Score

LFS BROKING

India|5-10 years|

India|5-10 years| https://lfsbroking.in

Website

Rating Index

Influence

Influence

C

Influence index NO.1

India 3.51

India 3.51Surpassed 15.30% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+1 800-102-4968

+91 022 4922 8222

Other ways of contact

Broker Information

More

LFS Broking Pvt. Ltd.

LFS BROKING

India

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed LFS BROKING also viewed..

XM

FXCM

ATFX

Exness

LFS BROKING · Company Summary

| Aspect | Information |

| Company Name | LFS BROKING |

| Registered Country/Area | India |

| Founded Year | 2011 |

| Regulation | Not regulated |

| Market Instruments | Equities, Stocks, Futures, Options, Currencies, Commodities, Mutual Funds |

| Account Types | Demat Account |

| Maximum Leverage | 1:5 |

| Spreads | Starting from 0.02% |

| Trading Platforms | Desktop (Windows, Mac), Web, Mobile (Android, iOS) |

| Customer Support | Telephone(022–4922 8222), Toll-Free, Email, Online Messaging, Social Media |

| Deposit & Withdrawal | Bank Transfer, Online Payment, Credit/Debit Card |

Overview of LFS BROKING

LFS BROKING, an Indian brokerage firm established in 2011, offers a wide range of financial instruments for trading, making it a versatile option for investors. However, it's worth noting that the broker operates without regulatory oversight, which can raise concerns about transparency and security.

Traders at LFS BROKING have access to various market instruments, including equities, stocks, futures, options, currencies, commodities, and mutual funds. This diverse portfolio allows clients to explore different investment opportunities within the financial markets.

LFS BROKING provides traders with flexible leverage options, with a maximum leverage of 1:5, depending on the tradable product. This allows traders to tailor their leverage based on their risk tolerance and trading strategy. However, it's essential to exercise caution with high leverage, as it can amplify both gains and losses.

Is LFS BROKING legit or a scam?

LFS Broking lacks regulation by any authoritative body. Unregulated exchanges often miss the legal protections and oversight offered by regulators, increasing the risks of fraud, market manipulation, and security breaches. Users of such platforms find difficulty in seeking recourse or resolving disputes, and the absence of regulatory oversight often results in a less transparent trading environment, making it challenging for users to verify the exchange's legitimacy and reliability.

Pros and Cons

| Pros | Cons |

| Flexible leverage options | Not regulated |

| Low brokerage fees | Limited account types |

| Multiple trading platforms (desktop, web, mobile) | Mixed customer reviews |

| Limited customer support options |

Pros:

1.Flexible Leverage Options: LFS BROKING offers flexible leverage options, allowing traders to choose the level of leverage that suits their risk tolerance and trading strategy. This can be advantageous for experienced traders who want to optimize their positions.

2. Low Brokerage Fees: The brokerage fees at LFS BROKING are competitively low. This can be cost-effective for traders, especially those who engage in frequent trading, as lower fees can help preserve more of their profits.

3. Multiple Trading Platforms: LFS BROKING provides traders with a variety of trading platforms, including desktop, web, and mobile applications. This versatility allows traders to access the markets from different devices and trade at their convenience.

Cons:

1.Not Regulated: One notable drawback is that LFS BROKING is not regulated by any regulatory authority. This lack of regulation can raise concerns about transparency and oversight in the exchange. Traders have limited recourse in case of disputes or issues.

2. Limited Account Types: LFS BROKING offers a limited range of account types. Some traders require specialized account options that are not available.

3. Mixed Customer Reviews: Customer reviews for LFS BROKING are mixed, with both positive and negative feedback. This suggests that the broker's service quality and customer satisfaction can vary, and traders should exercise caution.

4. Limited Customer Support Options: LFS BROKING provides limited customer support options. Traders have fewer channels to reach out for assistance or resolve issues, which can be a disadvantage in case of technical problems or inquiries.

Market Instruments

LFS BROKING offers a diverse range of trading instruments in the financial markets. Their portfolio includes Equity, allowing clients to invest in company shares. Stocks are another key asset, providing opportunities in various company shares. They also offer Futures and Options, which are derivatives based on the value of underlying assets. For those interested in currency markets, LFS BROKING provides Currency trading options. Commodities trading is available for those looking to invest in physical goods. Additionally, they offer Mutual Funds, pooling resources to invest in a variety of assets.

Account Types

LFS BROKING offers a single account type: the Demat Account. This account is suitable for traders who need to hold and trade securities electronically. Opening a Demat Account is free of charge, making it accessible for new traders. However, there is an annual maintenance fee of Rs. 160, which may be more suited for active traders who can justify this cost with their trading volume. This account type is ideal for those looking to invest in various financial instruments offered by LFS BROKING.

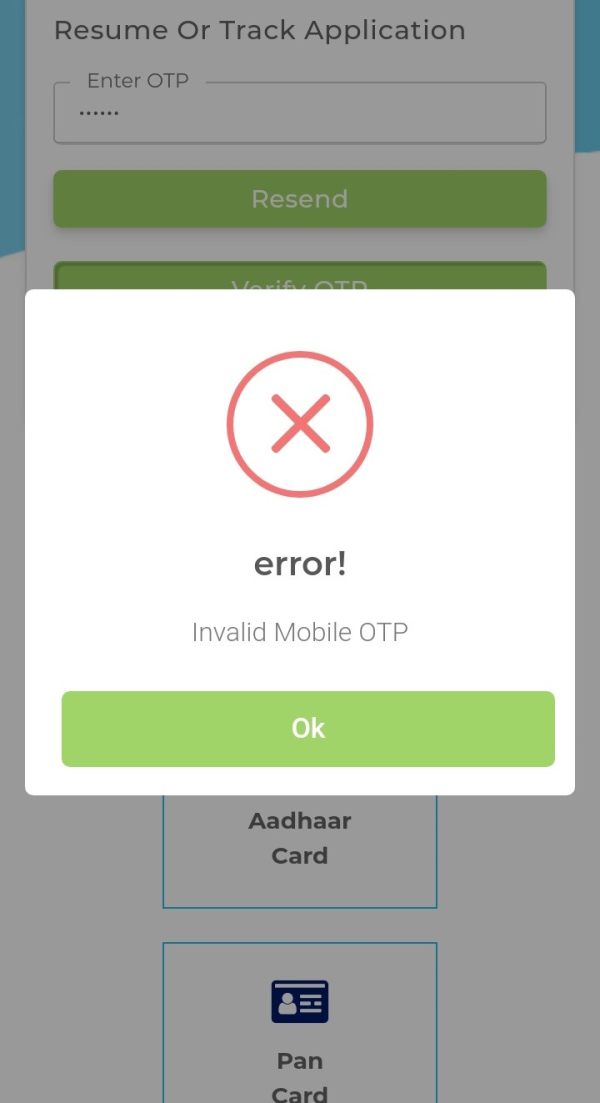

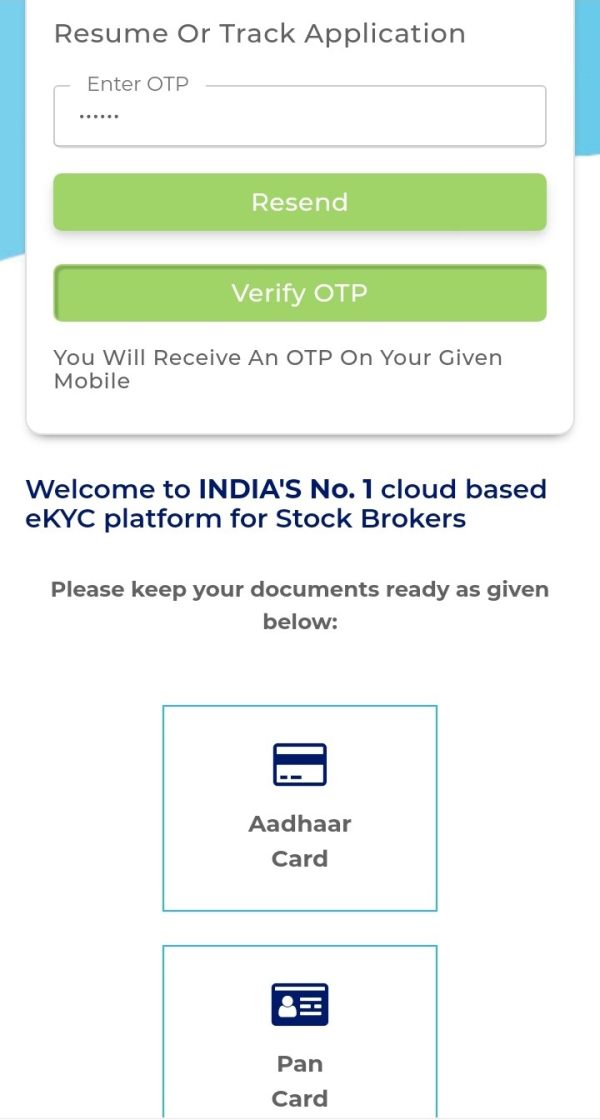

How to Open an Account?

To open an account with LFS BROKING, you can follow these general steps:

Visit the LFS BROKING Website: Access their official site for detailed information.

Choose the Account Type: Select the Demat Account option.

Complete the Registration Form: Fill in your personal and financial details.

Submit Required Documents: Provide necessary documents for identity verification.

Account Activation: After verification, your account will be activated.

Start Trading: Once your account is set up, you can begin trading.

Leverage

LFS BROKING's leverage options are tailored to various trading products, with a maximum leverage of up to five times. Specifically, they offer a leverage of one time for currency futures, two times for equity delivery, equity futures, and currency options. For commodities, the leverage goes up to three times, while equity intraday and equity options can avail up to five times leverage. This flexible approach allows traders to choose leverage based on their comfort level and experience, though it's advised for inexperienced traders to be cautious with high leverage due to the increased risk of amplified losses.

Spreads & Commissions

LFS BROKING provides a comprehensive range of trading services with competitive fees. For equity delivery trading, the fee is set at 0.16%, making it suitable for investors planning to hold their positions for an extended period. Active traders, on the other hand, can benefit from the lower fee of 0.02% for equity intraday trading. Currency and equity options traders have the flexibility of Rs. 16 per lot and Rs. 10 per lot, respectively, allowing them to tailor their trading strategies.

| Service | Fee |

| Equity Delivery Trading | 0.16% |

| Equity Intraday Trading | 0.02% |

| Equity Futures Trading | 0.02% |

| Equity Options Trading | Rs. 16 per Lot |

| Currency Futures Trading | 0.02% |

| Currency Options Trading | Rs. 10 per Lot |

| Minimum Brokerage | Percentage of Transaction |

| Demat AMC Charges | Rs. 160 per Annum |

| Trading AMC Charges | Rs. 160 per Annum |

| Margin Money | Zero Margin |

| Brokerage Calculator | Lfs Broking Brokerage Calculator |

LFS BROKING also offers zero-margin trading, which can be advantageous for those looking to leverage their positions without tying up additional capital. The absence of transaction charges, coupled with transparent fees and a user-friendly brokerage calculator, makes LFS BROKING a compelling choice for traders of varying experience levels, from beginners to seasoned professionals. Additionally, the broker's minimal annual maintenance charges for Demat and trading accounts add to its appeal as a cost-effective trading platform.

| Transaction Charges | 0.00% |

| STT | 0.0126% of Total Turnover |

| SEBI Turnover Charges | 0.0002% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

Trading Platform

LFS BROKING offers a variety of trading platforms. These platforms are available on desktop systems, including Windows and Mac, as well as web-based platforms and mobile applications for both Android and iOS devices.

The availability of mobile apps allows traders the convenience of accessing their accounts and executing trades from virtually anywhere, enhancing flexibility and accessibility. While LFS BROKING's platform options cover a range of devices and operating systems, the lack of specific information about the trading software leave some traders seeking more detailed insights into the features and capabilities of the platforms.

Deposit & Withdrawal

LFS BROKING offers a variety of convenient payment methods. You can choose to fund your account through:

Bank transfer: This is the most common method, allowing you to transfer funds directly from your bank account to your LFS BROKING account. There are no fees associated with bank transfers, and the processing time typically takes 1-2 business days.

Online payment: LFS BROKING partners with several online payment gateways, including popular options like PayPal and Skrill.

Credit/debit card: You can also conveniently deposit funds using your credit or debit card. While processing is instant, be aware that your card issuer charges transaction fees.

Remember, regardless of the chosen method, ensure you're using an account registered under your own name for compliance purposes.

Customer Support

LFS BROKING offers accessible customer support channels for traders. They can reach the support team via telephone at # 022–4922 8222 or use the toll-free number 1800-102-4968 for assistance. Alternatively, traders can communicate with the support team through email at customersupport@lfsbroking.co.in or send messages online.

Additionally, LFS BROKING maintains a presence on social media platforms like Twitter and Facebook, providing another avenue for communication and updates. The company is located at Unit No. 08, 2nd Floor, Prabhadevi Industrial Estate, 408 Veer Savarkar Marg, Prabhadevi, Mumbai – 400 025, Maharashtra, India, making it accessible to traders seeking in-person assistance.

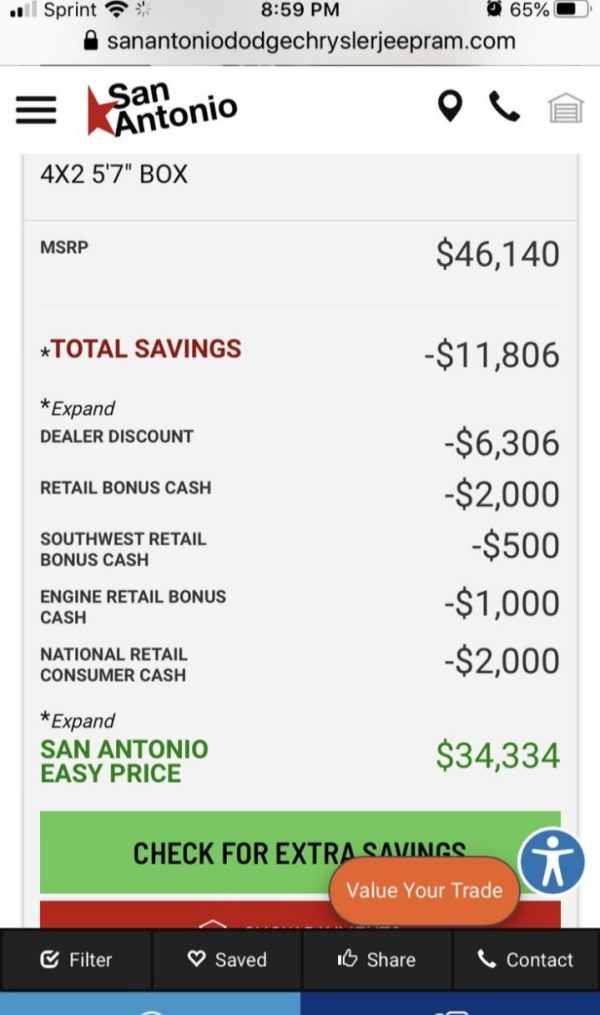

Exposure

There was a negative experience with LFS BROKING reported by a trader from Colombia. The trader expressed frustration over not being able to access their account, citing an incorrect code and unresponsive customer service. This experience was described as the worst in their life, and they highlighted concerns about a significant investment of $11,806. The trader's inability to access their account and seek assistance from customer service led them to consider this situation a scam.

Such negative experiences and exposure can have a detrimental impact on the reputation and trustworthiness of a trading platform like LFS BROKING. Traders should be cautious or hesitant to use the platform if they come across such reports, which can influence their decision to trade on the platform.

Conclusion

In conclusion, LFS BROKING offers a mixed bag of advantages and disadvantages for traders to consider. On the positive side, the brokerage provides traders with flexibility through its range of leverage options, allowing them to tailor their trading strategies according to their risk tolerance. Additionally, LFS BROKING stands out with its low brokerage fees, making it an attractive choice for cost-conscious traders who engage in frequent trading activities. The availability of multiple trading platforms, including desktop, web, and mobile applications, enhances accessibility and convenience.

However, there are significant drawbacks to be mindful of. The absence of regulatory oversight raises concerns about transparency and accountability within LFS BROKING. This lack of regulation can leave traders with limited recourse in case of disputes or security breaches. The limited variety of account types also restricts traders with specific needs or preferences, potentially excluding some segments of the trading community. Moreover, mixed customer reviews indicate variability in service quality and customer satisfaction, warranting caution when choosing LFS BROKING as a trading platform. Lastly, the brokerage's limited customer support options pose challenges for traders seeking timely assistance or resolution of issues, impacting the overall trading experience.

FAQs

Q: Is LFS BROKING a regulated brokerage?

A: No, LFS BROKING is not regulated by any regulatory authority.

Q: What is the maximum leverage offered by LFS BROKING?

A: LFS BROKING offers flexible leverage ratios ranging from one time to five times, depending on the tradable products.

Q: Are there any account management fees at LFS BROKING?

A: No, LFS BROKING does not charge account management fees.

Q: How can I contact LFS BROKING's customer support?

A: You can reach LFS BROKING's customer support through telephone, toll-free number, email, or by sending messages online.

Q: What trading platforms are available at LFS BROKING?

A: LFS BROKING offers trading platforms on desktop (Windows, Mac), the web, and mobile apps (Android, iOS).

Q: What are the brokerage fees for equity delivery trading at LFS BROKING?

A: The brokerage fee for equity delivery trading at LFS BROKING is 0.16% of the transaction amount.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now