Score

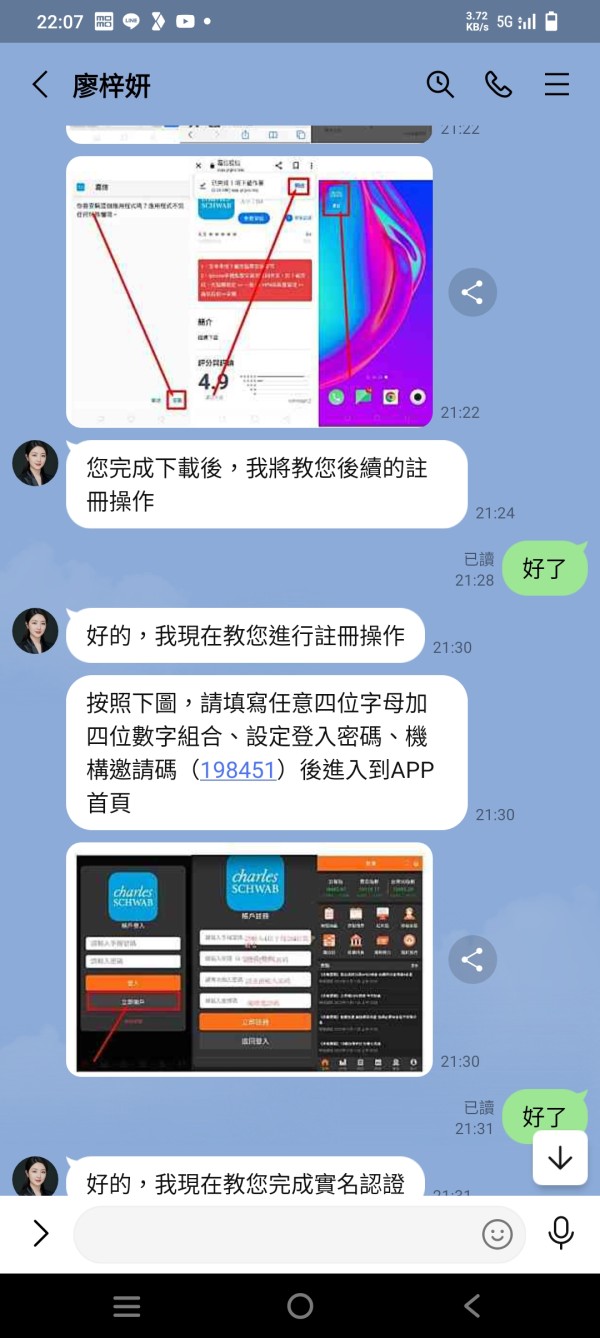

Charles Schwab

United States|5-10 years|

United States|5-10 years| https://www.schwab.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Hong Kong 2.60

Hong Kong 2.60Surpassed 15.00% brokers

Contact

Licenses

Single Core

1G

40G

Disclosure

More

Danger

Danger

Contact number

+1 877-519-1403

+852 2101-0511

+852 2374 7888

Other ways of contact

Broker Information

More

Charles Schwab & Co. Inc.

Charles Schwab

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- China Hong Kong SFC (license number: BJO462) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

WikiFX Verification

Users who viewed Charles Schwab also viewed..

XM

FXCM

FP Markets

IC Markets Global

Sources

Language

Mkt. Analysis

Creatives

Charles Schwab · Company Summary

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Minimum Deposit | $2,000 (Margin account) |

| Maximum Leverage | N/A |

| Minimum Spreads | N/A |

| Trading Platform | Thinkorswim |

| Demo Account | Yes |

| Trading Assets | Stocks, ETFs, Bonds |

| Payment Methods | FPS transfers, a cheque deposit, telegraphic transfer (international wire), ACAT |

| Customer Support | Phone, Email |

General Information & Regulation

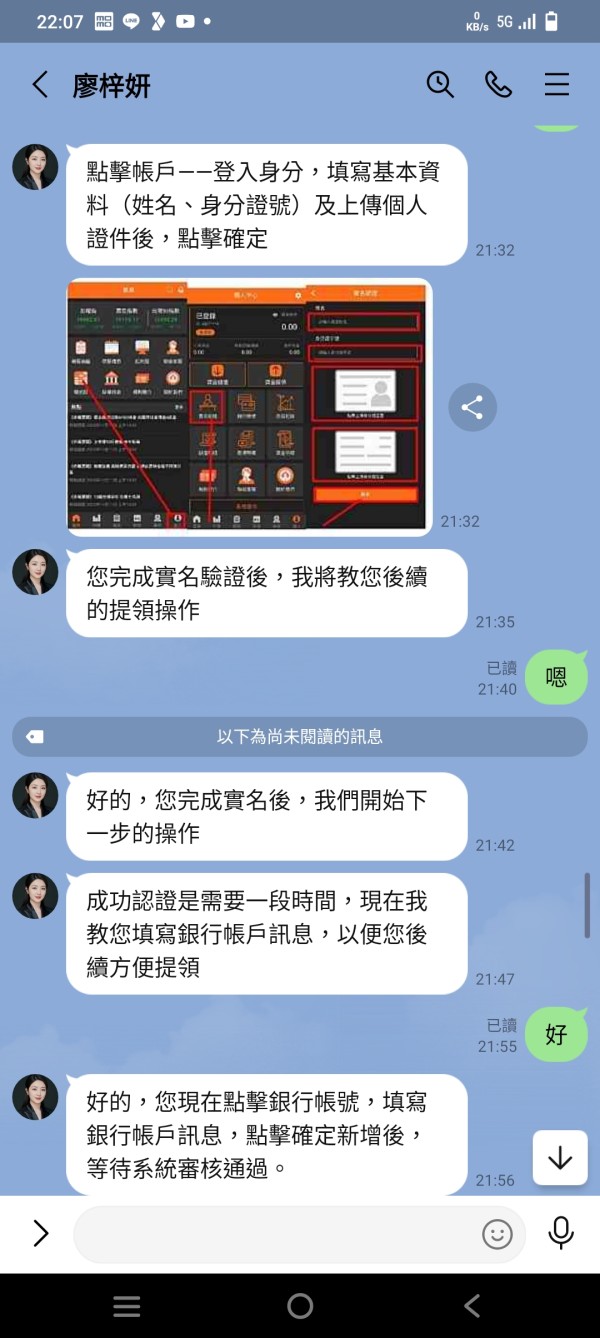

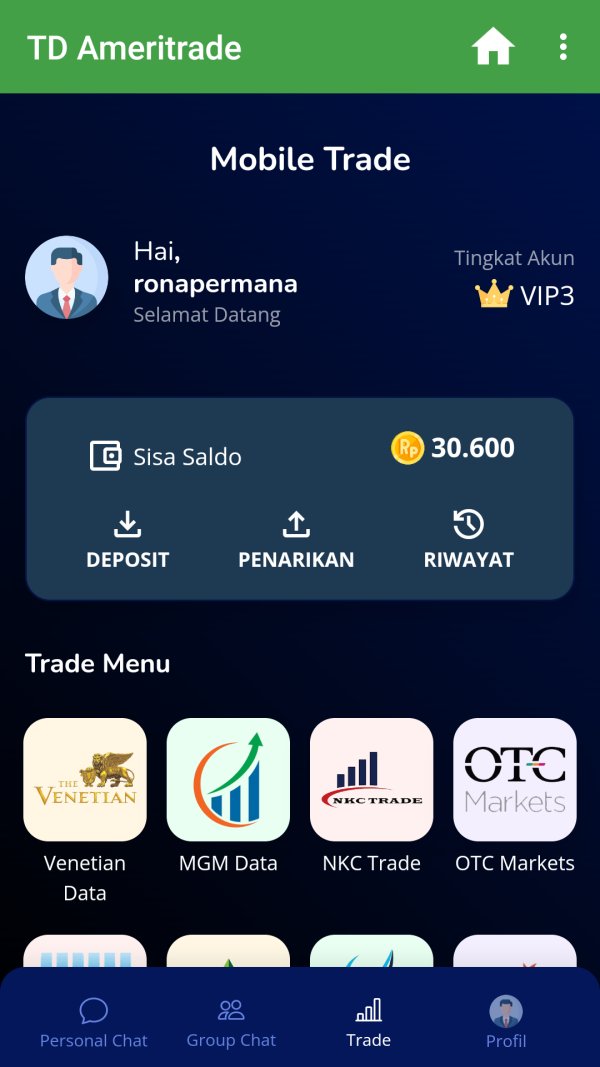

TD Ameritrade Hong Kong Limited is a regulated brokerage firm authorized by the Securities and Futures Commission (SFC) of Hong Kong. Holding a license for dealing in futures contracts, TD Ameritrade operates within the legal and regulatory framework of Hong Kong's financial markets. With an address at Room 1211-13, Two Exchange Square, 8 Connaught Place, Central, Hong Kong, the company can be contacted via email at help@tdameritrade.com.hk. The regulatory oversight provided by the SFC ensures that TD Ameritrade Hong Kong adheres to the established standards and practices in the industry.

TD Ameritrade offers a diverse range of market instruments to cater to the investment needs of its users. Investors can trade listed stocks online without any commissions, benefiting from real-time trade analysis and expert insights. The platform enables options trading at a cost of US$0.65 per contract, providing specialized tools and the assistance of U.S.-licensed options trading specialists. Additionally, TD Ameritrade provides access to over 2,000 ETFs across various asset classes and fund companies, along with U.S. Treasury bonds, corporate bonds, offshore mutual funds, American Depositary Receipts (ADRs), and foreign ordinaries.

TD Ameritrade provides various account types, including Individual, Joint, Trust, Corporate, and U.S. Retirement accounts. These accounts cater to different investment preferences and goals. The Individual Account is suitable for individuals who want to manage their portfolios independently, while the Joint Account is designed for opening accounts with another person. Trust Accounts are available for establishing trusts for investment purposes, and Corporate Accounts cater to companies and organizations. U.S. Retirement Accounts are specifically tailored for those interested in opening retirement accounts in the United States. TD Ameritrade also offers Demo accounts for users to test the platform's features and functionalities.

Pros and Cons

TD Ameritrade Hong Kong Limited, as a regulated brokerage firm operating within the legal and regulatory framework of Hong Kong's financial markets, offers a range of advantages and disadvantages for investors. On the positive side, the company holds a license from Hong Kong's Securities and Futures Commission (SFC), providing a sense of trust and assurance. They provide a diverse selection of market instruments, including stocks, options, ETFs, bonds, offshore mutual funds, ADRs, and foreign ordinaries. TD Ameritrade also offers various account types, multiple trading platforms with robust tools, and educational resources to enhance investors' knowledge. Moreover, clients have access to various funding methods for account deposits. However, there are also limitations. TD Ameritrade primarily operates within Hong Kong's market framework, which may restrict its services for investors outside Hong Kong. Additionally, their focus on futures contracts may not appeal to investors seeking broader investment options. The availability of trading platforms and customer support channels is relatively limited compared to other brokerage firms.

| Pros | Cons |

| Regulated brokerage firm with license from Hong Kong's Securities and Futures Commission (SFC) | Limited to operating within Hong Kong's market framework |

| Wide range of market instruments available, including stocks, options, ETFs, bonds, offshore mutual funds, ADRs, and foreign ordinaries | Limited availability of other investment options |

| Offers multiple account types (individual, joint, trust, corporate, U.S. retirement, and demo accounts) | Limited accessibility for non-Hong Kong residents or investors |

| Provides multiple trading platforms (web trading, StreetSmart Edge®, Schwab Mobile) and robust trading tools | Limited trading platforms compared to some other brokerage firms |

| Offers educational resources (workshops, webinars, market commentary, investing education) | Limited to dealing in futures contracts |

| Various funding methods available for account deposits | Customer support limited to phone, email, and online channels |

Latest News

On 28 February 2022, TD Ameritrade Hong Kong will close and will no longer maintain accounts.

Is TD Ameritrade Legit?

TD Ameritrade Hong Kong Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The company holds a license for dealing in futures contracts, with license number BJO462. The regulatory oversight provided by the SFC ensures that TD Ameritrade Hong Kong operates within the established legal and regulatory framework of Hong Kong's financial markets. The license was issued on October 17, 2017, and there is no specified expiry date mentioned. The address of TD Ameritrade Hong Kong Limited is Room 1211-13, Two Exchange Square, 8 Connaught Place, Central, Hong Kong. The company can be contacted via email at help@tdameritrade.com.hk. Further information about TD Ameritrade Hong Kong Limited can be found on their website at www.tdameritrade.com.hk.

Market Instruments

TD Ameritrade clients can trade a wide variety of assets on the web platform as well as the mobile apps. This includes exchanged-traded funds (ETFs), stocks, options, futures, and cryptocurrency.

Stocks: TD Ameritrade allows users to trade listed stocks online with no commissions. They provide tools and research informed by Schwab experts to simplify stock selection. Users can benefit from real-time trade analysis provided by Schwab professionals.

Options: TD Ameritrade enables online options trading with a cost of just US$0.65 per contract and no base commission. They offer platforms and tools specifically designed for options traders, aiding in navigating the market. U.S.-licensed options trading specialists are also available to provide support.

Exchange-Traded Funds (ETFs): TD Ameritrade provides access to over 2,000 ETFs across various asset classes and fund companies. Users can utilize the Schwab Personalized Portfolio Builder tool to easily create a diversified ETF portfolio. Additionally, European-domiciled UCITS ETFs are available for residents of the European Economic Area (EEA).

Bonds: TD Ameritrade offers access to a wide range of investments, including U.S. Treasury bonds and corporate bonds. Their Schwab BondSource® tool allows users to screen through 36,000+ bonds. Pricing is straightforward and easy to understand, ensuring users know what they are paying for.

Offshore mutual funds: TD Ameritrade provides a broad selection of funds that have been carefully screened by Schwab experts. Users can access premium independent research and analysis from Morningstar®. The platform also offers an advanced online screener tool that allows users to compare up to five funds simultaneously.

American Depositary Receipts (ADRs) and foreign ordinaries: TD Ameritrade offers trading of ADRs and foreign ordinaries, providing users with insights into the benefits, risks, and considerations associated with these international stock types. Advanced platforms and tools are available for trading stocks in local markets.

| Pros | Cons |

| Diverse range of market instruments | Limited mention of fees and costs |

| No-commission online trading for listed stocks | Lack of emphasis on specific stock selection criteria |

| Availability of European-domiciled UCITS ETFs for EEA residents | Limited information on options trading support |

| Low-cost options trading with U.S.-licensed specialists | No mention of the options trading platform's features |

| Access to over 2,000 ETFs across various asset classes | Limited information on the Schwab Personalized Portfolio Builder tool |

Account Types

Individual Account:

TD Ameritrade offers an Individual Account option for clients who wish to trade and invest on their own. This account type is suitable for individuals who want to manage their own portfolios and make independent investment decisions. The Individual Account does not have any specific minimum deposit requirements, although to open an Individual or Joint account, a minimum of US$25,000 is needed. Within the Individual Account category, there are two subtypes: Margin account and Cash account. The Margin account requires an initial deposit of at least 2000 USD, whereas the Cash account has no minimum deposit requirement.

Joint Account:

For clients who want to open an account with another person, TD Ameritrade offers a Joint Account option. The online application process is available for joint accounts with two account holders. However, if there are more than two account holders, it is necessary to contact TD Ameritrade to initiate the account-opening process.

Trust Account:

TD Ameritrade provides a Trust Account option for clients who want to establish a trust for investment purposes. Opening a Trust Account requires a minimum deposit of US$100,000. The online application process is available for trusts with two or fewer individual trustees and/or beneficiaries. If the trust has more than two individual trustees, a company trustee, or if the beneficiaries are greater than two and include a company or undisclosed parties, it is recommended to contact TD Ameritrade for further information.

Corporate Account:

TD Ameritrade offers a Corporate Account option for companies and organizations. To learn more about opening a Charles Schwab International corporate account, it is necessary to contact TD Ameritrade directly.

U.S. Retirement Account:

For clients interested in opening a retirement account in the United States, TD Ameritrade provides the U.S. Retirement Account option. To obtain more information about opening a U.S. retirement account with TD Ameritrade, it is advised to contact them directly. The U.S. Retirement Account includes Individual and Joint Account options.

TD Ameritrade also offers the option of Demo accounts, which allow both beginners and experienced traders to test the functionalities and features of the trading platform.

| Pros | Cons |

| Diverse range of account options | Account opening requirements may be restrictive |

| Individual account allows independent investing | Limited online application process for joint accounts |

| Trust account option for investment trusts | Trust account minimum deposit requirement |

| Corporate account option for companies | Limited information available on corporate accounts |

| U.S. Retirement account for retirement planning | Limited information on opening a U.S. retirement account |

| Demo accounts for testing platform functionalities | Lack of specific details on account benefits |

Demo Accounts Available

Demo accounts are available for both beginners and professionals to test trading platform's functionalities and features in a 100% risk-free trading environment.

How to Open an Account

To open an account with TD Ameritrade, follow these steps:

Visit the TD Ameritrade website and click on the “Open Your Account” button.

Select your country or region of residence from the provided list. This will connect you to the appropriate page for your location.

Begin the online application process, which typically takes around 15 minutes to complete.

Prepare the necessary documents for the application. These may include:

Tax ID Number or Social Security Number: Provide your tax identification number or social security number, depending on your country's requirements.

Passport or government ID: Have a valid passport or government-issued identification document ready for verification purposes.

Recent utility bill or proof of residency: Gather a recent utility bill (such as gas, electric, water, or cable) or any other document that serves as proof of your residency.

Employer's name and mailing address: If applicable, provide the name and mailing address of your employer.

Ensure you have access to a printer and scanner. You will need these to print, sign, and upload any required documents during the application process.

Select the Account Types.

Review the terms and conditions, disclosures, and any other relevant documents carefully before submitting your application.

After submitting your application, wait for confirmation and further instructions from TD Ameritrade regarding the status of your account.

Fees & Commissions

To open an Individual/Joint account, a minimum deposit of US$25,000 is required. Detailed information about fees and commissions can be found in the Charles Schwab Pricing Guide for Individual Investors.

For stocks and ETFs, the commission per trade for online trades is US$0, while broker-assisted trades incur a fee of US$25. Non-U.S. ETFs are not available for online trades and are subject to a transaction fee of US$50 for broker-assisted trades.

Regarding offshore mutual funds, there is no transaction fee for broker-assisted trades. However, a short-term redemption fee of US$49.95 may apply.

Options trading entails a commission per executed trade of US$0 plus US$0.65 per contract for online trades, while broker-assisted trades are subject to online pricing plus a fee of US$25.

In terms of fixed income, the transaction fee per trade for new issues is included in the offering price for both online and broker-assisted trades. For Treasuries, including Auction and Secondary, such as Treasury Bonds, Treasury Bills, Treasury Notes, and TIPS, the transaction fee is US$0 for online trades and US$25 for broker-assisted trades. Corporate Bonds, Municipal Bonds, Government Agencies, Zero-Coupon Treasuries (including STRIPS), incur a fee of US$1 per bond with a minimum of US$10 and a maximum of US$250 for online trades. Broker-assisted trades in this category are subject to online pricing plus a fee of US$25. Specialty products like Commercial Paper, Foreign Bonds, Asset-Backed Securities, Mortgage-Backed Securities, Collateralized Mortgage Obligations, and Unit Investment Trusts require contacting TD Ameritrade for specific information. For Preferred listed stocks and REITs, there is no commission for online trades, while broker-assisted trades incur a fee of US$25.

Pros and Cons

| Pros | Cons |

| No commission for online stock and ETF trades | Minimum deposit of US$25,000 for Individual/Joint accounts |

| No commission for online Preferred listed stocks and REIT trades | US$25 fee for broker-assisted stock trades |

| No transaction fee for offshore mutual fund broker-assisted trades | Short-term redemption fee of US$49.95 may apply for offshore mutual funds |

| US$0 commission for options trades | US$25 fee for broker-assisted options trades |

| No transaction fee for online Treasury trades | US$25 fee for broker-assisted Treasury trades |

| US$1 per bond fee for online fixed income trades | US$25 fee for broker-assisted fixed income trades |

| US$25 fee for broker-assisted Preferred listed stocks and REIT trades |

Minimum Deposit

TD Ameritrade Hong Kong Limited requires a minimum deposit of US$25,000 to open a brokerage account(Individual or Joint account).

Also, TD Ameritrade has a minimum deposit requirement of US$100,000 for its Trust Account.

Trading Platforms

TD Ameritrade offers a comprehensive trading platform that provides users with access to the U.S. market.

Web trading

One of their platforms is web trading, accessible through International.Schwab.com. This platform allows users to trade easily from anywhere with an internet connection. The website provides a user-friendly interface for accessing the U.S. market. Additionally,

StreetSmart Edge®.

One of the primary trading platforms provided by TD Ameritrade is StreetSmart Edge®. This platform is designed to cater to the needs of traders, offering powerful features and functionalities. It can be accessed either through downloadable software or online via the cloud.

Schwab Mobile.

In addition to the desktop platform, TD Ameritrade also offers mobile trading through Schwab Mobile. This mobile app enables users to stay connected to their U.S. investments on the go. It is available for Android™, iPhone®, iPad®, and Apple Watch™, allowing traders to access their accounts and make informed decisions wherever they are.

TD Ameritrade's trading platform is equipped with robust trading tools that help users translate insights into action. These tools are designed to assist traders in analyzing market trends and making informed trading decisions. The platform's features provide users with the necessary tools and resources to navigate the complexities of the U.S. market.

| Pros | Cons |

| Comprehensive trading platform | Minimum deposit requirement of US$25,000 for individual/joint accounts and US$100,000 for trust accounts |

| Web trading accessible | Limited availability of trading platforms compared to some competitors |

| Schwab Mobile app for on-the-go trading | Possible fees and commissions associated with trading activities |

| StreetSmart Edge® platform with powerful features | Limited customization options for trading platform layout and settings |

| Robust trading tools for market analysis and informed decision-making |

Educational Resources

TD Ameritrade offers a range of educational resources to help investors deepen their understanding of U.S. investing. These resources include workshops, webinars, U.S. market commentary, investing education, and daily updates.

The workshops and webinars provided by TD Ameritrade are designed specifically for international investors, catering to individuals at all levels of experience. These sessions offer the opportunity to learn directly from seasoned investment experts at TD Ameritrade. Whether attending an in-person workshop or participating in a live webinar, investors can benefit from the expertise shared during these educational events.

U.S. Market Commentary

To enhance U.S. investing intelligence, TD Ameritrade offers market commentary that provides insights into the U.S. and global markets. Through the Schwab Market Perspective, investors can gain valuable information to stay informed about the daily fluctuations of the stock market. This helps investors make informed decisions regarding U.S. investment opportunities.

Investing Education

TD Ameritrade's investing education aims to help investors apply their skills to U.S. markets. They provide resources that cover various aspects of investing, such as identifying favorable trends, conducting technical and fundamental analysis, and applying investment strategies. These educational materials can assist investors in making informed investment decisions in the U.S. market.

Additionally, TD Ameritrade offers daily updates, including the closing market update, which provides a summary of market movements and key events impacting the U.S. stock market. These updates help investors stay up-to-date with the latest developments and trends in the market, enabling them to make more informed investment decisions.

Pros and Cons

| Pros | Cons |

| Wide range of educational resources available in many different formats | Some resources can be outdated or inaccurate |

| Workshops and webinars designed specifically for international investors | Not all resources are available in all languages |

| Market commentary provides insights into the U.S. and global markets | Market commentary can be biased or subjective |

| Investing education covers various aspects of investing | Some educational materials can be complex or difficult to understand |

| Daily updates help investors stay up-to-date with the latest market developments | Daily updates can be overwhelming or too frequent |

Payment Methods

TD Ameritrade provides a range of funding options for clients to deposit funds into their accounts. These options include FPS transfers, cheque deposits, telegraphic transfers (international wire), and account transfers from another broker (ACAT). It is important to note that all deposits must be made in U.S dollars.

In addition to these methods, TD Ameritrade accepts various payment options for clients to fund their accounts. These include Mastercard, Visa, Metro, Skrill, Neteller, AstroPay, eBay.bg, GiroPay, Neosurf, Euteller, SOFORT, ToditoCash, and others.

Customer Support

TD Ameritrade provides customer support through various channels to assist clients with their inquiries and concerns. To reach customer service by phone, clients can call +1-415-667-7870 if they are outside the United States, or 1-877-853-1802 if they are within the U.S. The customer service hours are from 5:30 p.m. on Sunday to 1:00 a.m. on Saturday, following the U.S. Eastern Standard Time (EST).

Clients can also contact TD Ameritrade's customer support via email by writing to the provided email address. For mailing purposes, applications, deposits, and other materials can be sent to the following address:

Charles Schwab & Co., Inc.

Attn: International Operations

1945 Northwestern Drive

El Paso, TX 79912-1108, USA

Additionally, TD Ameritrade offers phone-based services. Clients can use Schwab by Phone™ by calling 1-800-435-4000 to reach an investment professional or utilize automated phone services. TeleBroker® provides access to automated touch-tone services, and it can be reached at 1-800-2SCHWAB (1-800-272-4922). For specific services in different languages, clients can contact the respective numbers provided, such as 1-800-662-6068 for 中文 (Chinese) services and 1-800-786-5174 for servicios en español (Spanish services). International clients can call 1-415-667-8400 for services in English, 中文, or español.

To access customer support online, clients can visit the official TD Ameritrade website at schwab.com, chinese.schwab.com, or international.schwab.com. For those using web-enabled phones, they can find Schwab on their phone's web menu. Additionally, PDA users can consult schwab.com/wireless on their desktop for further assistance.

Conclusion

In conclusion, TD Ameritrade Hong Kong Limited is a regulated brokerage firm authorized by the Securities and Futures Commission (SFC) of Hong Kong. It offers a diverse range of market instruments, including stocks, options, ETFs, bonds, offshore mutual funds, and ADRs/foreign ordinaries. The company provides various account types, such as Individual, Joint, Trust, Corporate, and U.S. Retirement Accounts, with different minimum deposit requirements. TD Ameritrade offers multiple trading platforms, including web trading, StreetSmart Edge®, and Schwab Mobile, to provide access to the U.S. market. They also offer educational resources, workshops, webinars, and market commentary to help investors enhance their understanding of U.S. investing. Payment methods include FPS transfers, cheque deposits, telegraphic transfers, and account transfers. Customer support is available through phone, email, and online channels.

FAQs

Q: Is TD Ameritrade regulated?

A: Yes, TD Ameritrade is regulated by the Securities and Futures Commission (SFC) of Hong Kong.

Q: What market instruments does TD Ameritrade offer?

A: TD Ameritrade offers a diverse range of market instruments including stocks, options, exchange-traded funds (ETFs), bonds, offshore mutual funds, American Depositary Receipts (ADRs), and foreign ordinaries.

Q: What are the minimum deposit requirements for TD Ameritrade?

A: TD Ameritrade requires a minimum deposit of US$25,000 for Individual and Joint accounts, and US$100,000 for Trust accounts.

Q: What trading platforms does TD Ameritrade provide?

A: TD Ameritrade offers web trading, StreetSmart Edge®, and Schwab Mobile as its primary trading platforms.

Q: What educational resources are available at TD Ameritrade?

A: TD Ameritrade offers workshops, webinars, U.S. market commentary, investing education, and daily updates to help investors enhance their understanding of U.S. investing.

Q: What are the payment methods accepted by TD Ameritrade?

A: TD Ameritrade accepts FPS transfers, cheque deposits, telegraphic transfers, and account transfers from another broker. It also accepts payment options such as Mastercard, Visa, and various other methods.

Q: How can I contact TD Ameritrade's customer support?

A: You can contact TD Ameritrade's customer support via phone, email, or by mailing your inquiries to their designated address. They also offer phone-based services and online customer support through their official website.

News

NewsSchwab Expands Trading Horizons with Forex and Futures on Thinkorswim

Charles Schwab introduces forex trading, futures, and portfolio margin on the Thinkorswim platforms, marking a significant expansion of its trading capabilities.

WikiFX

WikiFX

NewsBig Moves Ahead: Charles Schwab Integrates TD Ameritrade Accounts

Charles Schwab is set to move a large number of TD Ameritrade retail accounts this Labor Day. The merger represents significant progress in integrating the two online brokerage giants.

WikiFX

WikiFX

NewsORTEX Data Reveals $6.1 Billion in Short Bets on Canada's TD Bank

TD Bank Group's short interest has surged to $6.1 billion, a 45% increase, due to concerns surrounding its acquisition of First Horizon amid the collapse of U.S. regional lenders. Arbitrage investors betting on the deal are believed to be behind the heightened short interest. TD will address the $13.4 billion acquisition at its annual general meeting.

WikiFX

WikiFX

NewsAI Stocks - What You Need to Know

The article discusses investing in artificial intelligence (AI) stocks, the major players in the industry, and the criteria to consider when evaluating them. It also lists several online brokerage platforms that offer investment opportunities in AI stocks and ETFs. Factors to consider include competitive advantage, revenue growth, ethical considerations, partnerships, regulatory risks, and management team. A diverse portfolio is recommended.

WikiFX

WikiFX

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now