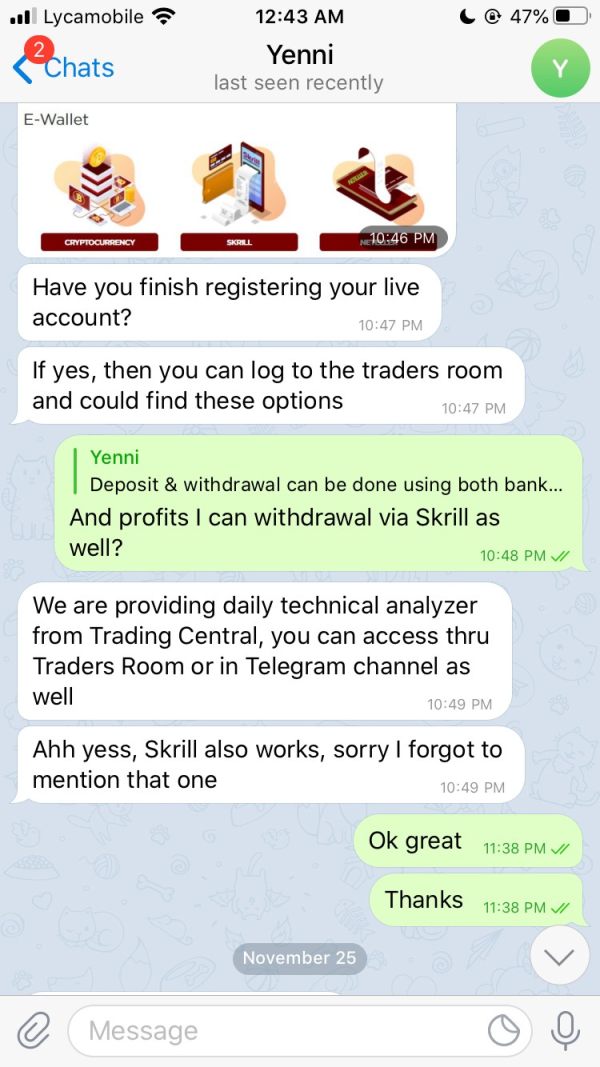

| Payment Methods | Bank Wire, Credit/Debit Cards, Skrill, Neteller |

| Customer Support | Email, Phone, Live Chat |

| Educational Resources | Webinars, Video Tutorials, Trading Guides |

*Please note that the information provided is subject to change and it is recommended to visit the official website of Juno Markets for the most up-to-date and accurate details.

General Information & Regulation

Established in 2014, Juno Markets are a Vanuatu-based broker that offers online trading in multiple markets, such as forex, metals, indices, and energies. Juno Markets Limited is incorporated in the Republic of Vanuatu with a registered address at Law Partners House, Kumul Highway, Port Vila, Vanuatu. The broker is regulated by the Vanuatu Financial Services Commission (VFSC) with a Principals License (No. 40099) for dealing in securities. Juno Markets offers its services to clients from different parts of the globe but specifically states that it does not accept clients from certain countries/regions including the United States and Hong Kong.

As an established player in the forex industry, Juno Markets offers a wide selection of trading instruments, including major and minor currency pairs, commodities, indices, and cryptocurrencies. This diverse range of assets allows traders to access various markets and seize potential trading opportunities.

Juno Markets offers clients access to diverse range of account types, catering to the specific needs and preferences of different traders. The broker offers three main account types: STP (Straight Through Processing), ECN (Electronic Communication Network), and Institutional accounts. Each account type is designed to provide traders with unique trading conditions and features, with a minimum deposit requirement of $25. Juno Markets places a strong emphasis on competitive trading conditions, offering tight spreads, low commissions, and flexible leverage options up to 1:500.

Juno Markets places great importance on providing advanced trading technology to its clients. With their advanced trading platforms, including MetaTrader 4 (MT4) and mobile trading applications, traders can enjoy a seamless trading experience with powerful analytical tools, real-time market data, and automated trading capabilities.

One of Juno Markets' standout features is their commitment to client education and support. They offer a range of educational resources, including webinars, tutorials, trading guides, and market analysis, to empower traders with knowledge and enhance their trading skills.

Is Juno Markets legit or a scam?

In terms of regulation, Juno Markets is registered and authorized by the Vanuatu Financial Services Commission (VFSC) under regulatory license number of 40099. This regulatory oversight ensures that the broker adheres to stringent financial standards and operates in accordance with industry best practices, providing clients with an added layer of confidence and security.

Pros and Cons

Juno Markets offers generous leverage of up to 1:500 and a wide range of account types to cater to different traders' needs. The broker also has a low minimum deposit requirement of $25 and provides swap-free options for those who require it. However, Juno Markets has offshore regulation, which may raise concerns for some traders. The selection of trading platforms is limited to only MT4, and the range of tradable instruments is also limited. The educational resources provided by Juno Markets are not extensive, and there may be inactivity fees for dormant accounts. Additionally, the broker lacks online chat support and 24/7 customer support.

| Pros | Cons |

| Generosu leveage up to 1:500 | Offshore regulation |

| Wide range of account types for different traders | Limited selection of trading platforms, only MT4 |

| Low minimum deposit of $25 | Limited range of tradable instruments |

| Swap-free options available | Limited educational resources |

| Inactivity fees for dormant accounts | |

| Limited research and analysis tools | |

| No online chat | |

| No 7/24 customer support |

Market Instruments

Juno Markets offers a diverse range of market instruments for traders to choose from. This includes Forex, which allows traders to access various currency pairs and participate in the global foreign exchange market. In addition to Forex, Juno Markets also offers Metals trading, providing opportunities to trade precious metals like gold and silver. Traders can also take advantage of Energy trading, allowing them to speculate on the price movements of commodities such as crude oil and natural gas. Furthermore, Juno Markets provides the option to trade indices, enabling traders to invest in and speculate on the performance of major stock market indices from around the world. With these market instruments available, Juno Markets offers traders the opportunity to diversify their portfolios and take advantage of different market opportunities.

| Pros | Cons |

| Access to the global Forex market | Limited selection of tradable instruments |

| Potential for portfolio diversification | No specific mention of Cryptocurrency trading |

| Limited selection of Energy and Indices instruments | |

| Limited exposure to alternative asset classes | |

| No specific mention of Bonds or Options trading |

Account Types

Juno Markets offers three distinct account types to cater to the diverse needs of traders. The first account type is the STP account, which requires a minimum deposit of $25 and provides a generous leverage of up to 1:500. Traders opting for the STP account also have the option of choosing a swap-free account, making it suitable for those who follow Islamic finance principles.

The second account type is the ECN account, which requires a higher minimum deposit of $500. With the ECN account, traders can enjoy a leverage of up to 1:400. Similar to the STP account, the ECN account also offers swap-free options for traders who require it.

For institutional traders or those with higher capital, Juno Markets offers an Institutional account. This account type requires a significant minimum deposit of $25,000, reflecting its focus on professional traders. The leverage available for the Institutional account is up to 1:100. However, it's important to note that swap-free options are not available for the Institutional account.

In addition to its live trading accounts, Juno Markets also offers a demo account option for traders. The demo account serves as a risk-free environment where traders can practice and familiarize themselves with the trading platform and market conditions.

How to open an account?

Opening an account with Juno Markets is a straightforward process.

To begin, you need to visit the official website and click on the “Open an Account” button.

2. Then, you will be directed to a registration page where you need to provide your personal information, including your name, email address, and country of residence.

3. Next, you will be required to choose the type of account you wish to open from the available options. Juno Markets offers various account types tailored to different trading preferences. Once you have selected your desired account type, you will need to provide additional information such as your preferred base currency and leverage.

4. After completing the registration form, you will be asked to review and agree to the terms and conditions. You can submit your application and wait for it to be processed. Juno Markets will typically verify your information and may require additional documentation for verification purposes.

5. Once your account is approved, you will receive login credentials to access your trading account and start trading in the financial markets.

Juno Markets Leverage

Juno Markets offers traders a generous leverage of up to 1:500, allowing them to amplify their trading positions and potentially increase their profit potential. Leverage is a powerful tool in the forex market as it enables traders to control larger positions with a smaller amount of capital. With a leverage of 1:500, traders can trade with a significantly higher buying power compared to their account balance. This means that even with a relatively small investment, traders have the opportunity to access larger market positions and potentially achieve higher returns. However, it's important to note that while leverage can magnify profits, it can also increase losses if trades are not managed properly.

The table below compares Juno Markets' leverage offering to similar brokers in terms of regulation, trading platforms, and tradable instruments.

| Broker | Leverage | Regulation | Trading Platforms | Tradable Instruments |

| Juno Markets | Up to 1:500 | Offshore | MT4 | Limited range |

| Broker A | Up to 1:400 | Regulated (ASIC) | MT4, MT5 | Wide range |

| Broker B | Up to 1:300 | Regulated (FCA) | MT4, cTrader | Wide range |

| Broker C | Up to 1:200 | Regulated (CySEC) | MT4, MT5, Webtrader | Wide range |

Spreads & Commissions

Here is a table comparing the spreads and commissions of Juno Markets based on different account types:

| Account Type | Spreads | Commissions |

| Standard Account | From 1.5 pips | Zero commission |

| ECN Account | From 0.0 pips | $4 per side |

| Institutional Account | From 0.0 pips | $1.50 per side |

In the Standard Account, traders can enjoy zero commissions, but the spreads start from 1.5 pips, which is relatively high compared to other account types. On the other hand, the ECN and Institutional Accounts offer tighter spreads starting from 0.0 pips, providing more competitive pricing. However, there are commissions involved, with the ECN Account charging $4 per side and the Institutional Account charging $1.50 per side. Traders should consider their trading preferences and cost structure when choosing the appropriate account type.

Non-Trading Fees

Juno Markets imposes various non-trading fees that traders should be aware of. While the broker offers attractive trading conditions, it is important to consider the additional costs associated with their services. Some of the non-trading fees charged by Juno Markets include inactivity fees for dormant accounts. These fees are applicable when an account remains inactive for a certain period of time. Traders should be mindful of this and ensure they are aware of the specific inactivity fee policy. Additionally, Juno Markets may charge withdrawal fees for certain payment methods. It is advisable to review the broker's fee schedule or contact their customer support for detailed information on withdrawal fees and payment methods available.

Trading Platform

Juno Markets offers the widely recognized and popular MetaTrader 4 (MT4) trading platform. MT4 is a powerful and versatile platform that is widely used by forex traders around the world. It provides traders with a comprehensive set of tools and features to analyze the markets, execute trades, and manage their trading accounts efficiently. With MT4, traders can access a wide range of technical indicators, charting tools, and customizable trading strategies. The platform also supports automated trading through Expert Advisors (EAs), allowing traders to automate their trading strategies. Furthermore, MT4 is known for its user-friendly interface, making it accessible to both novice and experienced traders.

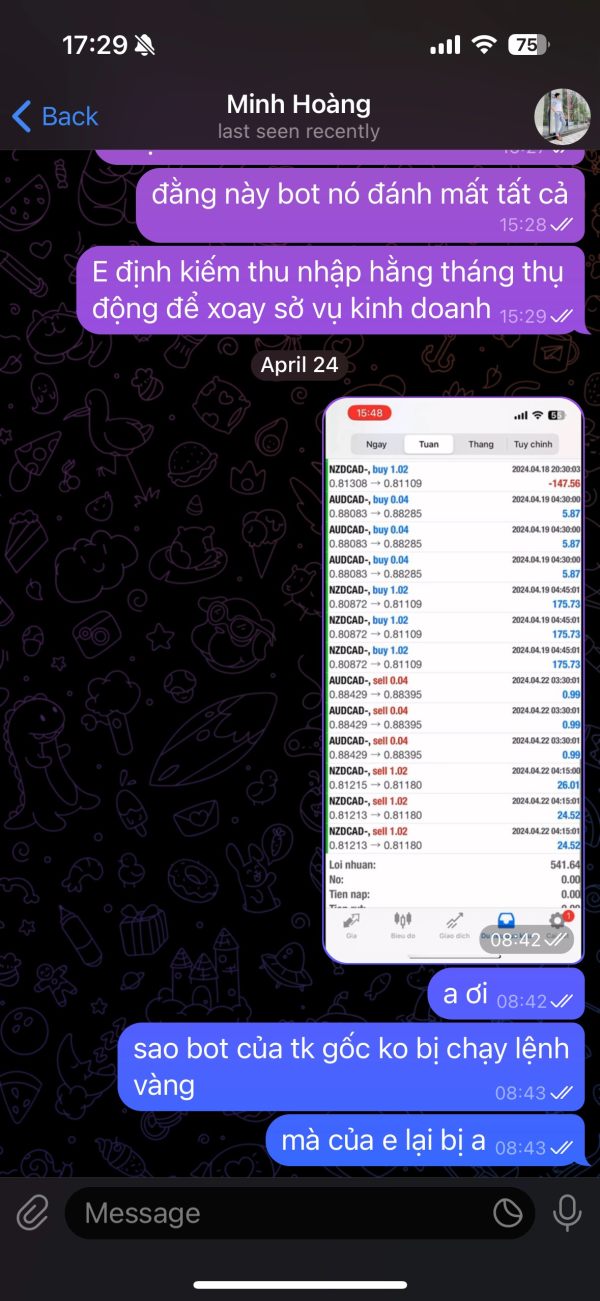

Social Trading

Juno Markets offers a social trading feature known as Juno Auto Trader. Juno Auto Trader allows both novice and seasoned traders to benefit from the expertise of successful traders within the Juno Markets community. By utilizing this feature, you can automatically mirror the trades executed by skilled traders, known as signal providers, without the need for manual intervention.

With Juno Auto Trader, you can explore a diverse range of signal providers, each with their own unique trading styles and strategies. By carefully selecting signal providers based on their performance, risk tolerance, and trading objectives, you can create a customized portfolio of strategies to match your investment goals.

Trading Tools

In addition to the tools built into the MT4 platform, Juno Markets offers some other tools, such as the Alpha Generator Indicator, Real-Time Signals, Economic Calendar, and MAM/PAMM Account for account managers.

Deposit & Withdrawal

Juno Markets offers a diverse range of payment methods to cater to the needs of traders worldwide. Whether you prefer the convenience of Instant Bank Transfer, the reliability of International Bank Wire, the flexibility of Cryptocurrency (including popular options like Bitcoin), the efficiency of e-wallets such as Skrill and Neteller, or the accessibility of Union Pay and Alipay, Juno Markets has you covered. Each payment method supports various currencies, ensuring that you can transact in your preferred currency. The minimum deposit required by Juno Markets is $25, allowing traders with different budget sizes to start their trading journey. For more details, please see the following screentshot:

While Juno Markets endeavors to expedite processing times, it's important to note that unforeseen circumstances or third-party factors beyond the broker's control may occasionally cause slight delays. Traders are encouraged to reach out to Juno Markets' customer support for any specific inquiries regarding processing times for their chosen payment method.

Bonuses Offered

Juno Markets provides various bonuses and promotional offers to attract potential traders. These bonuses include deposit bonuses, rebates, or special promotions during specific periods. The eligibility criteria for bonuses may vary, and it is essential to carefully review the terms and conditions provided by Juno Markets.Bonuses offered by Juno Markets may come with certain limitations or restrictions. These may include time-limited offers, withdrawal restrictions, or specific trading conditions that need to be fulfilled before the bonus can be withdrawn. Traders should carefully read and understand the terms and conditions associated with the bonuses to ensure compliance.

Customer Support

Juno Markets offers multiple channels for customer assistance. Whether you prefer traditional methods or prefer the convenience of digital platforms, Juno Markets has you covered.

Online Chat: Juno Markets provides an online chat feature on their website, allowing you to engage in real-time conversations with their support team.

Phone Support: Juno Markets understands the importance of direct communication, which is why they offer phone support to address any queries or concerns you may have. Their dedicated team of knowledgeable professionals is ready to assist you over the phone.

Email Support: For those who prefer written communication or have non-urgent inquiries, Juno Markets offers email support. You can reach out to their customer support team via email, detailing your questions or issues, and they will respond promptly with comprehensive answers or assistance.

Social Media Engagement: Juno Markets maintains an active presence on popular channels such as Facebook, Instagram, and Youtube.

Educational Resources

When it comes to educational resources, Juno Markets offers a range of educational resources designed to cater to both beginner and experienced traders. One of the key educational resources provided by Juno Markets is the Alpha generation indicators. These indicators are designed to help traders identify potential market opportunities and make informed trading decisions.

In addition to the Alpha generation indicators, Juno Markets also offers an economic calendar. This calendar provides traders with important economic events, such as interest rate announcements, GDP releases, and employment data.

For beginners, Juno Markets offers a simple trading guide. This guide covers the basics of forex trading, including essential concepts, terminology, and trading principles.

Furthermore, Juno Markets provides trading signals to assist traders in making informed trading decisions. These signals are generated by experienced analysts and are designed to highlight potential entry and exit points in the market.

Conclusion

Juno Markets is a forex broker offering a range of trading services to its clients. The broker provides competitive spreads, low minimum deposit requirements, and flexible leverage options, allowing traders to tailor their trading experience to their preferences. Moreover, the broker employs advanced trading platforms such as MetaTrader 4 (MT4) and Juno Auto Trader for social trading.

However, it is worth noting that Juno Markets has limited educational resources available for traders, which may be a drawback for those seeking extensive learning materials. Additionally, this broker is currently under offshore regulation, which contains a certain level of risks.

FAQs

Q: Is Juno Markets a regulated broker?

A: Yes, Juno Markets is regulated by the Vanuatu Financial Services Commission (VFSC) in Vanuatu.

Q: What are the available trading platforms offered by Juno Markets?

A: Juno Markets offers the popular MetaTrader 4 (MT4) platform.

Q: What trading instruments can I trade with Juno Markets?

A: Juno Markets provides a wide range of trading instruments, including Forex, Metals, Energy, Indices.

Q: What are the minimum deposit requirements for Juno Markets?

A: The minimum deposit requirement with Juno Markets is relatively low, only $25, allowing traders to start with an affordable amount and access the various trading services provided.

Q: What leverage options are available at Juno Markets?

A: Juno Markets offers flexible leverage options up to 1:500, allowing traders to select their preferred leverage ratio based on their risk appetite and trading strategy.

Q: What customer support options are available at Juno Markets?

A: Juno Markets primarily offers customer support through phone, email and online chat.

Review 12

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now